Rapid Prototyping Capabilities

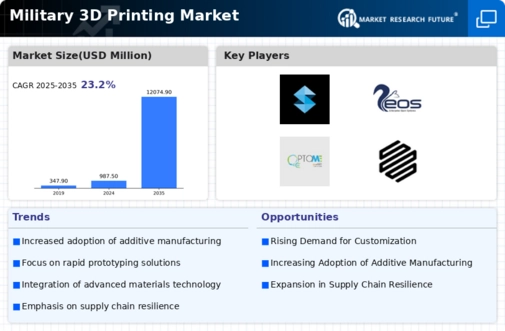

Rapid prototyping capabilities are transforming the Global military 3d printing Market Industry. The ability to quickly design and produce prototypes accelerates the development of new technologies and equipment. This agility is crucial for military organizations that must adapt to changing operational environments. For example, 3D printing allows for the swift iteration of designs, enabling faster testing and deployment of new systems. As a result, the market is anticipated to grow at a CAGR of 25.56% from 2025 to 2035, underscoring the importance of rapid prototyping in military innovation.

Integration of Advanced Materials

The integration of advanced materials is a key driver in the Global Military 3D Printing Market Industry. Innovations in material science enable the production of stronger, lighter, and more durable components. This capability is particularly relevant for military applications, where performance and reliability are paramount. For instance, the use of metal alloys and composite materials in 3D printing enhances the functionality of military equipment. As these advanced materials become more accessible, the market is poised for growth, reflecting the increasing demand for high-performance military solutions.

Increased Demand for Customization

The Global Military 3D Printing Market Industry experiences heightened demand for customized parts and equipment. This trend is driven by the need for tailored solutions that meet specific operational requirements. For instance, military units can produce unique components on-site, reducing lead times and enhancing mission readiness. The ability to rapidly prototype and manufacture parts allows for greater flexibility in responding to evolving threats. As a result, the market is projected to reach 987.5 USD Million in 2024, reflecting the growing reliance on 3D printing technology for customized military applications.

Cost Efficiency and Waste Reduction

Cost efficiency remains a pivotal driver in the Global Military 3D Printing Market Industry. Traditional manufacturing processes often involve significant material waste and high production costs. In contrast, 3D printing minimizes waste by utilizing only the necessary materials for each component. This efficiency not only reduces costs but also supports sustainability initiatives within military operations. As the technology matures, it is expected that the market will expand significantly, potentially reaching 12074.9 USD Million by 2035, driven by the increasing adoption of cost-effective manufacturing solutions.

Logistical Advantages and Supply Chain Resilience

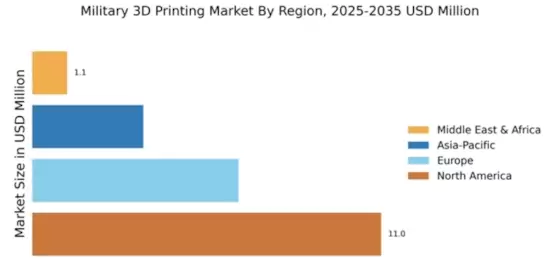

Logistical advantages play a critical role in the Global Military 3D Printing Market Industry. The ability to produce parts on-demand reduces dependency on complex supply chains, which can be vulnerable to disruptions. By utilizing 3D printing technology, military forces can manufacture components at forward operating bases, thus enhancing operational efficiency and reducing transportation costs. This shift towards localized production is likely to become increasingly important as military operations evolve. Consequently, the market is expected to witness substantial growth as military organizations recognize the logistical benefits of 3D printing.