Emergence of New Variants

The COVID-19 Sample Collection Kits Market is facing ongoing challenges due to the emergence of new variants of the virus. As variants continue to evolve, the need for effective testing solutions remains critical. This situation has led to an increased demand for sample collection kits that can accurately detect various strains of the virus. Market analysis suggests that the presence of new variants may drive innovation in the development of more sophisticated testing kits, which could enhance the overall efficacy of COVID-19 testing. Consequently, manufacturers are likely to focus on creating versatile sample collection kits that can adapt to the changing landscape of the virus.

Expansion of Telehealth Services

The COVID-19 Sample Collection Kits Market is being positively influenced by the expansion of telehealth services. As healthcare providers increasingly adopt telemedicine, the need for efficient sample collection methods has become paramount. Telehealth consultations often require patients to provide samples for diagnostic testing, thereby driving the demand for COVID-19 sample collection kits. Data suggests that telehealth usage has surged, with a significant percentage of patients opting for virtual consultations. This trend indicates a growing reliance on remote healthcare solutions, which in turn necessitates the availability of effective sample collection kits that can be easily integrated into telehealth platforms.

Government Initiatives and Funding

The COVID-19 Sample Collection Kits Market is benefiting from various government initiatives and funding aimed at enhancing public health infrastructure. Governments worldwide are investing in the procurement and distribution of COVID-19 testing kits to ensure widespread access to testing. This financial support is crucial for manufacturers, as it enables them to scale production and improve the quality of their sample collection kits. Recent data indicates that government funding for testing initiatives has increased, with several countries allocating substantial budgets to combat the pandemic. Such initiatives not only bolster the market but also reinforce the importance of accessible testing solutions in managing public health crises.

Increased Focus on Preventive Healthcare

The COVID-19 Sample Collection Kits Market is witnessing a shift towards preventive healthcare measures. As individuals become more health-conscious, there is a growing emphasis on early detection and prevention of diseases, including COVID-19. This trend is reflected in the rising sales of sample collection kits, as consumers seek proactive solutions to monitor their health. Market data indicates that the preventive healthcare sector is expanding, with a significant increase in the adoption of at-home testing kits. This focus on prevention not only enhances public health outcomes but also drives the demand for innovative and reliable COVID-19 sample collection kits that cater to the needs of health-conscious consumers.

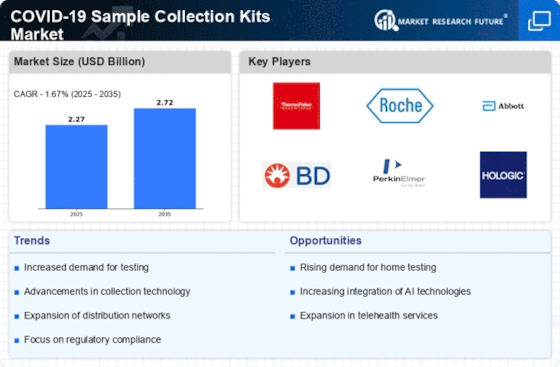

Rising Demand for Home Testing Solutions

The COVID-19 Sample Collection Kits Market is experiencing a notable surge in demand for home testing solutions. This trend is largely driven by the convenience and accessibility that home testing offers to consumers. As individuals seek to minimize exposure to healthcare facilities, the preference for at-home sample collection kits has increased. Reports indicate that the market for home testing kits is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This shift towards home testing not only reflects changing consumer behavior but also highlights the need for reliable and user-friendly sample collection kits that can be utilized without professional supervision.