Dermal Fillers Market Summary

As per Market Research Future analysis, the Dermal fillers Market Size was estimated at USD 6,232.12 Million in 2024. The Dermal fillers industry is projected to grow from USD 6,699.04 Million in 2025 to 23,667.64 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 13.45% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Dermal fillers Market is experiencing robust growth driven by growing demand for facial aesthetics & increased no. of aesthetic procedures performed by plastic surgeons.

- The increasing demand for facial aesthetics has emerged as one of the strongest growth drivers in the worldwide dermal filler industry, changing both its consumer base and competitive dynamics. Minimally invasive cosmetic procedures, particularly those aimed at facial rejuvenation, have grown in popularity. As the market continues to evolve, it is anticipated that the growing acceptance and demand for facial aesthetics will drive further research and development, fostering a landscape where individuals have access to increasingly sophisticated and tailored dermal filler solutions to achieve their desired aesthetic outcomes.

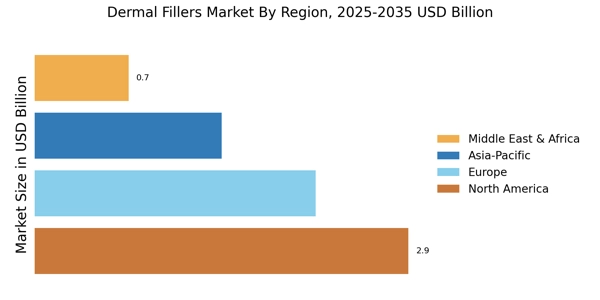

- The Asia-Pacific region represents the highest growth potential in the global dermal fillers market, driven by rapid economic development and expanding middle-class populations. Countries like China and India are experiencing unprecedented wealth creation, with disposable income levels enabling increased spending on aesthetic treatments. However, cultural acceptance varies significantly across the region, with countries like South Korea and Japan showing high acceptance rates, while more conservative societies demonstrate gradual adoption patterns.

- biodegradable remains the dominant product category, driven by their their safety profile, reversibility, and natural integration with surrounding tissues. They are predominantly used for facial volume restoration, wrinkle reduction, and contouring.

- Hyaluronic Acid (HA) is a naturally occurring glycosaminoglycan that retains water, providing hydration and volume. HA is highly versatile, reversible with hyaluronidase, and available in various formulations for different depths of injection. It is used for lip augmentation, nasolabial folds, marionette lines, and overall facial volume enhancement. Juvederm, Restylane, Belotero, and other brands are prominent HA which dominate this segment.

- Face line correction lead the market, supported widely used to smooth out fine lines and wrinkles, such as crow’s feet, forehead lines, and marionette lines. These treatments help restore a youthful, rested appearance by filling in static and dynamic lines caused by aging and facial expressions.

- Hospitals serve as a significant end-user in the dermal filler market, particularly in departments specializing in plastic surgery, dermatology, and reconstructive procedures. They are equipped with advanced facilities and trained professionals to perform complex and comprehensive aesthetic treatments.

Market Size & Forecast

| 2024 Market Size | 6,232.12 (USD Million) |

| 2035 Market Size | 6,699.04 (USD Million) |

| CAGR (2025 - 2035) | 13.45% |

Major Players

Galderma, Revance Therapeutics, Merz Pharmaceuticals, Sinclair, and AbbVie.