Increased Focus on Food Safety

Food safety remains a paramount concern for consumers and manufacturers alike, significantly influencing the Cpp Packaging Films Market. The need for packaging that ensures product integrity and safety is driving innovations in film technology. Enhanced barrier properties and tamper-evident features are becoming standard requirements in food packaging. Recent statistics indicate that the food packaging segment is expected to account for over 30% of the total Cpp Packaging Films Market by 2025. This focus on safety not only protects consumers but also helps brands maintain their reputation, thereby fostering loyalty and trust. As regulations around food safety tighten, the demand for high-quality packaging solutions is likely to escalate, further propelling market growth.

Regulatory Compliance and Standards

The Cpp Packaging Films Market is increasingly influenced by stringent regulatory requirements and standards. Governments and regulatory bodies are implementing guidelines to ensure that packaging materials are safe and environmentally friendly. Compliance with these regulations is essential for manufacturers to maintain market access and consumer trust. Recent data indicates that over 60% of packaging companies are prioritizing compliance as a key strategy for growth. This focus on regulatory adherence not only enhances product safety but also drives innovation in the development of new materials and processes. As regulations continue to evolve, the Cpp Packaging Films Market must adapt to meet these challenges, potentially leading to new opportunities for growth and differentiation.

Rising Demand for Flexible Packaging

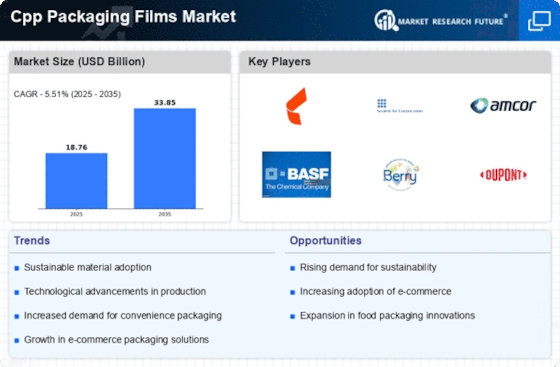

The Cpp Packaging Films Market is experiencing a notable increase in demand for flexible packaging solutions. This trend is largely driven by the growing consumer preference for lightweight and easy-to-handle packaging options. Flexible packaging not only enhances product shelf life but also reduces material waste, aligning with sustainability goals. According to recent data, the flexible packaging segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of a broader shift towards more efficient packaging solutions, which the Cpp Packaging Films Market is well-positioned to capitalize on. As manufacturers innovate to meet these demands, the market is likely to see a surge in the adoption of advanced materials and technologies.

Growth in E-commerce and Online Retail

The rapid expansion of e-commerce and online retail is reshaping the Cpp Packaging Films Market. As more consumers turn to online shopping, the need for durable and protective packaging solutions has surged. Packaging films that can withstand the rigors of shipping and handling are increasingly in demand. Data suggests that the e-commerce sector is expected to grow by over 20% annually, which directly correlates with the rising need for effective packaging solutions. This trend presents a significant opportunity for the Cpp Packaging Films Market to innovate and develop products that cater specifically to the unique challenges posed by e-commerce logistics. Companies that adapt to these changing dynamics are likely to gain a competitive edge.

Technological Innovations in Packaging

Technological advancements are playing a crucial role in shaping the Cpp Packaging Films Market. Innovations such as biodegradable films, smart packaging, and enhanced barrier technologies are gaining traction. These developments not only improve the functionality of packaging films but also address environmental concerns. The market for biodegradable packaging is projected to grow significantly, with estimates suggesting a potential increase of 15% in the next five years. As consumers become more environmentally conscious, the demand for sustainable packaging solutions is likely to rise. Companies that invest in research and development to create cutting-edge packaging technologies will likely find themselves at the forefront of the Cpp Packaging Films Market.