Research Methodology on Diacetone Alcohol Market

Introduction

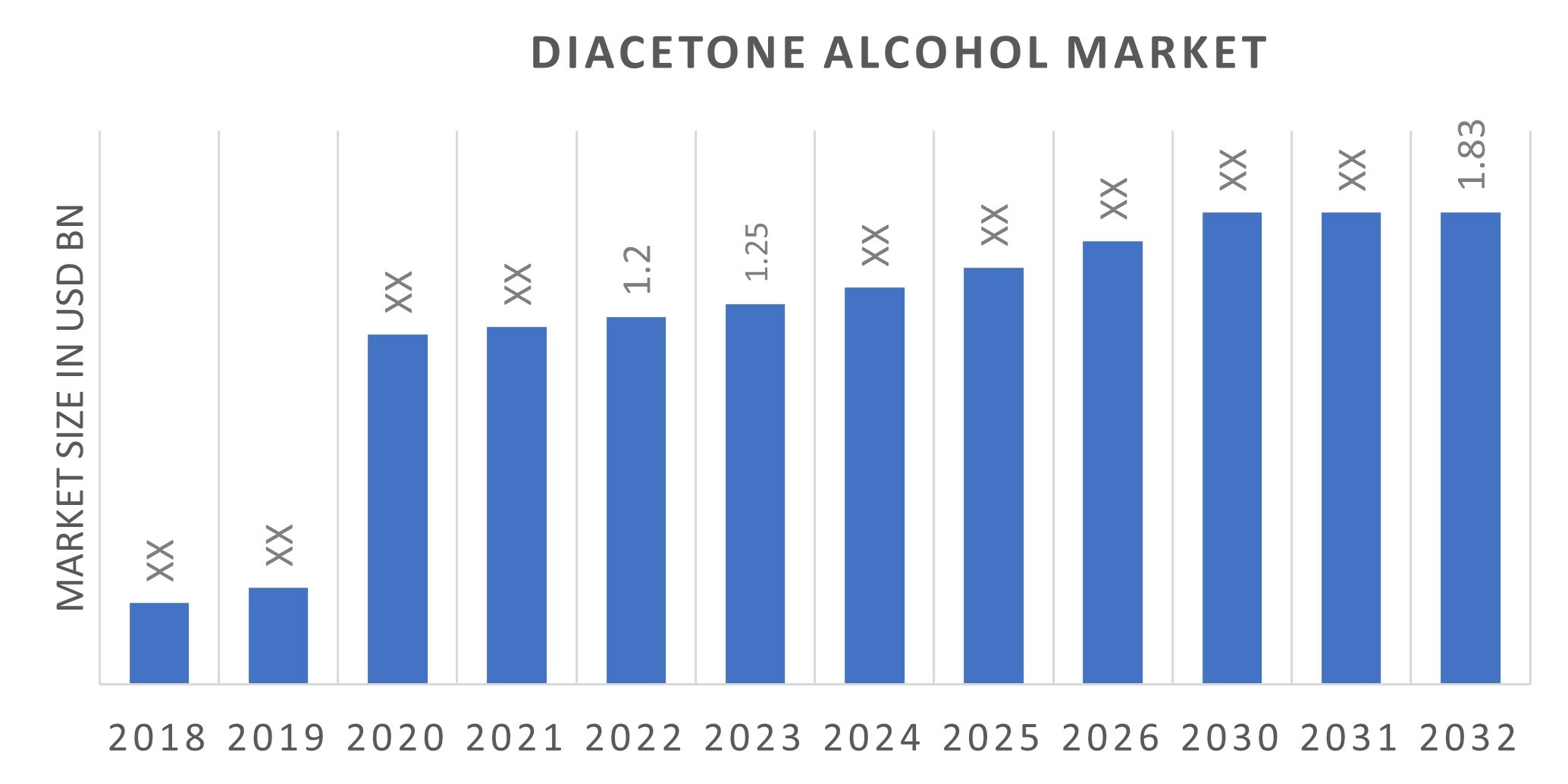

Market Research Future publishes market reports on the diacetone alcohol market. The purpose of this research is to understand the production trends and growth rate of the diacetone alcohol (MDA) market in the forecast period from 2023–2030. Market speculation is made based on a thorough evaluation of data sourced from both primary and secondary resources. The process involves a range of activities such as market intelligence, expert advice, industry awareness, relevant judgments, and market risks.

Research Objectives

The research objectives of this report on the diacetone alcohol market are to:

• Learn about market drivers and restraints

• Understand the size and value of the market in 2023-2030

• Identify the key trends and growth rates

• Understand the product demand

• Understand the competitive landscape of the market

• Learn about strategies used by top players

Research Design

The research design of this report on the diacetone alcohol market involves gathering data from both primary and secondary sources. Primary sources consist of industry experts, government sources, and data collected from relevant stakeholders in the market. Secondary sources include market reports, news, databases, industry journals, and research papers.

Data Collection and Analysis

The data were collected and analyzed using the following methods:

• Top Down Approach: Data for this report was gathered from industry experts, industry players, and relevant stakeholders to understand the market size and value.

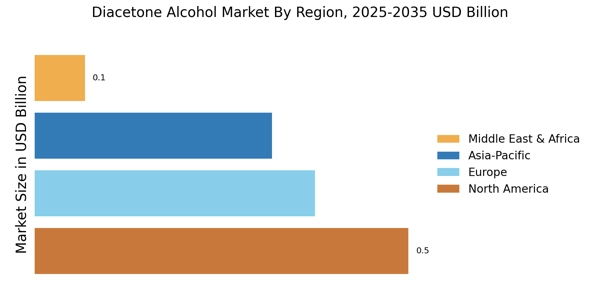

• Bottom-Up Approach: Data was segmented by application, region, and country to understand market trends.

• Time–Series Analysis: Historical data from 2023 to 2030 was collected and analyzed to understand the diacetone alcohol market’s growth rate.

• Factor Analysis: Industry trends were analyzed to understand the demand and supply-side scenarios.

• Demand Side and Supply Side Data Triangulation: The report focuses on triangulating the data to understand the market size and growth rate.

Definition of Enterprise Insights

Enterprise insights from primary and secondary research were used to understand the diacetone alcohol market’s competitive landscape. The enterprise insights and information collected from data analysis techniques such as factor analysis, market intelligence, expert advice, and relevant judgments, were used to identify strategies used by top market players.

Quality Assurance Procedures

Quality assurance procedures were implemented to ensure the highest quality and accuracy of the data. The following procedures were deployed in the report:

• Data Cleaning: To avoid errors, redundant or duplicate data was removed from the data set.

• Data Transforming: The gathered data was transformed from one form to another so that it could be easily analyzed.

• Data Editing: The data was edited to eliminate any inconsistencies or discrepancies.

• Data Validation: The data gathered was validated to check the accuracy of the data.

Data Processing and Analysis

The collected data was processed and analyzed with descriptive and inferential methods. Descriptive methods of data analysis such as mean, median, mode, and summated measures were deployed for summarizing the data to understand the top-line growth and size of the market. Inferential methods of data analysis such as regression analysis were used to understand the correlation between independent and dependent variables.

Secondary Research

Secondary research was conducted to understand the current scenario and market insights of the diacetone alcohol market. The secondary sources were sourced from company websites, investor presentations, press releases, annual reports, government sources, statistical databases, white papers, interviews, and market reports.

Primary Research

Primary research involved interviews with relevant stakeholders and key opinion leaders to understand the diacetone alcohol market. The primary research also involved in-depth interviews with industry experts, industry players, regional stakeholders, and other key opinion leaders to understand the competitive landscape.

Research Outcomes

The research outcomes of this report include an in-depth analysis of the drivers and restraints, trends, product demand, competitive landscape, and strategies employed by top players to maximize their market shares. The report also provides insights into the diacetone alcohol market size and value and the growth rate in the forecast period from 2023–2030.