Aging Population

The demographic shift towards an aging population in South America will significantly impact the diabetic retinopathy market. As individuals age, the prevalence of diabetes and its complications, including diabetic retinopathy, tends to increase. By 2030, it is projected that the population aged 60 and above in South America will reach approximately 20% of the total population. This demographic trend suggests a growing patient base requiring specialized care for diabetic retinopathy. Consequently, healthcare providers may need to enhance their services and treatment modalities to cater to this aging demographic, thereby driving growth in the diabetic retinopathy market.

Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is another significant driver for the diabetic retinopathy market. Governments and private sectors are investing more in healthcare infrastructure, which includes the provision of advanced diagnostic and treatment facilities for diabetic retinopathy. In recent years, healthcare spending in South America has seen a growth rate of approximately 5% annually, reflecting a commitment to improving health outcomes. This financial support enables the adoption of innovative technologies and therapies, enhancing the overall management of diabetic retinopathy. As healthcare systems evolve, the diabetic retinopathy market is likely to benefit from improved access to care and a wider range of treatment options.

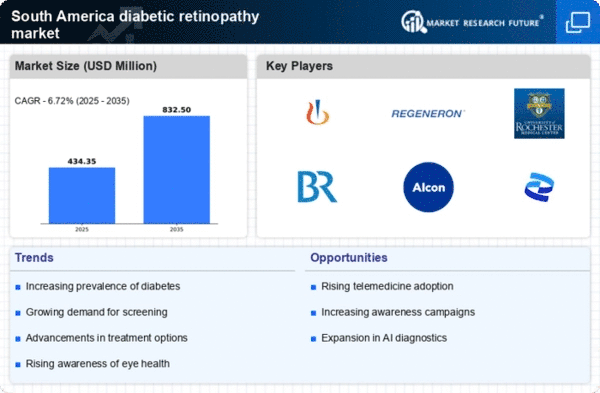

Advancements in Treatment Modalities

The continuous advancements in treatment modalities for diabetic retinopathy are likely to propel the market forward. Innovative therapies, such as anti-VEGF injections and laser treatments, have shown promising results in managing the disease. In South America, the introduction of these advanced treatment options has the potential to improve patient outcomes significantly. The market for diabetic retinopathy is expected to grow as healthcare providers adopt these new technologies, which may lead to better management of the disease and reduced incidence of vision loss. The increasing availability of these treatments is indicative of a dynamic market landscape that is responsive to patient needs.

Increasing Awareness of Diabetic Retinopathy

The growing awareness regarding diabetic retinopathy among healthcare professionals and patients is a crucial driver for the diabetic retinopathy market in South America. Educational campaigns and initiatives by health organizations have led to improved understanding of the disease, its symptoms, and the importance of early detection. This heightened awareness is likely to result in increased screening and diagnostic procedures, thereby expanding the market. In South America, it is estimated that around 30% of individuals with diabetes may develop some form of diabetic retinopathy, underscoring the need for effective management strategies. As more patients become informed about the risks associated with diabetes, the demand for treatment options in the diabetic retinopathy market is expected to rise significantly.

Rising Incidence of Diabetes-Related Complications

The rising incidence of diabetes-related complications in South America serves as a critical driver for the diabetic retinopathy market. As the number of individuals diagnosed with diabetes continues to grow, the associated complications, including diabetic retinopathy, are becoming more prevalent. Reports indicate that nearly 50% of individuals with diabetes may develop some form of retinopathy over their lifetime. This alarming statistic highlights the urgent need for effective screening and treatment options. Consequently, healthcare systems are likely to prioritize the management of diabetic retinopathy, leading to increased investments in the market. The focus on addressing these complications is expected to foster growth and innovation within the diabetic retinopathy market.