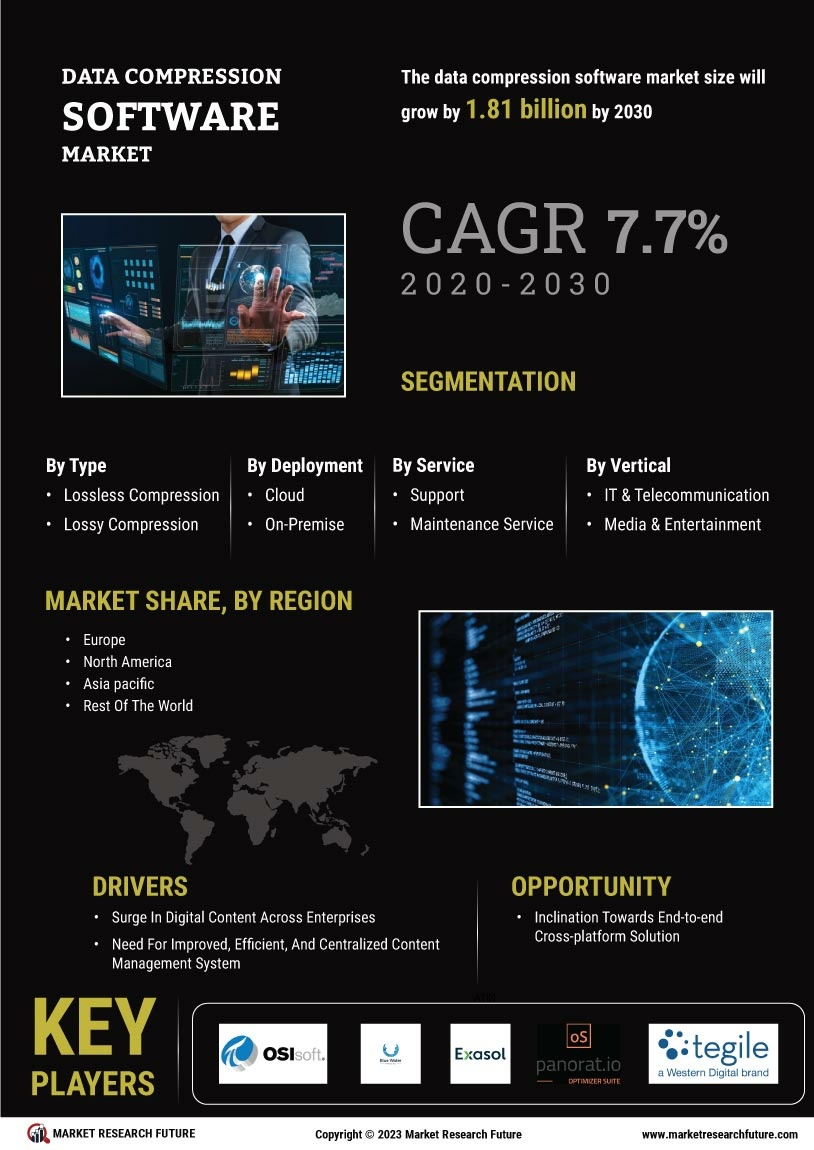

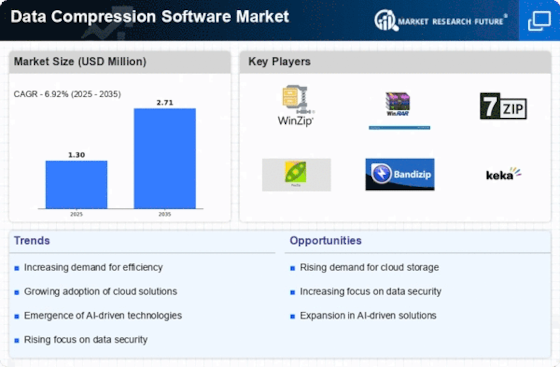

Rising Data Volumes

The exponential growth of data generated across various sectors is a primary driver for the Data Compression Software Market. As organizations increasingly rely on data analytics, the volume of data produced continues to surge. According to recent estimates, the total amount of data created globally is expected to reach 175 zettabytes by 2025. This burgeoning data landscape necessitates efficient storage solutions, prompting businesses to adopt data compression software to optimize storage capacity and reduce costs. The ability to compress large datasets not only enhances storage efficiency but also improves data transfer speeds, making it a critical component in the data management strategies of organizations. Consequently, the rising data volumes are likely to propel the demand for data compression solutions, thereby shaping the trajectory of the Data Compression Software Market.

Emergence of Big Data Analytics

The increasing reliance on big data analytics is significantly influencing the Data Compression Software Market. Organizations are leveraging big data to derive actionable insights, enhance decision-making, and improve operational efficiency. However, the vast amounts of data generated require effective management and storage solutions. Data compression software plays a pivotal role in this context, as it enables organizations to store and process large datasets more efficiently. The market for big data analytics is projected to grow substantially, with estimates suggesting it could reach USD 274 billion by 2022. This growth in big data analytics is likely to drive the demand for data compression solutions, as businesses seek to optimize their data storage and processing capabilities. Thus, the emergence of big data analytics serves as a crucial driver for the Data Compression Software Market.

Increased Focus on Cost Efficiency

Cost efficiency remains a paramount concern for organizations, driving the adoption of data compression solutions within the Data Compression Software Market. As businesses strive to minimize operational costs, the need for effective data management becomes increasingly critical. Data compression software allows organizations to reduce storage requirements, leading to lower costs associated with data storage infrastructure. Furthermore, compressed data can be transmitted more quickly, reducing bandwidth costs. With The Data Compression Software Market projected to reach USD 77 billion by 2023, the potential for cost savings through data compression is substantial. Organizations are likely to prioritize solutions that enhance cost efficiency, thereby propelling the growth of the Data Compression Software Market. This focus on cost efficiency is expected to remain a driving force in the market.

Advancements in Compression Algorithms

Technological advancements in compression algorithms are playing a crucial role in shaping the Data Compression Software Market. Innovations in algorithm design have led to more efficient and effective data compression techniques, enabling organizations to achieve higher compression ratios without compromising data integrity. These advancements not only enhance the performance of data compression software but also expand its applicability across various sectors, including healthcare, finance, and entertainment. As organizations increasingly seek to optimize their data storage and processing capabilities, the demand for advanced compression algorithms is likely to rise. The continuous evolution of compression technologies may lead to the development of new solutions that cater to the specific needs of different industries. Thus, advancements in compression algorithms are expected to be a significant driver for the Data Compression Software Market.

Growing Demand for Mobile Applications

The proliferation of mobile applications is significantly impacting the Data Compression Software Market. As mobile devices become ubiquitous, the demand for applications that require efficient data handling is on the rise. Mobile applications often need to manage large volumes of data while ensuring optimal performance and user experience. Data compression software enables developers to reduce the size of application data, facilitating faster load times and improved performance on mobile devices. The mobile application market is projected to reach USD 407 billion by 2026, indicating a robust growth trajectory. This increasing demand for mobile applications is likely to drive the adoption of data compression solutions, as developers seek to enhance application performance and user satisfaction. Consequently, the growing demand for mobile applications serves as a vital driver for the Data Compression Software Market.