Increasing Data Volume

The exponential growth of data generated globally drives the Global Data-wrangling Market Industry. In 2024, the market is projected to reach 5.65 USD Billion, reflecting the urgent need for effective data management solutions. Organizations across various sectors, including finance, healthcare, and retail, are inundated with vast amounts of structured and unstructured data. This surge necessitates advanced data-wrangling techniques to extract meaningful insights, streamline operations, and enhance decision-making processes. As data continues to proliferate, the demand for robust data-wrangling tools is likely to escalate, positioning the industry for substantial growth.

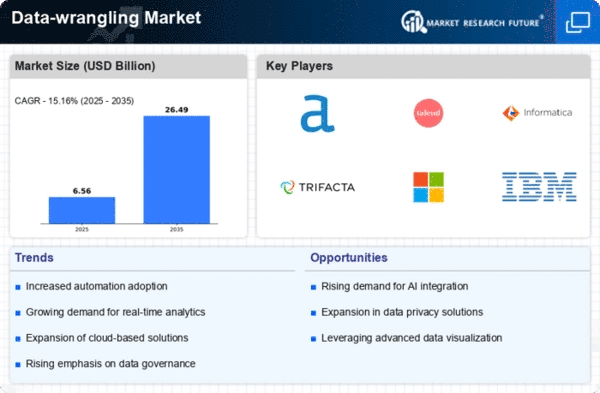

Market Growth Projections

The Global Data-wrangling Market Industry is poised for remarkable growth, with projections indicating a market size of 5.65 USD Billion in 2024 and an anticipated expansion to 26.7 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 15.17% from 2025 to 2035. Such figures reflect the increasing reliance on data-driven strategies across various sectors, highlighting the critical role of data-wrangling in facilitating effective data management and analysis. The market's upward trend underscores the necessity for organizations to invest in data-wrangling solutions to remain competitive in a data-centric landscape.

Rising Adoption of Cloud Computing

The increasing adoption of cloud computing technologies significantly influences the Global Data-wrangling Market Industry. Organizations are migrating their data to cloud platforms, which necessitates efficient data-wrangling processes to ensure data integrity and accessibility. By 2035, the market is anticipated to expand to 26.7 USD Billion, driven by the need for seamless data integration and management in cloud environments. Cloud-based data-wrangling solutions offer scalability, flexibility, and cost-effectiveness, making them appealing to businesses of all sizes. This trend underscores the importance of data-wrangling in optimizing cloud data workflows and enhancing overall operational efficiency.

Regulatory Compliance and Data Governance

The increasing complexity of regulatory requirements and the need for robust data governance frameworks significantly impact the Global Data-wrangling Market Industry. Organizations are compelled to ensure compliance with various data protection regulations, such as GDPR and CCPA. This necessitates effective data-wrangling practices to manage and process data responsibly. The market's growth is fueled by the demand for solutions that facilitate data lineage, auditing, and reporting capabilities. As businesses navigate the evolving regulatory landscape, the importance of data-wrangling in maintaining compliance and governance is likely to intensify, further driving market expansion.

Technological Advancements in Data Processing

Technological advancements in data processing and analytics are reshaping the Global Data-wrangling Market Industry. Innovations such as artificial intelligence and machine learning are enhancing data-wrangling capabilities, enabling organizations to automate and streamline data preparation processes. These advancements allow for faster data integration and transformation, which is crucial in today’s fast-paced business environment. As organizations seek to leverage advanced analytics for competitive advantage, the demand for sophisticated data-wrangling tools is expected to rise. This trend indicates a shift towards more intelligent data management solutions that can handle complex data challenges effectively.

Growing Demand for Data-Driven Decision Making

The increasing emphasis on data-driven decision-making across industries propels the Global Data-wrangling Market Industry. Organizations recognize the value of leveraging data analytics to gain competitive advantages. As a result, the market is projected to grow at a CAGR of 15.17% from 2025 to 2035. Companies are investing in data-wrangling tools to transform raw data into actionable insights, enabling them to make informed strategic decisions. This trend is particularly evident in sectors such as marketing, where data-driven strategies are essential for targeting and engagement. The focus on data-driven decision-making is likely to sustain the momentum of the data-wrangling market.