Rising Energy Costs

The Diesel Rotary UPS Market is influenced by the rising costs of energy, which compel businesses to seek more efficient power solutions. As energy prices continue to escalate, organizations are exploring alternatives that not only provide reliability but also enhance energy efficiency. Diesel Rotary UPS Market systems offer a viable solution by ensuring that power is available when needed, thus reducing reliance on the grid. This shift towards energy-efficient solutions is expected to drive market growth, with projections indicating that the Diesel Rotary UPS Market could expand by 5% annually as companies invest in more sustainable energy practices.

Growing Awareness of Power Quality Issues

The Diesel Rotary UPS Market is also driven by an increasing awareness of power quality issues among businesses. Fluctuations in power supply can lead to equipment damage and operational inefficiencies. As organizations recognize the importance of maintaining high power quality, the demand for diesel rotary UPS systems is expected to rise. These systems provide a stable power supply, mitigating the risks associated with power disturbances. Consequently, the Diesel Rotary UPS Market is likely to see a growth trajectory as more companies invest in solutions that ensure power quality and reliability.

Technological Innovations in Power Systems

Technological advancements play a crucial role in shaping the Diesel Rotary UPS Market. Innovations in engine design, control systems, and energy management are enhancing the efficiency and reliability of diesel rotary UPS systems. These advancements enable better performance, reduced emissions, and lower operational costs. As manufacturers continue to invest in research and development, the Diesel Rotary UPS Market is likely to witness the introduction of more sophisticated systems that cater to the evolving needs of various sectors. This focus on innovation is expected to attract new customers and expand market share.

Expansion of Data Centers and IT Infrastructure

The expansion of data centers and IT infrastructure is a significant driver for the Diesel Rotary UPS Market. With the increasing reliance on digital services and cloud computing, data centers require robust power solutions to support their operations. Diesel rotary UPS systems are particularly well-suited for this environment, providing the necessary backup power to ensure continuous service availability. As the number of data centers continues to grow, the Diesel Rotary UPS Market is expected to experience substantial growth, with estimates suggesting a market increase of around 7% over the next few years.

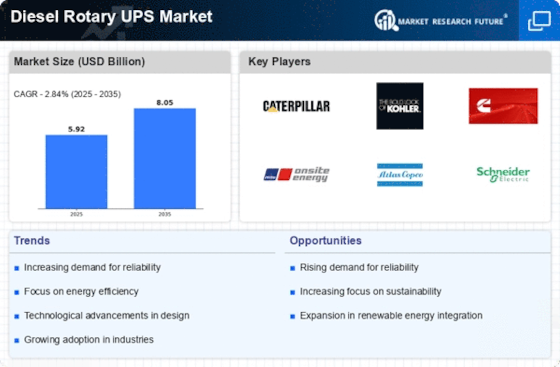

Increasing Demand for Uninterrupted Power Supply

The Diesel Rotary UPS Market is experiencing a notable surge in demand for uninterrupted power supply solutions across various sectors. Industries such as healthcare, data centers, and manufacturing are increasingly reliant on consistent power to maintain operations. This trend is driven by the need to prevent costly downtimes and ensure operational continuity. According to recent data, the demand for reliable power solutions is projected to grow at a compound annual growth rate of approximately 6% over the next five years. As organizations prioritize energy security, the Diesel Rotary UPS Market is positioned to benefit significantly from this increasing demand.