Research Methodology on Uninterruptible Power Supply (UPS) Market

1. Introduction

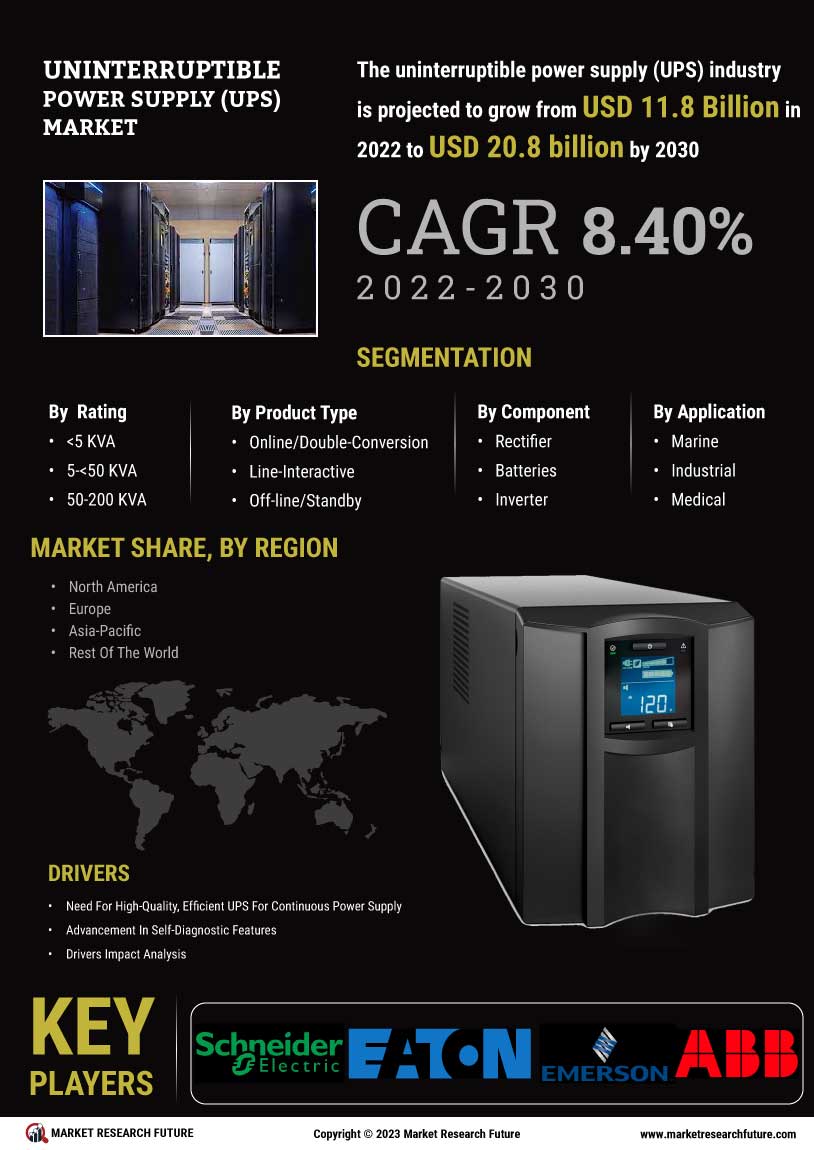

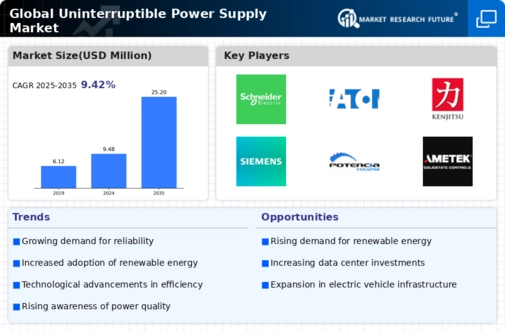

The research report looks into the potential of the Uninterruptible Power Supply (UPS) Market for the forecast period of 2023 -2030. It assesses the market size, share, growth, trends, and key players involved in the market. The report also includes PESTLE analysis, value chain, Porter’s five forces, demand and supply, and other qualitative and quantitative information. The research takes into account the changing dynamics of the energy, manufacturing, and IT sectors, and their impacts on the UPS market.

2. Research Objectives

This research report on the Uninterruptible Power Supply (UPS) Market aims to:

- Study the current market trends, economic developments, and regulatory environment of the UPS market.

- Analyze the industry value chain structure and detail Porter’s five forces to understand the competitive landscape of the market.

- Evaluate the historical, current and future market size of the UPS market.

- Identify the key market players and their strategies for the market.

- Provide a complete qualitative and quantitative analysis of the market to understand the current and futuristic potential of the market.

3. Research Methodology

For this research report, primary research surveys and secondary research techniques are employed. The data collection method used is primary and secondary research. Primary sources such as industry experts and secondary sources including books, case studies, press releases, news, journals, and other sources are used in this research. Furthermore, the report is based on a top-down and bottom-up approach.

Primary research includes in-depth interviews with various industry experts and opinion leaders, such as CEOs, industry analysts, technology and design experts, market researchers, and various other stakeholder companies in the UPS market. Primary research surveys are conducted to gather information on the demand and supply sides of the UPS market.

Secondary research includes assessment of data and information sources such as industry journals and publications, annual/quarterly financial reports, press releases and other publicly available databases such as the World Bank, World Trade Organization, industry association websites, government databases, and financial websites.

The report is powered by an extensive consumer survey. This survey helps to understand consumer preferences for the UPS market. This is done by conducting surveys with the customers of various UPS companies in the sector.

(1) Market Breakdown and Data Triangulation

Data triangulation is the procedure of breaking up and studying a single set of data from multiple angles or sources. This technique helps to verify the validity and reliability/accuracy of the data collected from varied sources regarding the size of the UPS market, segmentation, and geographical impact.

The market data is validated by performing studies on records and publications, internal datasets, MSMEs, government sources, and industry experts. The data is estimated and authenticated using state-of-the-art primary and secondary research techniques. The extrapolated historical data and forecasting data comprise on a year-on-year basis, quarterly basis, and month-to-month basis. The historical data gathered is analyzed based on inflation, currency exchange rate, income levels, and GDP of respective countries.

The secondary data gathered is cross-checked with the primary research data and a weighted average is calculated. Once the market size is determined for each of the segments, market estimation and triangulation are performed to arrive at a consensus market size and related information.

(2) Research Assumptions

The research project is based on certain assumptions that are incorporated before the research project started. The following assumptions were used for the report:

- The evaluation of the UPS market depends on the quality of the data collected from both primary and secondary sources.

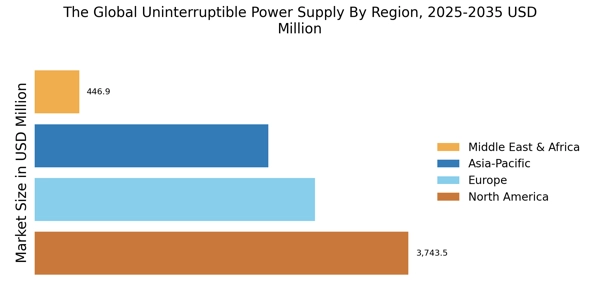

- The analysis of the UPS market considers a total of seven regions: North America, South America, Europe, the Middle East & Africa, and Asia-Pacific.

- The pricing models are based on the cost of goods and services related to UPS.

- All the currency conversions are based on the exchange rate of 2022.

- The market numbers are evaluated based on our historical data, which covers past years and the forecast period.

To analyse the market information and to make the report easier to read and understand, the research report looks at the UPS market globally and its impact on the market in major regions such as North America, EMEA, and APAC.

4. Sampling size

The sampling size for this research project is 50. The sample includes an interview with industry experts, manufacturers, suppliers, vendors, and other stakeholders who have a significant impact on the UPS market.

For primary research, Groundviews’ proprietary SurveyCAD- an online survey platform is used to conduct the primary survey. The survey aims to get an understanding of the user preferences, requirements and thoughts on the UPS market. The survey is conducted with 500 respondents which include the end users, channel players, distributors, and other stakeholders who are involved in the UPS market.

5. Data Collection Methods

The data collection method used is primary and secondary research. Primary sources such as industry experts and secondary sources including books, case studies, press releases, news, journals, and other sources have been used in this research.

The secondary data is collected from public sources such as government reports, websites, industry associations and periodicals. For primary data collection, MRFR conducted in-depth interviews with key opinion leaders, industry experts, and other stakeholders in the UPS market. The interview is conducted in person, over the telephone and via e-mail. The objective of the primary research is to validate the findings from secondary research and to gather data on the customer preferences, the customer offered low cost and differentiation factors in the UPS market.

6. Conclusion

This research report on the Uninterruptible Power Supply (UPS) Market covers all the global, regional and country-level energy markets. The report provides insight into the UPS market and helps to identify the drivers, restraints, opportunities, and challenges that make or break the market. The report is segmented into various categories to provide an in-depth understanding of the UPS market. The analysis of primary and secondary data provides insight into the market structure and the potential opportunities the market holds.