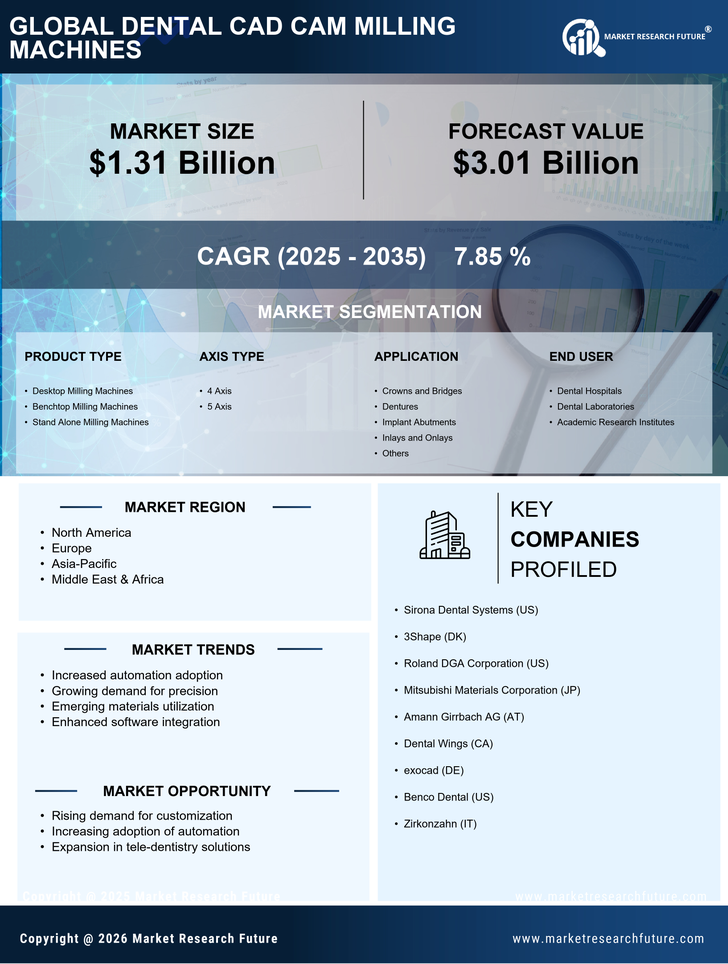

Rising Geriatric Population

The increasing geriatric population is a significant driver for the Dental CAM Milling Machines Market. As individuals age, they often require more dental care, including restorative procedures such as crowns, bridges, and dentures. This demographic shift is expected to lead to a higher demand for dental services, consequently increasing the need for efficient milling machines capable of producing high-quality restorations. Reports indicate that the population aged 65 and older is projected to double by 2050, which will likely result in a substantial rise in dental procedures. Consequently, dental practices will need to invest in advanced milling technologies to cater to this growing patient base, thereby fueling the Dental CAM Milling Machines Market.

Growth of Dental Laboratories

The expansion of dental laboratories is another key driver in the Dental CAM Milling Machines Market. As the number of dental laboratories increases, so does the demand for efficient and precise milling machines. These laboratories require advanced equipment to produce a wide range of dental restorations quickly and accurately. The market for dental laboratories is projected to grow significantly, driven by the increasing number of dental procedures and the demand for high-quality restorations. This growth necessitates the adoption of advanced CAM milling technologies, which can enhance productivity and meet the evolving needs of dental professionals. Thus, the growth of dental laboratories is likely to propel the Dental CAM Milling Machines Market.

Increasing Demand for Aesthetic Dentistry

The rising consumer preference for aesthetic dentistry is a notable driver in the Dental CAM Milling Machines Market. Patients increasingly seek cosmetic dental procedures, which necessitate high-quality restorations. This trend has led to a surge in demand for dental milling machines that can produce precise and aesthetically pleasing dental restorations. According to industry reports, the aesthetic dentistry segment is projected to grow at a compound annual growth rate of over 10% in the coming years. As dental practices adapt to meet these demands, the need for advanced milling machines becomes paramount, thereby propelling the growth of the Dental CAM Milling Machines Market.

Regulatory Support for Dental Innovations

Regulatory support for dental innovations is an emerging driver in the Dental CAM Milling Machines Market. Governments and regulatory bodies are increasingly recognizing the importance of advanced dental technologies in improving patient outcomes. This support often translates into favorable policies and funding for research and development in dental equipment. As regulations evolve to encourage innovation, dental practices are more likely to invest in cutting-edge milling machines that comply with new standards. This trend not only enhances the quality of dental care but also stimulates growth in the Dental CAM Milling Machines Market, as manufacturers respond to the demand for compliant and innovative solutions.

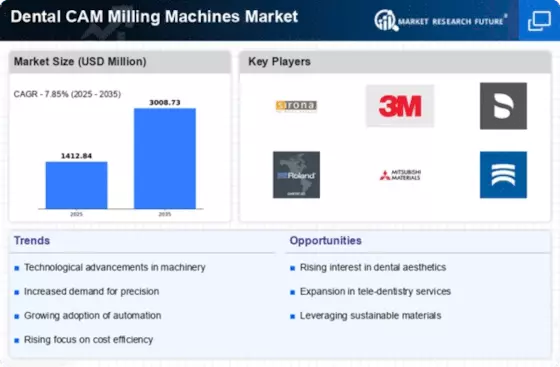

Technological Innovations in Dental Equipment

Technological advancements play a crucial role in shaping the Dental CAM Milling Machines Market. Innovations such as computer-aided design (CAD) and computer-aided manufacturing (CAM) have revolutionized the way dental restorations are created. These technologies enhance precision, reduce production time, and improve the overall quality of dental products. The integration of artificial intelligence and machine learning into milling machines is also on the rise, allowing for more efficient workflows and better outcomes. As dental practices increasingly adopt these technologies, the demand for sophisticated milling machines is expected to rise, further driving the growth of the Dental CAM Milling Machines Market.