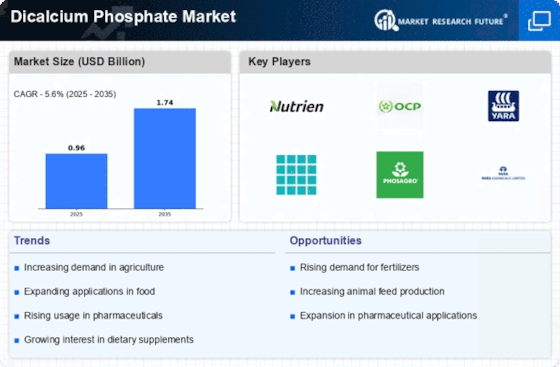

Increasing Use in Food Industry

The Dicalcium Phosphate Market is experiencing a notable increase in demand from the food sector. This compound serves as a food additive, enhancing nutritional value and acting as a leavening agent. The food industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, which could significantly boost the demand for dicalcium phosphate. As consumers become more health-conscious, the need for fortified foods is likely to rise, thereby driving the market further. Additionally, the regulatory frameworks surrounding food safety and nutritional labeling are becoming more stringent, which may compel manufacturers to incorporate dicalcium phosphate into their products to meet these standards.

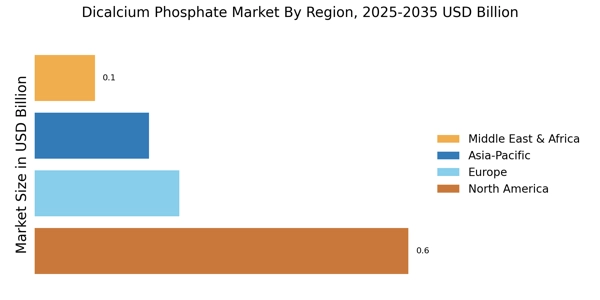

Expansion in Fertilizer Applications

The Dicalcium Phosphate Market is also witnessing growth due to its application in fertilizers. As agricultural practices evolve, there is an increasing emphasis on soil health and nutrient management. Dicalcium phosphate is recognized for its role in enhancing soil fertility and crop yield. The fertilizer segment is expected to grow at a rate of around 5% annually, driven by the rising global population and the consequent demand for food production. This trend suggests that dicalcium phosphate will play a crucial role in sustainable agriculture, as it provides essential nutrients to plants while minimizing environmental impact. The integration of dicalcium phosphate in fertilizers aligns with the broader movement towards sustainable farming practices.

Rising Demand in Pet Food Production

The Dicalcium Phosphate Market is benefiting from the increasing demand for high-quality pet food. As pet ownership rises, consumers are seeking nutritious options for their pets, leading to a surge in the pet food market. Dicalcium phosphate is often included in pet food formulations to provide essential minerals, particularly calcium and phosphorus, which are vital for pet health. The pet food industry is projected to grow at a rate of approximately 6% per year, indicating a robust market for dicalcium phosphate as a key ingredient. This trend highlights the importance of dicalcium phosphate in meeting the nutritional needs of pets, thereby driving its demand in the market.

Growth in Pharmaceutical Applications

The Dicalcium Phosphate Market is also expanding due to its applications in the pharmaceutical sector. Dicalcium phosphate is utilized as an excipient in tablet formulations, providing essential properties such as binding and disintegration. The pharmaceutical industry is expected to grow at a compound annual growth rate of around 4% in the coming years, which may enhance the demand for dicalcium phosphate. As the focus on drug formulation and delivery systems intensifies, the role of dicalcium phosphate as a reliable excipient becomes increasingly significant. This growth in the pharmaceutical sector could provide a substantial boost to the dicalcium phosphate market, reflecting its versatility and importance in various applications.

Emerging Markets and Economic Development

The Dicalcium Phosphate Market is poised for growth due to the economic development in emerging markets. As these economies expand, there is a rising demand for various industrial applications, including animal feed, food additives, and fertilizers. The increasing disposable income in these regions is likely to lead to higher consumption of products containing dicalcium phosphate. Furthermore, the agricultural sector in emerging markets is evolving, with a greater focus on improving crop yields and livestock health. This trend suggests that the demand for dicalcium phosphate will continue to rise, driven by both industrial and agricultural needs, thereby presenting opportunities for market players.