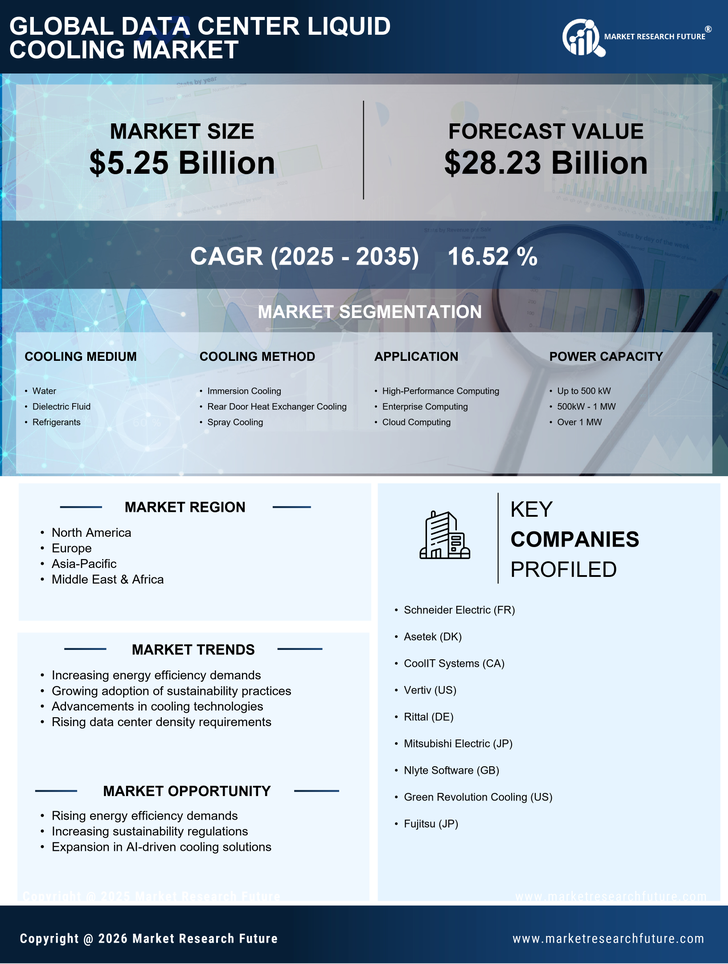

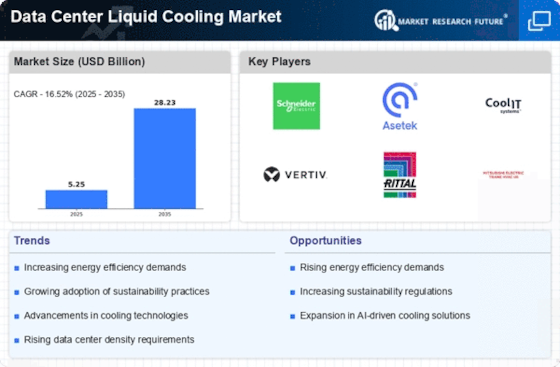

The Data Center Liquid Cooling Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for energy-efficient cooling solutions and the growing need for sustainable practices in data center operations. Several data center liquid cooling companies are expanding their portfolios to address AI workloads. Leading

data center cooling companies are investing heavily in liquid cooling technologies. Several publicly traded data center cooling companies are benefiting from rising infrastructure investments.

Key players such as Schneider Electric (France), Asetek (Denmark), and Vertiv (United States) are at the forefront of this market, each adopting distinct strategies to enhance their market positioning. Schneider Electric (France) emphasizes innovation in energy management and automation, while Asetek (Denmark) focuses on liquid cooling technologies that optimize

thermal management. Vertiv (United States) is leveraging its extensive portfolio to provide integrated solutions that address the complexities of modern data centers. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set industry standards and drive innovation. This competitive structure fosters an environment where smaller firms can thrive by offering niche solutions, while larger entities dominate through comprehensive service offerings and established reputations.

In August Schneider Electric (France) announced a partnership with a leading cloud service provider to develop a new line of liquid cooling solutions tailored for

hyperscale data centers. This strategic move is likely to enhance Schneider's market presence and align its offerings with the growing demand for scalable and efficient cooling technologies. The collaboration underscores the importance of partnerships in driving innovation and meeting customer needs in a rapidly evolving market.

In September Asetek (Denmark) launched a new liquid cooling product designed specifically for high-performance computing applications. This introduction not only showcases Asetek's commitment to innovation but also positions the company to capture a larger share of the HPC segment, which is experiencing robust growth. The strategic importance of this launch lies in its potential to address the cooling challenges faced by data centers operating at high densities, thereby enhancing operational efficiency.

In July Vertiv (United States) expanded its manufacturing capabilities in Europe to meet the rising demand for liquid cooling solutions. This expansion is indicative of Vertiv's strategy to localize production and reduce lead times, which is crucial in a market where speed and reliability are paramount. By enhancing its manufacturing footprint, Vertiv is likely to strengthen its competitive edge and respond more effectively to regional market demands.

As of October current trends in the Data Center Liquid Cooling Market are heavily influenced by digitalization, sustainability, and the integration of

artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in driving innovation and addressing complex customer requirements. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on technological innovation, supply chain reliability, and sustainable practices. This transition may redefine how companies position themselves in the market, emphasizing the importance of adaptability and forward-thinking strategies.