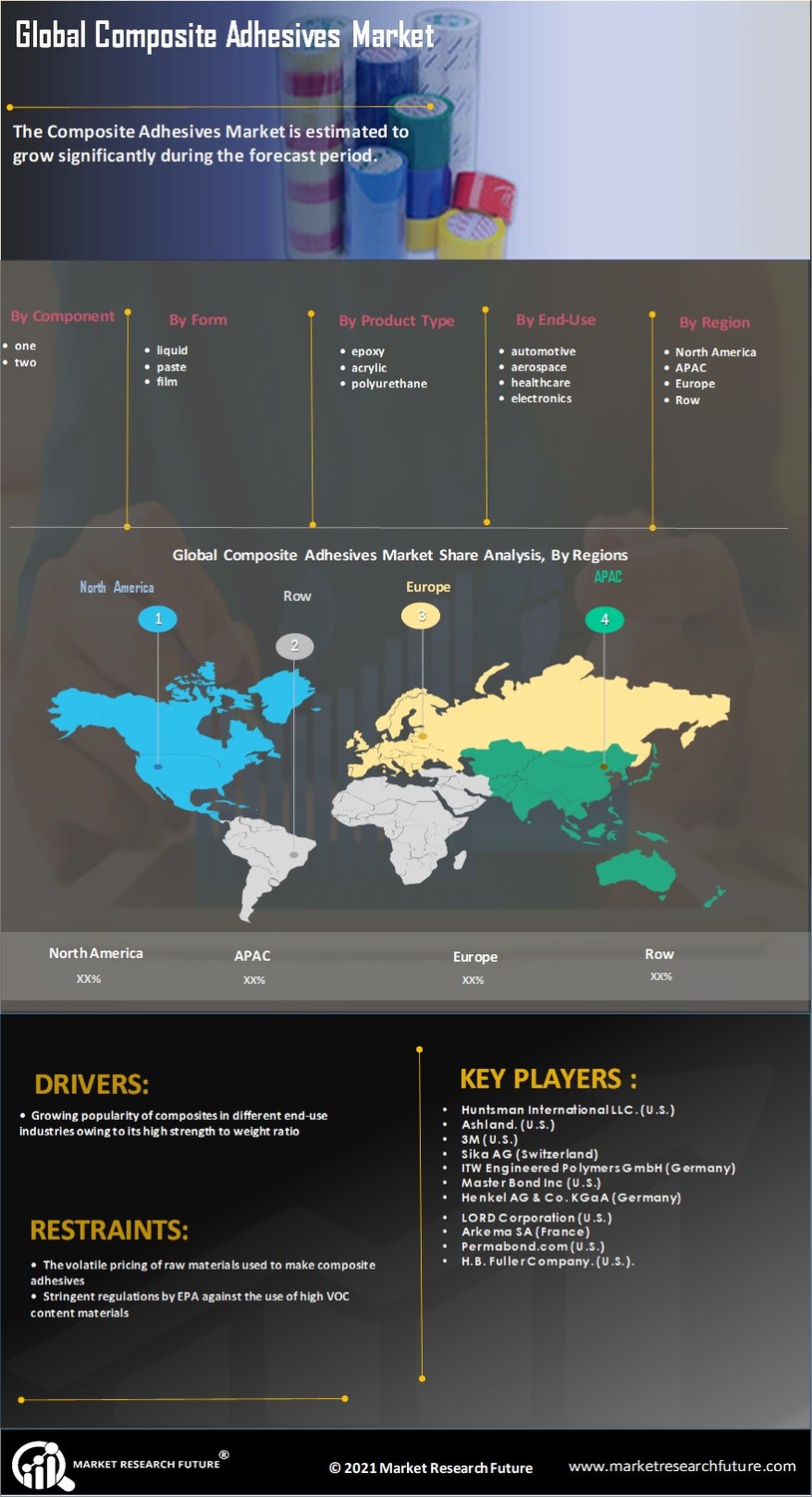

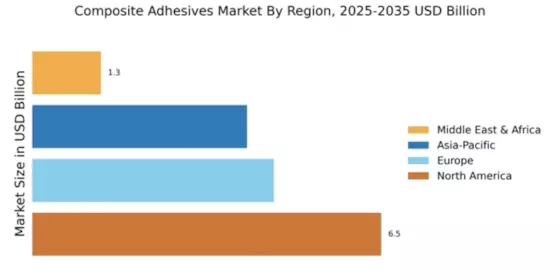

Market Growth Projections

The Global Composite Adhesives Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 4.9% from 2025 to 2035. This growth trajectory is supported by increasing applications across various sectors, including automotive, aerospace, and construction. As industries continue to embrace composite materials for their lightweight and durable properties, the demand for advanced adhesive solutions is expected to rise. The market's expansion reflects broader trends in material science and engineering, suggesting a dynamic landscape for composite adhesives in the coming years.

Expansion in Aerospace Applications

The aerospace industry is increasingly utilizing composite adhesives due to their superior bonding capabilities and lightweight properties. The Global Composite Adhesives Market Industry benefits from this trend as manufacturers seek to improve aircraft performance and fuel efficiency. With the global aerospace market projected to expand significantly, the demand for composite materials and adhesives is expected to rise correspondingly. This sector's growth is indicative of a broader trend towards advanced materials in high-performance applications, suggesting that the market could see substantial investment and innovation in adhesive technologies tailored for aerospace applications.

Growing Demand in Automotive Sector

The automotive sector is experiencing a notable surge in demand for composite adhesives, driven by the industry's shift towards lightweight materials to enhance fuel efficiency and reduce emissions. The Global Composite Adhesives Market Industry is projected to reach 3.68 USD Billion in 2024, reflecting the increasing adoption of composite materials in vehicle manufacturing. This trend is particularly evident in electric vehicles, where weight reduction is critical for performance. As manufacturers seek to improve vehicle design and safety, the reliance on advanced adhesive technologies is likely to grow, fostering innovation and expansion within the market.

Increasing Applications in Construction

The construction industry is witnessing a rising trend in the adoption of composite adhesives, particularly in prefabricated and modular construction. The Global Composite Adhesives Market Industry is benefiting from this shift as builders seek efficient bonding solutions that enhance structural integrity and reduce assembly time. With the construction sector projected to grow steadily, the demand for advanced adhesive technologies is likely to increase. This trend is further supported by the industry's focus on improving energy efficiency and sustainability, suggesting a robust future for composite adhesives in construction applications.

Rising Demand for Sustainable Solutions

There is a growing emphasis on sustainability within the Global Composite Adhesives Market Industry, driven by consumer preferences and regulatory pressures. Manufacturers are increasingly seeking eco-friendly adhesive solutions that minimize environmental impact while maintaining performance standards. This shift is evident in various sectors, including packaging and construction, where sustainable materials are becoming a priority. As companies adapt to these changing demands, the market for bio-based and recyclable adhesives is expected to expand, aligning with global sustainability goals and potentially influencing market dynamics over the coming years.

Technological Advancements in Adhesive Formulations

Innovations in adhesive formulations are driving the growth of the Global Composite Adhesives Market Industry. Advances in chemistry and material science have led to the development of high-performance adhesives that offer enhanced durability, temperature resistance, and environmental stability. These improvements are particularly relevant in industries such as construction and manufacturing, where the need for reliable bonding solutions is paramount. As companies invest in research and development to create next-generation adhesives, the market is likely to witness a significant transformation, potentially increasing its value to 6.22 USD Billion by 2035.