Rising Demand for Miniaturization

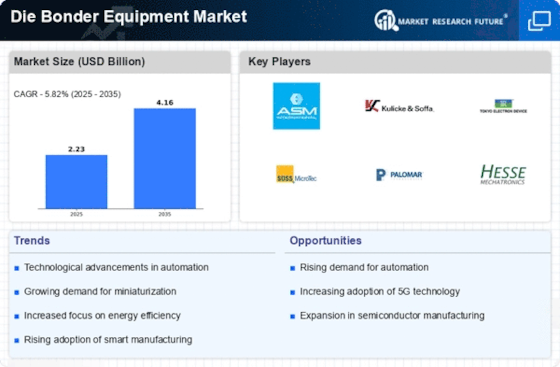

The trend towards miniaturization in electronic devices is a key driver for the Die Bonder Equipment Market. As consumer electronics, automotive components, and medical devices become increasingly compact, the need for precise and efficient die bonding solutions intensifies. This demand is reflected in the projected growth of the semiconductor market, which is expected to reach USD 1 trillion by 2030. Consequently, manufacturers are investing in advanced die bonder equipment that can accommodate smaller die sizes while maintaining high levels of accuracy and speed. The ability to meet these evolving requirements positions companies favorably within the Die Bonder Equipment Market, as they strive to enhance their production capabilities and meet customer expectations.

Growing Adoption of Electric Vehicles

The transition towards electric vehicles (EVs) is significantly influencing the Die Bonder Equipment Market. As the automotive sector shifts to electrification, the demand for advanced semiconductor components, such as power modules and battery management systems, is on the rise. This shift necessitates the use of sophisticated die bonding technologies to ensure reliable performance and longevity of these components. The EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2030, which will likely drive the demand for die bonder equipment tailored for automotive applications. Consequently, manufacturers in the Die Bonder Equipment Market are adapting their offerings to cater to the unique requirements of the EV sector.

Technological Innovations in Die Bonding

Technological advancements are reshaping the Die Bonder Equipment Market, as manufacturers seek to enhance the performance and capabilities of their equipment. Innovations such as automated die bonding systems, advanced vision systems, and improved adhesive materials are becoming increasingly prevalent. These technologies not only improve the accuracy and speed of the bonding process but also reduce waste and operational costs. As companies strive to remain competitive, the integration of these innovations is essential for meeting the growing demands of various sectors, including consumer electronics and telecommunications. The ongoing evolution of die bonding technology is expected to drive growth in the Die Bonder Equipment Market, as manufacturers invest in state-of-the-art solutions to optimize their production processes.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure is a significant driver for the Die Bonder Equipment Market. With the increasing demand for high-speed internet and advanced communication technologies, there is a growing need for semiconductor components that support these systems. The rollout of 5G networks, in particular, is expected to create substantial opportunities for die bonding equipment manufacturers. As telecommunications companies invest heavily in upgrading their infrastructure, the demand for reliable and efficient die bonding solutions is likely to rise. This trend suggests that the Die Bonder Equipment Market will experience growth as manufacturers align their offerings with the evolving needs of the telecommunications sector.

Increased Investment in Semiconductor Manufacturing

The Die Bonder Equipment Market is experiencing a surge in investment as countries and corporations prioritize semiconductor manufacturing. Governments are recognizing the strategic importance of semiconductor production, leading to initiatives that support local manufacturing capabilities. For instance, recent reports indicate that investments in semiconductor facilities are projected to exceed USD 500 billion over the next decade. This influx of capital is likely to drive demand for die bonding equipment, as manufacturers seek to upgrade their production lines to meet the anticipated increase in semiconductor output. As a result, the Die Bonder Equipment Market stands to benefit from this trend, with companies focusing on innovative solutions to enhance efficiency and reduce production costs.