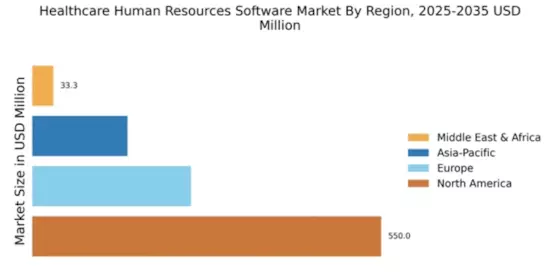

Market Growth Projections

The Global Healthcare Human Resources (HR) Software Market Industry is projected to experience substantial growth over the coming years. With a market value of 0.98 USD Billion in 2024, it is anticipated to reach 1.61 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.62% from 2025 to 2035. Such projections indicate a robust demand for HR software solutions as healthcare organizations increasingly prioritize workforce management and operational efficiency. The market's expansion reflects the ongoing evolution of the healthcare sector and the critical role that effective HR practices play in supporting organizational success.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Global Healthcare Human Resources (HR) Software Market Industry. These technologies enable healthcare organizations to analyze workforce data more effectively, leading to better decision-making and enhanced employee engagement. For instance, AI-driven analytics can identify trends in employee performance and satisfaction, allowing HR departments to implement targeted interventions. This technological advancement is expected to contribute to the market's growth, with projections indicating a market value of 1.61 USD Billion by 2035, reflecting the increasing reliance on data-driven insights in HR management.

Focus on Employee Engagement and Retention

Employee engagement and retention are becoming paramount in the Global Healthcare Human Resources (HR) Software Market Industry. Organizations are recognizing that a satisfied workforce is essential for delivering high-quality patient care. HR software solutions that facilitate employee feedback, performance evaluations, and career development opportunities are gaining traction. By fostering a positive work environment, healthcare organizations can reduce turnover rates and enhance overall productivity. As the market continues to evolve, the emphasis on employee engagement is likely to drive further investments in HR software, contributing to a projected CAGR of 4.62% from 2025 to 2035.

Global Workforce Mobility and Remote Work Trends

The trend towards global workforce mobility and remote work is reshaping the Global Healthcare Human Resources (HR) Software Market Industry. As healthcare organizations adapt to changing work environments, HR software that supports remote workforce management is increasingly in demand. This includes features such as virtual onboarding, remote performance tracking, and telehealth integration. The ability to manage a dispersed workforce effectively is crucial for maintaining operational continuity and ensuring quality patient care. As organizations embrace these trends, the market is poised for growth, reflecting the need for innovative HR solutions that cater to a mobile workforce.

Regulatory Compliance and Reporting Requirements

Regulatory compliance remains a critical driver for the Global Healthcare Human Resources (HR) Software Market Industry. Healthcare organizations must adhere to various regulations, including labor laws and patient privacy standards. HR software solutions are increasingly being utilized to ensure compliance with these regulations, thereby mitigating risks associated with non-compliance. For example, software that automates reporting and tracks employee certifications can significantly reduce the administrative burden on HR departments. As the market evolves, the emphasis on compliance is likely to grow, further propelling the demand for sophisticated HR software solutions.

Increasing Demand for Workforce Management Solutions

The Global Healthcare Human Resources (HR) Software Market Industry experiences a growing demand for effective workforce management solutions. Healthcare organizations are increasingly seeking software that streamlines recruitment, onboarding, and employee management processes. This trend is driven by the need to optimize staffing levels and enhance operational efficiency. For instance, hospitals are adopting HR software to manage their workforce more effectively, which can lead to improved patient care and reduced operational costs. As of 2024, the market is valued at 0.98 USD Billion, indicating a robust growth trajectory as organizations recognize the importance of efficient workforce management.