Demand for Real-Time Analytics

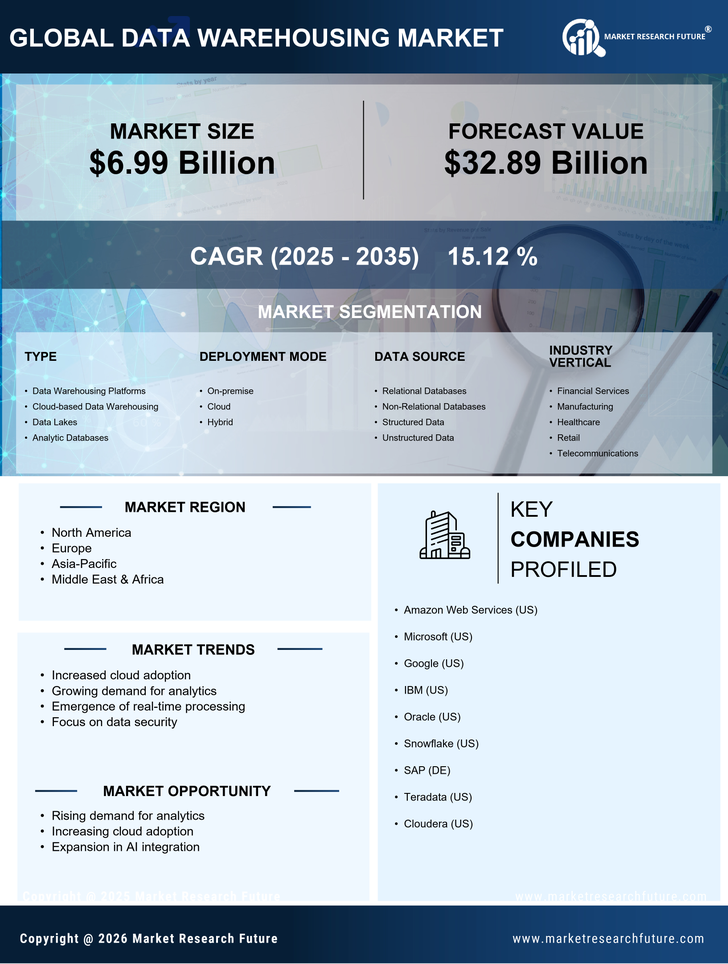

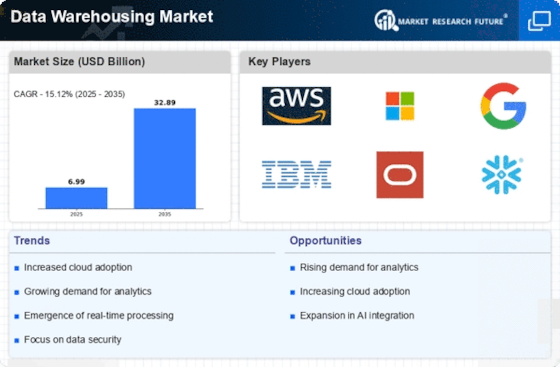

The rising need for real-time analytics is significantly influencing the Data Warehousing Market. Organizations are striving to gain immediate insights from their data to remain competitive. This demand is driven by the necessity to make timely decisions based on current data trends. As a result, data warehousing solutions are evolving to support real-time data processing and analytics capabilities. The market for real-time analytics is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 30% in the coming years. This trend indicates a shift towards more agile data warehousing solutions that can accommodate the need for speed and accuracy in data analysis.

Increased Data Volume and Variety

The exponential growth of data generated by businesses is a primary driver for the Data Warehousing Market. Organizations are increasingly collecting diverse data types, including structured, semi-structured, and unstructured data. This surge in data volume necessitates robust data warehousing solutions that can efficiently store, manage, and analyze vast amounts of information. According to recent estimates, the data generated worldwide is expected to reach 175 zettabytes by 2025. Consequently, businesses are compelled to invest in advanced data warehousing technologies to harness this data effectively, leading to enhanced decision-making and operational efficiency.

Cloud Migration and Hybrid Solutions

The trend towards cloud migration is reshaping the Data Warehousing Market. Many organizations are transitioning from on-premises data warehousing solutions to cloud-based platforms, seeking the benefits of scalability, flexibility, and cost-effectiveness. Hybrid data warehousing solutions, which combine on-premises and cloud capabilities, are also gaining traction. This shift is driven by the need for businesses to adapt to changing market conditions and optimize their data management strategies. The cloud data warehousing market is projected to grow at a compound annual growth rate of over 20%, reflecting the increasing preference for cloud solutions among enterprises.

Integration of Advanced Analytics Tools

The integration of advanced analytics tools into data warehousing solutions is a significant driver for the Data Warehousing Market. Organizations are increasingly leveraging tools such as artificial intelligence and machine learning to extract deeper insights from their data. This integration enhances the analytical capabilities of data warehouses, enabling businesses to perform predictive analytics and data mining more effectively. The market for advanced analytics is expected to grow substantially, with estimates suggesting a rise to over 150 billion dollars by 2025. As a result, data warehousing providers are focusing on incorporating these advanced tools to meet the evolving needs of their clients.

Regulatory Compliance and Data Security

The increasing emphasis on regulatory compliance and data security is a crucial driver for the Data Warehousing Market. Organizations are required to adhere to various regulations concerning data privacy and protection, such as GDPR and CCPA. This regulatory landscape compels businesses to implement robust data warehousing solutions that ensure compliance while safeguarding sensitive information. The market for data security solutions is expected to witness significant growth, with projections indicating a rise to over 300 billion dollars by 2025. Consequently, data warehousing providers are focusing on integrating advanced security features to meet these compliance requirements, thereby enhancing their market appeal.