Rising Urbanization

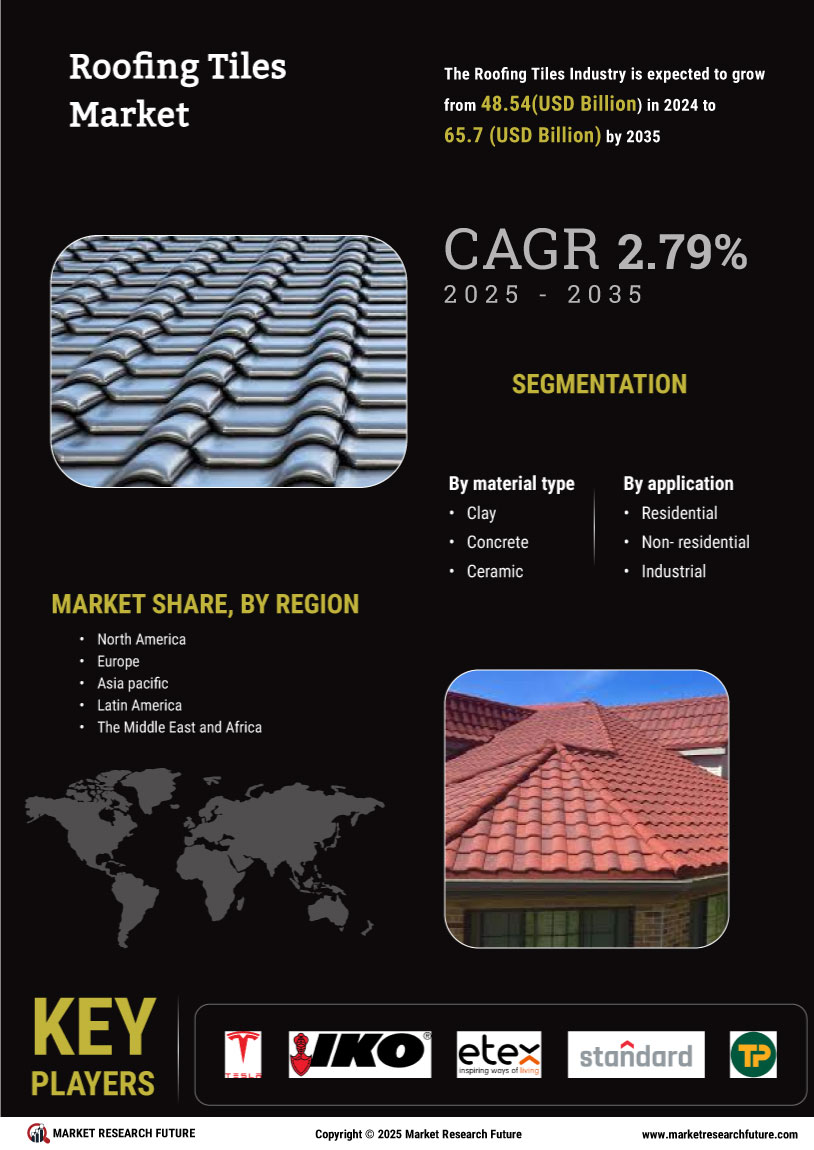

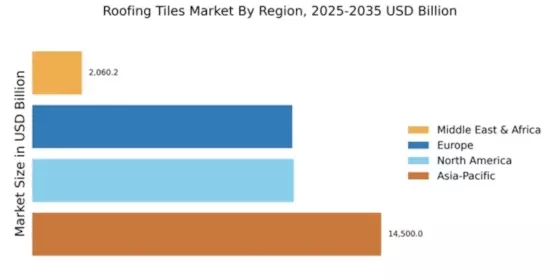

The Global Roofing Tiles Market Industry experiences a notable boost due to the increasing urbanization trends worldwide. As more individuals migrate to urban areas, the demand for residential and commercial buildings escalates, leading to a heightened need for roofing solutions. For instance, urbanization rates in developing countries are projected to rise significantly, contributing to the overall market growth. This trend is expected to drive the Global Roofing Tiles Market to an estimated value of 48.5 USD Billion in 2024, as urban infrastructure development necessitates durable and aesthetically pleasing roofing materials.

Sustainability Trends

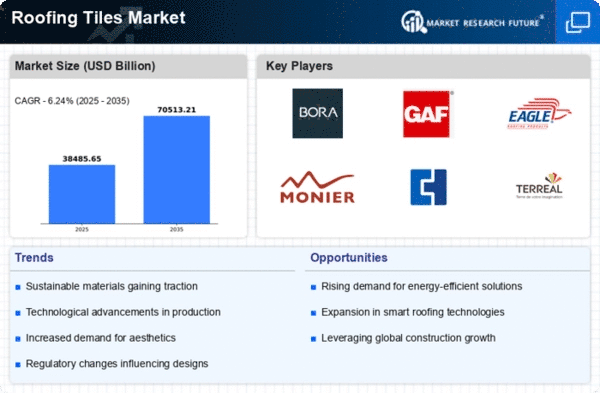

Sustainability has emerged as a pivotal driver in the Global Roofing Tiles Market Industry. Consumers and builders increasingly prioritize eco-friendly materials, prompting manufacturers to innovate and produce sustainable roofing options. For example, tiles made from recycled materials or those that enhance energy efficiency are gaining traction. This shift towards sustainable construction practices aligns with global environmental goals, potentially influencing market dynamics. As the demand for green building materials rises, the Global Roofing Tiles Market is likely to witness a compound annual growth rate of 2.79% from 2025 to 2035, reflecting the industry's adaptation to sustainability.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Roofing Tiles Market. Innovations in manufacturing processes, such as improved durability and weather resistance, enhance the appeal of roofing tiles. For instance, the introduction of lightweight materials and advanced coatings has revolutionized the market, allowing for greater design flexibility and performance. These advancements not only meet consumer demands but also comply with stringent building regulations. As a result, the Global Roofing Tiles Market is expected to grow significantly, reaching approximately 65.7 USD Billion by 2035, driven by these technological improvements.

Diverse Consumer Preferences

Diverse consumer preferences are shaping the Global Roofing Tiles Market Industry, as homeowners and builders seek a variety of styles, colors, and materials. This trend encourages manufacturers to diversify their product offerings, catering to different aesthetic and functional requirements. For instance, the popularity of clay and concrete tiles varies by region, influenced by local architectural styles and climate conditions. As consumers increasingly prioritize personalization in their roofing choices, the market is likely to expand, supporting the projected growth of the Global Roofing Tiles Market to 65.7 USD Billion by 2035.

Increased Construction Activities

The Global Roofing Tiles Market Industry is significantly influenced by the surge in construction activities across various regions. With governments investing in infrastructure development and housing projects, the demand for roofing tiles is on the rise. For example, initiatives aimed at enhancing public infrastructure in emerging economies contribute to this trend. As construction projects proliferate, the need for reliable roofing solutions becomes paramount. This growing demand is anticipated to propel the Global Roofing Tiles Market to a valuation of 48.5 USD Billion in 2024, reflecting the industry's responsiveness to the construction boom.