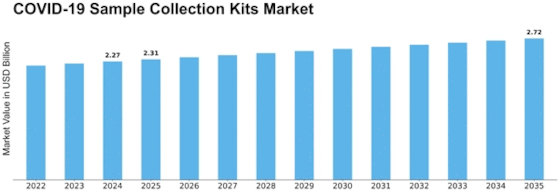

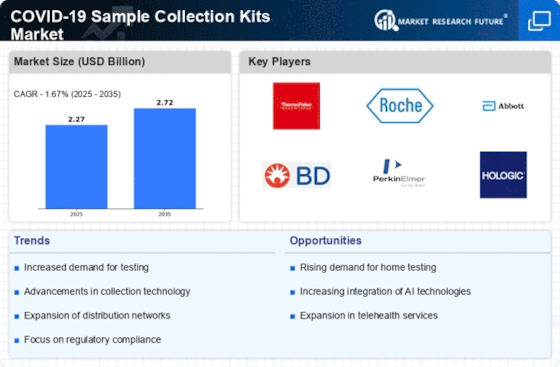

Covid 19 Sample Collection Kits Size

COVID 19 Sample Collection Kits Market Growth Projections and Opportunities

The COVID-19 sample collection kits market has seen exceptional development because of the worldwide effect of the COVID-19 pandemic. The expanded requirement for unlimited testing to identify and control the spread of the virus has driven the interest for effective and genuine sample collection arrangements. The surge in COVID-19 testing volumes has been a significant driver for sample collection unit interest. As testing turns into a vital procedure for pandemic management, the versatility and reliability of sample collection kits are pivotal to meet the developing testing necessities. The market has seen the turn of events and reception of different sample collection strategies, including nasal swabs, throat swabs, saliva tests, and at-home collection kits. Various choices take special care of various testing needs, inclinations, and assets, improving the market's versatility. Persistent development in sample collection pack plan and materials is molding the market. Upgrades in swab materials, transport mediums, and bundling add to the productivity, stability, and usability of the kits, guaranteeing precise and dependable experimental outcomes. The development of point-of-care testing for COVID-19 has driven the interest for easy-to-use sample collection kits. Kits intended for simple use by healthcare professionals or even self-collection at home help the decentralization of testing and increment testing openness. The worldwide dissemination challenges related with the quick and unlimited interest for sample collection kits have been a market factor. Strategies, store network turbulences, and global coordination endeavors influence the availability and circulation of kits, impacting market elements. Financial contemplations of COVID-19 testing influence the market for sample collection kits. Endeavors to foster practical arrangements take special care of a more extensive market, guaranteeing openness for people and healthcare offices with shifting spending plan constraints. The combination of sample collection kits with cutting edge symptomatic innovations is a prominent pattern. Kits intended for similarity with different analytic stages, including PCR and quick antigen tests, add to the adaptability and proficiency of COVID-19 testing techniques.

Leave a Comment