North America : E-commerce Growth Driver

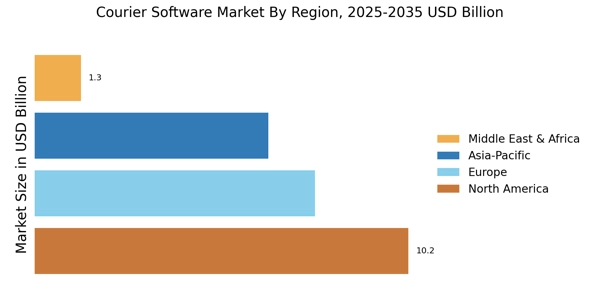

The North American courier software market is primarily driven by the rapid growth of e-commerce, which has led to increased demand for efficient delivery solutions. The region holds the largest market share at approximately 40%, with the United States being the dominant player, followed by Canada at around 15%. Regulatory support for logistics and technology adoption further fuels this growth, as companies seek to enhance operational efficiency and customer satisfaction.

In North America, key players like FedEx, UPS, and DHL lead the competitive landscape, leveraging advanced technologies to optimize delivery processes. The presence of a robust infrastructure and a high level of consumer demand for fast shipping options contribute to the region's market strength. Additionally, innovations in last-mile delivery solutions are reshaping the courier software landscape, ensuring that companies remain competitive in a rapidly evolving market.

Europe : Regulatory Framework Impact

Europe's courier software market is characterized by stringent regulations and a strong emphasis on sustainability, which are driving innovation and efficiency in logistics. The region holds the second-largest market share at approximately 30%, with Germany and the UK being the leading countries, accounting for about 10% and 8% respectively. The European Union's Green Deal and various logistics regulations are catalysts for growth, pushing companies to adopt eco-friendly practices and advanced technologies.

Leading players in Europe include DPD, Royal Mail, and PostNL, which are actively investing in technology to enhance their service offerings. The competitive landscape is marked by a focus on customer-centric solutions and partnerships to improve delivery networks. As the demand for reliable and sustainable courier services rises, companies are adapting their strategies to meet regulatory requirements and consumer expectations, ensuring a dynamic market environment.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific courier software market is witnessing rapid growth, driven by the increasing adoption of e-commerce and mobile technology. This region is projected to hold a market share of around 25%, with China and Japan leading the way, contributing approximately 12% and 6% respectively. The rise in urbanization and a growing middle class are significant demand drivers, alongside supportive government policies aimed at enhancing logistics infrastructure and services.

In this competitive landscape, key players like SF Express and Yamato Transport are expanding their operations to capture the growing market. The presence of numerous local and international companies fosters a dynamic environment, with innovations in technology and service delivery becoming crucial for success. As the demand for efficient and timely deliveries escalates, the courier software market in Asia-Pacific is set for substantial growth, driven by both consumer expectations and technological advancements.

Middle East and Africa : Logistics Transformation Initiatives

The Middle East and Africa courier software market is evolving, driven by increasing demand for logistics solutions and government initiatives aimed at improving infrastructure. This region holds a market share of approximately 5%, with the UAE and South Africa being the leading countries, contributing around 2% and 1% respectively. The growth is supported by investments in technology and logistics capabilities, as well as a rising e-commerce sector that demands efficient delivery services.

In this region, local players are emerging alongside established international companies, creating a competitive landscape that encourages innovation. The presence of key players is growing, with companies focusing on enhancing their service offerings to meet the unique needs of the market. As the logistics sector continues to transform, the courier software market is expected to expand, driven by both regional demand and global trends in e-commerce and technology adoption.