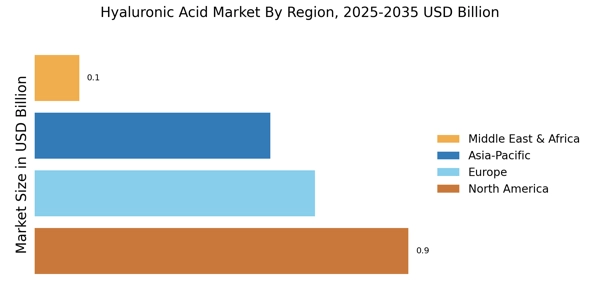

North America : Market Leader in Hyaluronic Acid

North America held the largest Hyaluronic Acid Market Share, accounting for over 39.13% of the global market in 2024. The region's growth is driven by increasing demand for cosmetic procedures, advancements in medical technology, and a growing aging population. Regulatory support from agencies like the FDA has also catalyzed market expansion, ensuring safety and efficacy in product offerings.

The United States leads the market, with key players such as Allergan and Revance Therapeutics dominating the landscape. The competitive environment is characterized by innovation and strategic partnerships, enhancing product offerings. Canada also contributes significantly, focusing on research and development to meet consumer needs. Overall, the North American market is poised for continued growth, driven by both aesthetic and therapeutic applications.

Europe : Emerging Market with Regulations

Europe Hyaluronic Acid Market size was valued at USD 0.69 billion in 2024, making it the second-largest regional market with a 30% share. The region's growth is propelled by increasing consumer awareness regarding skincare and the rising popularity of minimally invasive procedures. Stringent regulations from the European Medicines Agency (EMA) ensure product safety, fostering consumer trust and market expansion.

Leading countries include Germany, France, and the UK, where the presence of major companies like Galderma enhances competition. The market is characterized by a mix of established brands and emerging players, focusing on innovative formulations. The European market is also witnessing a trend towards organic and natural products, aligning with consumer preferences for sustainability and health-conscious choices.

Asia-Pacific : Rapid Growth and Innovation

Asia-Pacific is rapidly emerging as a powerhouse in the hyaluronic acid market, accounting for approximately 25% of the global share. The region's growth is driven by rising disposable incomes, increasing awareness of aesthetic treatments, and a growing aging population. Countries like South Korea and Japan are at the forefront, with a strong emphasis on beauty and wellness.

Regulatory frameworks are evolving to support market growth, ensuring product safety and efficacy. South Korea is a key player, with companies like Medytox leading the charge in innovation. Japan also plays a significant role, focusing on advanced research and development. The competitive landscape is marked by a mix of local and international players, driving innovation and expanding product offerings to meet diverse consumer needs.

Middle East and Africa : Untapped Potential in Market

The Middle East and Africa region is an emerging market for hyaluronic acid, holding approximately 5% of the global share. The growth is driven by increasing urbanization, rising disposable incomes, and a growing interest in cosmetic procedures. Regulatory bodies are beginning to establish frameworks to ensure product safety, which is crucial for market expansion. Countries like the UAE and South Africa are leading the way, with a growing number of clinics offering aesthetic treatments.

The competitive landscape is still developing, with both local and international players entering the market. As awareness of the benefits of hyaluronic acid increases, the region is expected to see significant growth in the coming years, driven by both aesthetic and therapeutic applications.