Rising Cybersecurity Threats

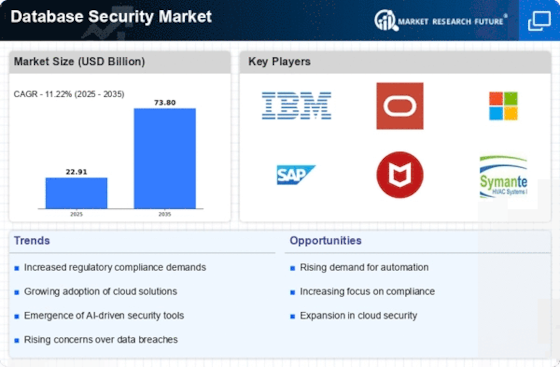

The Database Security Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations are facing a surge in data breaches, ransomware attacks, and insider threats, which necessitate robust security measures. According to recent statistics, the number of reported data breaches has escalated, prompting businesses to invest significantly in database security solutions. This trend indicates a growing recognition of the importance of safeguarding sensitive information. As cybercriminals continue to evolve their tactics, the Database Security Market is likely to expand, driven by the urgent need for advanced security technologies and practices.

Adoption of Cloud-Based Solutions

The Database Security Market is being propelled by the widespread adoption of cloud-based solutions. As businesses migrate their operations to the cloud, the need for robust database security measures becomes paramount. Cloud environments present unique security challenges, including data breaches and unauthorized access. Consequently, organizations are increasingly investing in cloud security solutions that protect their databases in these environments. This shift indicates a growing recognition of the importance of securing cloud-based databases, which is likely to drive the expansion of the Database Security Market in the coming years.

Regulatory Compliance Requirements

The Database Security Market is significantly influenced by stringent regulatory compliance requirements imposed on organizations across various sectors. Regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) mandate strict data protection measures. Non-compliance can result in severe penalties, which drives organizations to prioritize database security investments. The market is projected to grow as companies seek solutions that not only protect their data but also ensure adherence to these regulations. This compliance-driven approach is likely to shape the future landscape of the Database Security Market.

Increased Data Volume and Complexity

The Database Security Market is witnessing growth due to the exponential increase in data volume and complexity. As organizations generate vast amounts of data from various sources, the challenge of securing this information becomes more pronounced. The rise of big data analytics and the Internet of Things (IoT) further complicates the security landscape. Organizations are compelled to adopt advanced database security solutions to manage and protect their data effectively. This trend suggests that the Database Security Market will continue to evolve, with a focus on innovative technologies that can address the challenges posed by large and complex datasets.

Integration of Advanced Technologies

The Database Security Market is evolving with the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the ability to detect and respond to security threats in real-time. By leveraging AI-driven analytics, organizations can identify anomalies and potential breaches more effectively. This trend suggests that the Database Security Market will continue to innovate, as businesses seek solutions that not only protect their databases but also provide proactive threat detection capabilities. The integration of these technologies is likely to redefine security strategies within the industry.