Rising Prevalence of Diabetes

The increasing incidence of diabetes worldwide is a primary driver for the Diabetic Lancing Device Market. According to recent statistics, the number of individuals diagnosed with diabetes has surged, with estimates suggesting that over 500 million people are currently living with the condition. This growing patient population necessitates effective blood glucose monitoring solutions, thereby propelling demand for lancing devices. As diabetes management becomes more critical, healthcare providers and patients alike are seeking reliable and user-friendly lancing devices. This trend indicates a robust market potential, as manufacturers strive to innovate and enhance their product offerings to meet the needs of a diverse patient demographic.

Increased Awareness and Education

Growing awareness regarding diabetes management and the importance of regular blood glucose monitoring is significantly influencing the Diabetic Lancing Device Market. Educational initiatives by healthcare organizations and advocacy groups are empowering patients with knowledge about diabetes care. This heightened awareness is likely to lead to increased adoption of lancing devices, as patients recognize the necessity of monitoring their blood sugar levels. Furthermore, market data indicates that regions with robust educational programs exhibit higher usage rates of lancing devices, suggesting a correlation between awareness and market growth. As education continues to expand, the demand for effective lancing solutions is expected to rise.

Shift Towards Home Healthcare Solutions

The trend towards home healthcare is reshaping the Diabetic Lancing Device Market. Patients increasingly prefer managing their diabetes at home, driven by the convenience and comfort it offers. This shift has led to a surge in demand for user-friendly lancing devices that can be easily utilized in a home setting. Market data reveals that the home healthcare segment is experiencing rapid growth, with more patients opting for self-monitoring solutions. Manufacturers are responding to this trend by developing lancing devices that are not only efficient but also designed for ease of use. This evolution in patient care is likely to sustain market growth in the coming years.

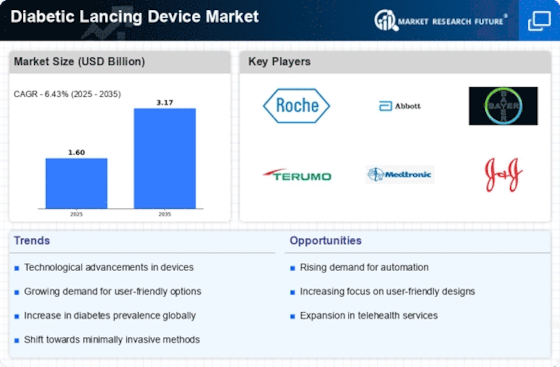

Technological Innovations in Lancing Devices

Technological advancements play a pivotal role in shaping the Diabetic Lancing Device Market. Innovations such as smart lancing devices equipped with Bluetooth connectivity and mobile applications are gaining traction. These devices not only facilitate easier blood sampling but also enable users to track their glucose levels in real-time. The integration of advanced features is likely to enhance user experience and adherence to diabetes management protocols. Market data suggests that the demand for such technologically advanced devices is on the rise, as patients increasingly prefer solutions that offer convenience and improved functionality. This trend is expected to drive growth in the market as manufacturers invest in research and development.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are crucial drivers for the Diabetic Lancing Device Market. Governments and health authorities are increasingly recognizing the importance of diabetes management, leading to the establishment of policies that facilitate access to necessary medical devices. Enhanced reimbursement options for lancing devices are encouraging patients to utilize these essential tools for blood glucose monitoring. Market data indicates that regions with robust reimbursement frameworks witness higher adoption rates of lancing devices, suggesting that financial support plays a significant role in market dynamics. As regulatory environments continue to evolve, the market is likely to benefit from increased accessibility and affordability.