Expansion of E-commerce Platforms

The expansion of e-commerce platforms is reshaping the landscape of the dehydrated food market. With the increasing prevalence of online shopping, consumers are more inclined to purchase dehydrated foods through digital channels. This shift is driven by the convenience of online shopping, as well as the ability to access a wider variety of products than what is typically available in physical stores. Market data suggests that online sales of dehydrated foods are expected to grow significantly, as consumers appreciate the ease of ordering and home delivery. Furthermore, e-commerce platforms often provide detailed product information and customer reviews, which can influence purchasing decisions. As a result, companies that effectively leverage e-commerce strategies may enhance their visibility and reach within the dehydrated food market.

Rising Demand for Shelf-Stable Foods

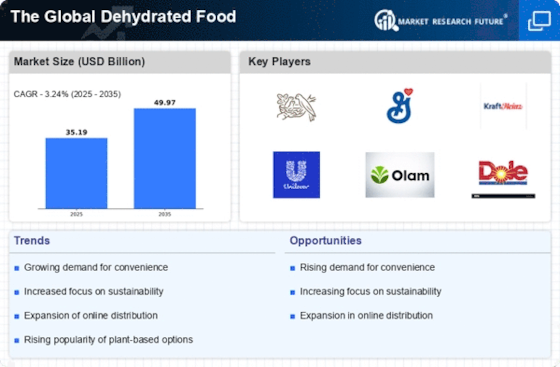

The increasing consumer preference for shelf-stable foods is a notable driver in the dehydrated food market. As lifestyles become busier, individuals seek convenient meal options that require minimal preparation. Dehydrated foods, which can be stored for extended periods without refrigeration, align well with this trend. According to industry reports, the market for dehydrated foods is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is fueled by the rising demand for ready-to-eat meals and snacks, particularly among urban populations. The ability of dehydrated foods to retain nutritional value while offering convenience makes them an attractive choice for health-conscious consumers. As a result, manufacturers are likely to innovate and expand their product lines to cater to this evolving consumer preference.

Growing Interest in Outdoor Activities

The growing interest in outdoor activities, such as hiking, camping, and backpacking, is significantly influencing the dehydrated food market. As more individuals engage in these activities, the demand for lightweight, portable, and nutritious food options rises. Dehydrated foods are particularly well-suited for outdoor enthusiasts, as they are easy to carry and require minimal preparation. Market analysis indicates that the outdoor recreation sector is expanding, with a notable increase in participation rates. This trend is likely to drive sales of dehydrated meals and snacks, as consumers seek convenient options that can sustain them during their adventures. Companies that cater to this niche market may find opportunities for growth by developing specialized products tailored to the needs of outdoor enthusiasts.

Advent of Innovative Packaging Solutions

Innovative packaging solutions are emerging as a critical driver in the dehydrated food market. Packaging technology has advanced significantly, allowing for better preservation of flavor, texture, and nutritional content. Vacuum-sealed and nitrogen-flushed packaging methods are becoming increasingly popular, as they extend shelf life and enhance product appeal. This trend is particularly relevant in the context of e-commerce, where consumers expect high-quality products delivered directly to their homes. The Global Dehydrated Food industry is witnessing a shift towards sustainable packaging materials, which not only meet consumer demand for eco-friendly options but also comply with regulatory standards. As a result, companies that invest in innovative packaging solutions may gain a competitive edge, potentially leading to increased market share and consumer loyalty.

Increased Focus on Food Preservation Techniques

The increased focus on food preservation techniques is a significant driver in the dehydrated food market. As consumers become more aware of food waste and its environmental impact, there is a growing interest in methods that extend the shelf life of food products. Dehydration is recognized as an effective preservation technique that retains essential nutrients while reducing spoilage. This trend aligns with the broader movement towards sustainability and responsible consumption. The Global Dehydrated Food industry is likely to benefit from this shift, as consumers seek products that minimize waste and promote longevity. Additionally, educational initiatives aimed at informing consumers about the benefits of dehydrated foods may further enhance market growth, as individuals become more inclined to incorporate these products into their diets.