- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

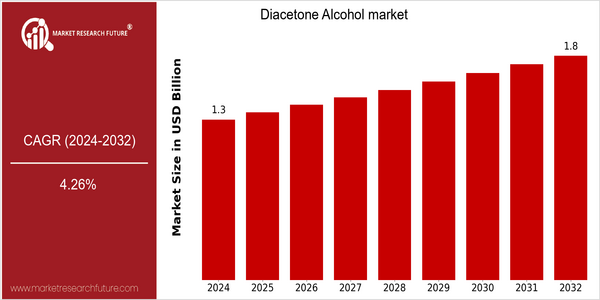

| Year | Value |

|---|---|

| 2024 | USD 1.31 Billion |

| 2032 | USD 1.83 Billion |

| CAGR (2024-2032) | 4.26 % |

Note – Market size depicts the revenue generated over the financial year

The global Diacetone Alcohol market is poised for steady growth, with a current market size of USD 1.31 billion in 2024, projected to reach USD 1.83 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.26% over the forecast period. The increasing demand for Diacetone Alcohol in various applications, including solvents, coatings, and personal care products, is a significant driver of this market expansion. As industries continue to seek versatile and effective chemical solutions, the adoption of Diacetone Alcohol is expected to rise, bolstered by its favorable properties such as low toxicity and high solvency power. Technological advancements and innovations in production processes are also contributing to the market's growth. Companies are investing in research and development to enhance the efficiency of Diacetone Alcohol production, which not only reduces costs but also minimizes environmental impact. Key players in the market, such as BASF, Eastman Chemical Company, and Solvay, are actively pursuing strategic initiatives, including partnerships and product launches, to strengthen their market position. For instance, recent collaborations aimed at developing sustainable chemical solutions are indicative of the industry's shift towards eco-friendly practices, further propelling the demand for Diacetone Alcohol in the coming years.

Regional Market Size

Regional Deep Dive

The Diacetone Alcohol market is characterized by diverse applications across various industries, including paints, coatings, and cosmetics. In North America, the market is driven by a robust manufacturing sector and increasing demand for solvent-based products. Europe showcases a strong emphasis on sustainability, leading to innovations in bio-based Diacetone Alcohol production. The Asia-Pacific region is witnessing rapid industrialization, which is propelling the demand for Diacetone Alcohol in various applications. The Middle East and Africa are gradually emerging as potential markets due to increasing investments in chemical manufacturing. Latin America is also seeing growth, primarily due to rising demand in the automotive and construction sectors.

Europe

- In Europe, the market is significantly influenced by the European Union's Green Deal, which aims to make Europe climate-neutral by 2050, prompting investments in sustainable chemical processes.

- Key players such as BASF and Solvay are focusing on developing bio-based Diacetone Alcohol, which is expected to reshape the market landscape towards more sustainable practices.

Asia Pacific

- The Asia-Pacific region is witnessing rapid industrial growth, particularly in countries like China and India, where the demand for Diacetone Alcohol in coatings and adhesives is on the rise.

- Innovations in production technologies, such as the use of renewable feedstocks, are being adopted by companies like Mitsubishi Gas Chemical, enhancing the market's growth potential.

Latin America

- In Latin America, the automotive industry's growth is driving the demand for Diacetone Alcohol, with companies like Braskem focusing on expanding their chemical production capabilities.

- The region is also witnessing a shift towards sustainable practices, with local governments promoting the use of bio-based solvents, which is expected to positively impact the Diacetone Alcohol market.

North America

- The North American market is experiencing a surge in demand for eco-friendly solvents, with companies like Eastman Chemical Company investing in sustainable production methods for Diacetone Alcohol.

- Regulatory changes, particularly the implementation of stricter VOC (Volatile Organic Compounds) regulations, are pushing manufacturers to innovate and develop low-emission products, thereby influencing the market dynamics.

Middle East And Africa

- The Middle East is seeing increased investments in the chemical sector, with companies like SABIC exploring the production of Diacetone Alcohol to cater to local and export markets.

- Regulatory frameworks are gradually evolving, with governments encouraging the development of the chemical industry, which is expected to boost the Diacetone Alcohol market in the region.

Did You Know?

“Diacetone Alcohol is not only used as a solvent but also serves as an intermediate in the production of various chemicals, making it a versatile compound in the chemical industry.” — Chemical & Engineering News

Segmental Market Size

The Diacetone Alcohol segment plays a crucial role in the solvent and chemical intermediate markets, currently experiencing stable demand due to its versatile applications in various industries. Key drivers include the increasing need for eco-friendly solvents in paints and coatings, as well as the growing demand for high-performance chemicals in the cosmetics and personal care sectors. Regulatory policies favoring low-VOC (volatile organic compounds) products further bolster this segment's appeal. Currently, Diacetone Alcohol is in a mature adoption stage, with companies like BASF and Eastman Chemical leading in production and innovation. Its primary applications include use as a solvent in coatings, adhesives, and cleaning products, showcasing its importance across multiple sectors. Trends such as sustainability initiatives and the shift towards greener chemistry are accelerating growth, while advancements in production technologies, such as bio-based synthesis methods, are shaping the segment's evolution. These factors collectively position Diacetone Alcohol as a key player in the transition towards more sustainable industrial practices.

Future Outlook

The Diacetone Alcohol market is poised for steady growth from 2024 to 2032, with a projected market value increase from $1.31 billion to $1.83 billion, reflecting a compound annual growth rate (CAGR) of 4.26%. This growth trajectory is underpinned by the rising demand for solvents in various applications, including coatings, adhesives, and personal care products. As industries increasingly prioritize eco-friendly and sustainable solutions, the adoption of Diacetone Alcohol, known for its low toxicity and favorable environmental profile, is expected to gain momentum. By 2032, penetration rates in key sectors such as automotive and construction are anticipated to reach approximately 15%, driven by stringent regulations on volatile organic compounds (VOCs) and a shift towards greener alternatives. Technological advancements in production processes and the development of innovative applications are also expected to play a crucial role in shaping the market landscape. The integration of advanced manufacturing techniques will enhance the efficiency and cost-effectiveness of Diacetone Alcohol production, making it more accessible to a broader range of industries. Furthermore, the growing trend of customization in formulations will likely lead to increased usage in specialty applications, further expanding the market. As companies align their strategies with sustainability goals and regulatory frameworks, the Diacetone Alcohol market is set to experience robust growth, positioning itself as a key player in the global solvent market by 2032.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.2 Billion |

| Market Size Value In 2023 | USD 1.25 Billion |

| Growth Rate | 4.85% (2023-2032) |

Diacetone Alcohol Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.