Pharma Packaging Films Market Summary

As per Market Research Future analysis, the Pharma Packaging Films Market Size was estimated at 18.94 USD Billion in 2024. The Pharma Packaging Films industry is projected to grow from 20.05 USD Billion in 2025 to 35.58 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Pharma Packaging Films Market is experiencing a dynamic shift towards sustainability and technological innovation.

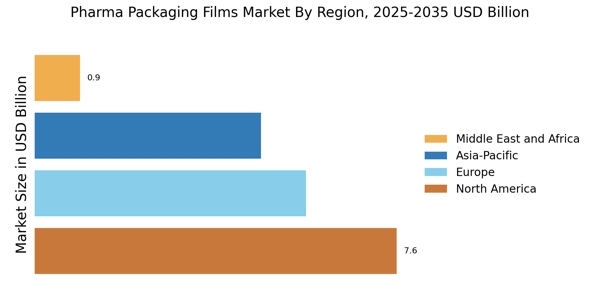

- North America remains the largest market for pharma packaging films, driven by advanced healthcare infrastructure and stringent regulatory standards.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing pharmaceutical production and rising healthcare expenditures.

- Plastic films dominate the market, while aluminum films are gaining traction due to their lightweight and recyclable properties.

- The rising demand for biopharmaceuticals and the emphasis on regulatory compliance are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 18.94 (USD Billion) |

| 2035 Market Size | 35.58 (USD Billion) |

| CAGR (2025 - 2035) | 5.9% |

Major Players

Amcor (AU), BASF (DE), Sealed Air (US), Mondi Group (GB), DuPont (US), Berry Global (US), Constantia Flexibles (AT), WestRock (US), AptarGroup (US)