Research Methodology on Diabetic Nephropathy Market

1. Introduction

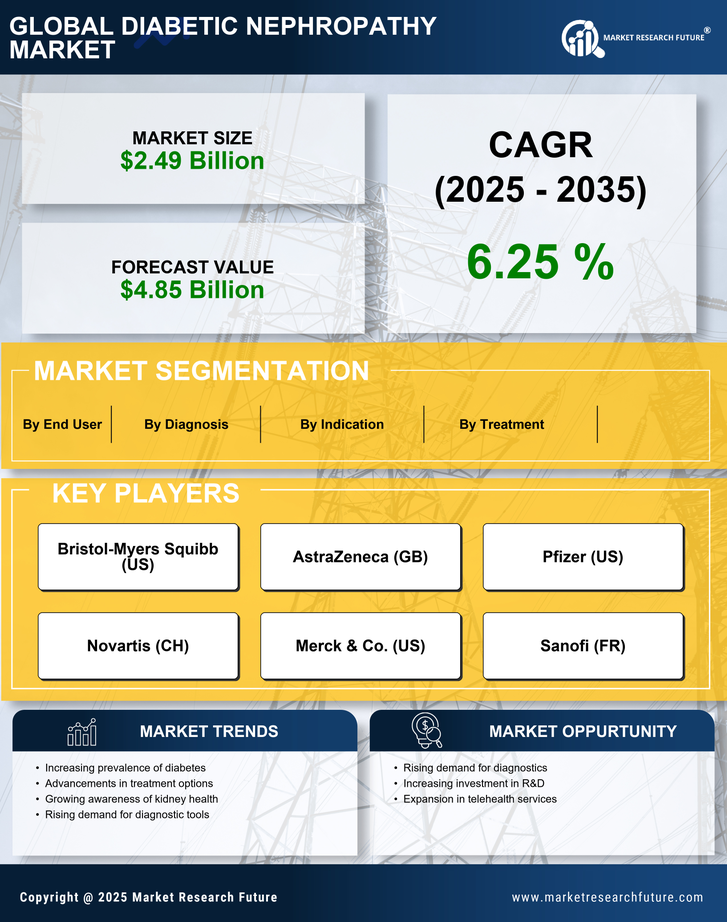

The research report on the global Diabetic Nephropathy Market is curated to explore the current trends in the market and the potential opportunities for the stakeholders and market participants. The research covered a comprehensive analysis of market trends, factors influencing the market and its demand in the global market. In the report, we have included the current trends in the market and the potential opportunities for the stakeholders and market participants. We have also included the competitive landscape of the market and the competitive strategies adopted by the key players in the industry.

2. Research Data

Data used in this report is sourced through primary and secondary research. We used primary research sources such as interviews, surveys, and questionnaires to understand the market landscape and demand and supply of the Diabetic Nephropathy market. For secondary research, we used sources such as published yearly reports, research papers, articles, magazines, and international journals. All sources were extensively analyzed to gain maximum information on the Diabetic Nephropathy market.

3. Research Approach

The research approach for this report is comprised of both Primary and Secondary research. The research methodology was based on Market Research Future’s proprietary 5-way process framework. The 5-way process includes: 1. Understanding of the global Diabetic Nephropathy market, 2. Assessment of market size, 3. Identification of the key players, 4. Analysis of the market and 5. Forecasting the market outlook.

4. Market Segmentation

The report is divided into different segments like types, applications, geographical analysis and competitor analysis. The types of Diabetic Nephropathy are categorized into:

- Type 1 diabetes

- Type 2 diabetes

The applications of the Diabetic Nephropathy market are grouped into:

- Patient Management

- Treatment

- Diagnosis

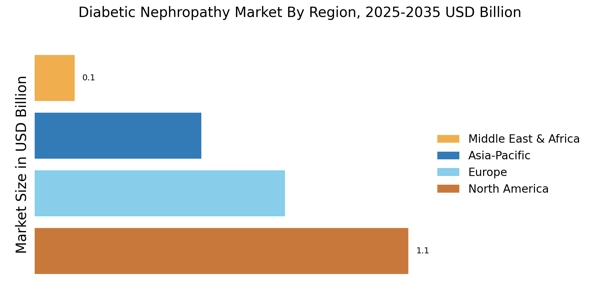

The geographical analysis of the Diabetic Nephropathy market is categorized into:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

Research Methodology on Diabetic Nephropathy Market

1. Introduction

The research report on the global Diabetic Nephropathy Market is curated to explore the current trends in the market and the potential opportunities for the stakeholders and market participants. The research covered a comprehensive analysis of market trends, factors influencing the market and its demand in the global market. In the report, we have included the current trends in the market and the potential opportunities for the stakeholders and market participants. We have also included the competitive landscape of the market and the competitive strategies adopted by the key players in the industry.

2. Research Data

Data used in this report is sourced through primary and secondary research. We used primary research sources such as interviews, surveys, and questionnaires to understand the market landscape and demand and supply of the Diabetic Nephropathy market. For secondary research, we used sources such as published yearly reports, research papers, articles, magazines, and international journals. All sources were extensively analyzed to gain maximum information on the Diabetic Nephropathy market.

3. Research Approach

The research approach for this report is comprised of both Primary and Secondary research. The research methodology was based on Market Research Future’s proprietary 5-way process framework. The 5-way process includes: 1. Understanding of the global Diabetic Nephropathy market, 2. Assessment of market size, 3. Identification of the key players, 4. Analysis of the market and 5. Forecasting the market outlook.

4. Market Segmentation

The report is divided into different segments like types, applications, geographical analysis and competitor analysis. The types of Diabetic Nephropathy are categorized into:

- Type 1 diabetes

- Type 2 diabetes

The applications of the Diabetic Nephropathy market are grouped into:

- Patient Management

- Treatment

- Diagnosis

The geographical analysis of the Diabetic Nephropathy market is categorized into:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

5. Key Player Analysis

This section of the report will provide a comprehensive profile of the key players in the global Diabetic Nephropathy market. This section of the report will include profiling of the key players, their SWOT analysis and an analysis of their product and service offerings. Some of the major companies included in this analysis are:

- Merck & Co, Inc.

- Novo Nordisk

- Abbott Laboratories

- Bristol-Myers Squibb Company

- AstraZeneca

- Eli Lilly and Company

- Sanofi

- Teva Pharmaceutical Industries Ltd. and others.

6. Research Report Outcome

The research report on the global Diabetic Nephropathy market has provided a comprehensive overview of the market. The report also provides an in-depth analysis of the market size, segmentation, geographical analysis, key player profile and competitiveness in the market. The report also provides insight into the current trends in the market and the potential opportunities for the stakeholders and market participants.

This section of the report will provide a comprehensive profile of the key players in the global Diabetic Nephropathy market. This section of the report will include profiling of the key players, their SWOT analysis and an analysis of their product and service offerings. Some of the major companies included in this analysis are:

- Merck & Co, Inc.

- Novo Nordisk

- Abbott Laboratories

- Bristol-Myers Squibb Company

- AstraZeneca

- Eli Lilly and Company

- Sanofi

- Teva Pharmaceutical Industries Ltd. and others.

6. Research Report Outcome

The research report on the global Diabetic Nephropathy market has provided a comprehensive overview of the market. The report also provides an in-depth analysis of the market size, segmentation, geographical analysis, key player profile and competitiveness in the market. The report also provides insight into the current trends in the market and the potential opportunities for the stakeholders and market participants.