Market Trends and Projections

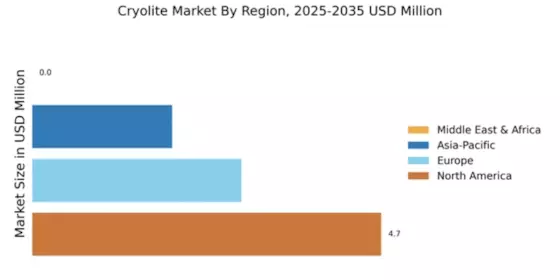

The Global Cryolite Market Industry is characterized by several key trends and projections that shape its future. The market is anticipated to reach a valuation of 450 USD Million by 2035, reflecting a robust growth trajectory. The projected CAGR of 5.49% from 2025 to 2035 indicates a steady increase in demand across various applications. Factors such as rising aluminum production, advancements in glass manufacturing, and environmental regulations are likely to drive this growth. Additionally, technological innovations in mining and processing may enhance production capabilities, further supporting market expansion. These trends collectively suggest a dynamic and evolving landscape for the cryolite market.

Growth in Specialty Glass Manufacturing

The Global Cryolite Market Industry is significantly influenced by the expansion of specialty glass manufacturing. Cryolite Market is utilized as a flux in glass production, improving melting efficiency and product quality. The increasing demand for specialty glass in applications such as electronics, automotive, and construction is likely to propel the cryolite market forward. As manufacturers seek to enhance their production processes, the incorporation of cryolite is becoming more prevalent. This trend suggests a promising outlook for the market, with projections indicating a potential market value of 450 USD Million by 2035, driven by advancements in glass technology and rising consumer preferences.

Increasing Demand in Aluminum Production

The Global Cryolite Market Industry experiences a notable surge in demand due to its essential role in aluminum production. Cryolite Market serves as a flux in the electrolytic reduction of aluminum oxide, enhancing efficiency and reducing energy consumption. As the global aluminum market expands, driven by sectors such as automotive and construction, the demand for cryolite is projected to rise. In 2024, the market is valued at approximately 250 USD Million, reflecting the growing reliance on cryolite in aluminum smelting processes. This trend indicates a robust growth trajectory, positioning cryolite as a critical component in the aluminum supply chain.

Environmental Regulations Favoring Cryolite Use

The Global Cryolite Market Industry is positively impacted by stringent environmental regulations promoting the use of eco-friendly materials. Cryolite Market, being a naturally occurring mineral, presents a sustainable alternative to synthetic fluxes that may pose environmental risks. As industries strive to comply with regulations aimed at reducing carbon footprints, the adoption of cryolite is likely to increase. This shift not only aligns with regulatory frameworks but also appeals to environmentally conscious consumers. Consequently, the market may witness a steady growth rate, with a projected CAGR of 5.49% from 2025 to 2035, reflecting the increasing preference for sustainable materials in various industrial applications.

Technological Advancements in Mining and Processing

The Global Cryolite Market Industry benefits from ongoing technological advancements in mining and processing techniques. Innovations in extraction methods and processing technologies enhance the efficiency and yield of cryolite production. As mining operations become more sophisticated, the quality and availability of cryolite are expected to improve, meeting the rising demand from various industries. These advancements not only optimize production but also reduce operational costs, making cryolite a more attractive option for manufacturers. This trend indicates a positive outlook for the market, as improved production capabilities may support the anticipated growth trajectory in the coming years.

Rising Applications in Metallurgy and Chemical Industries

The Global Cryolite Market Industry is experiencing growth due to its diverse applications in metallurgy and chemical industries. Cryolite Market is utilized in the production of aluminum fluoride and other chemical compounds, which are essential in various industrial processes. The increasing demand for these compounds, driven by sectors such as pharmaceuticals and agrochemicals, is likely to bolster the cryolite market. As industries continue to expand and diversify their product offerings, the reliance on cryolite for its unique properties is expected to grow. This trend suggests a favorable market environment, supporting the overall growth of the cryolite sector.