Increasing Consumer Awareness

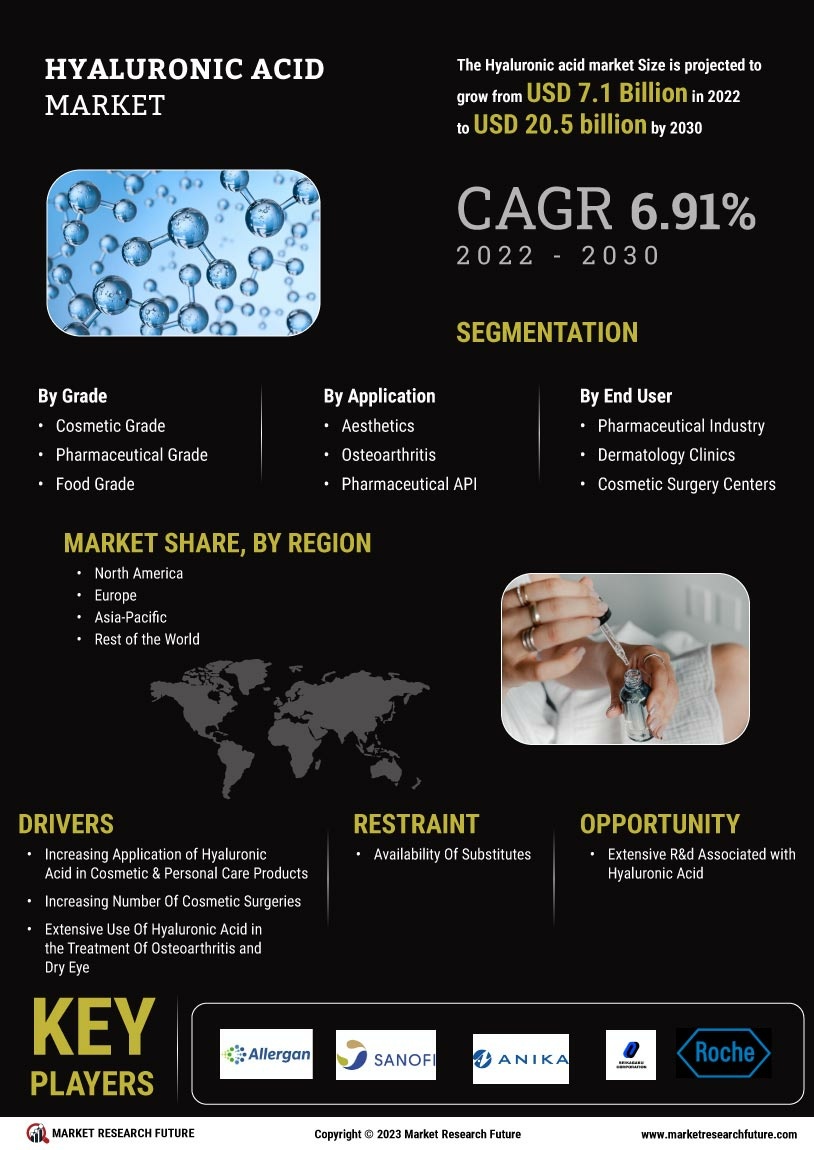

The Hyaluronic Acid Market is experiencing a notable surge in consumer awareness regarding the benefits of hyaluronic acid. As individuals become more informed about skincare ingredients, the demand for products containing hyaluronic acid is likely to rise. This compound is recognized for its ability to retain moisture, enhance skin elasticity, and reduce the appearance of fine lines. Consequently, the market for hyaluronic acid in cosmetics is projected to grow, with estimates suggesting a compound annual growth rate of over 7% in the coming years. This heightened awareness is not limited to cosmetics; consumers are also seeking hyaluronic acid in dietary supplements and health products, further driving the market's expansion.

Growth in E-commerce Platforms

The Hyaluronic Acid Market is experiencing a transformation due to the growth of e-commerce platforms. With the increasing preference for online shopping, consumers are more inclined to purchase skincare and health products containing hyaluronic acid through digital channels. This shift is supported by the convenience and accessibility that e-commerce offers, allowing consumers to explore a wider range of products. Market analysis indicates that e-commerce sales of beauty and personal care products are projected to grow at a rate of over 10% annually. This trend is likely to enhance the visibility and availability of hyaluronic acid products, thereby driving the overall market growth.

Advancements in Medical Research

The Hyaluronic Acid Market is benefiting from significant advancements in medical research, particularly in the fields of orthopedics and dermatology. Hyaluronic acid is increasingly utilized in joint injections for osteoarthritis treatment, with studies indicating its efficacy in pain relief and improved joint function. The market for hyaluronic acid in medical applications is projected to reach substantial figures, with estimates suggesting a growth rate of approximately 8% annually. Furthermore, ongoing research into its potential uses in wound healing and tissue engineering may open new avenues for the Hyaluronic Acid Market, thereby enhancing its overall growth prospects.

Innovations in Product Formulations

The Hyaluronic Acid Market is characterized by continuous innovations in product formulations. Manufacturers are increasingly developing advanced formulations that combine hyaluronic acid with other beneficial ingredients, such as peptides and antioxidants, to enhance efficacy. This trend is particularly evident in the skincare sector, where hybrid products are gaining traction. Market data suggests that the demand for multifunctional skincare products is on the rise, with consumers seeking solutions that address multiple skin concerns. As a result, the Hyaluronic Acid Market is likely to benefit from these innovations, leading to an expanded product range and increased consumer interest.

Rising Popularity of Anti-Aging Products

The Hyaluronic Acid Market is witnessing a rising popularity of anti-aging products, which prominently feature hyaluronic acid as a key ingredient. As the global population ages, there is an increasing demand for effective skincare solutions that address signs of aging. Hyaluronic acid's ability to hydrate and plump the skin makes it a sought-after component in serums, creams, and injectables. Market data indicates that the anti-aging segment is expected to grow significantly, with projections suggesting a market size exceeding several billion dollars by the end of the decade. This trend is likely to bolster the overall demand for hyaluronic acid, further solidifying its position in the skincare industry.