Market Growth Projections

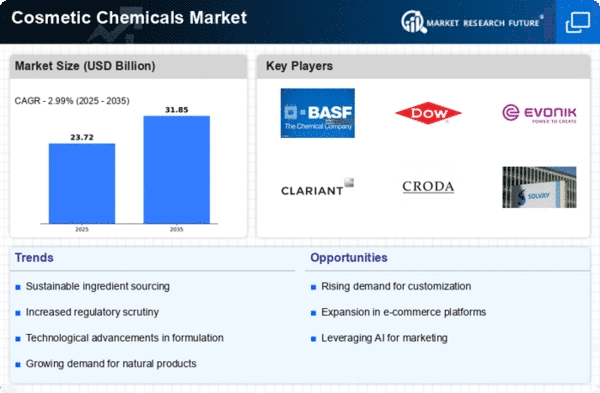

The Global Cosmetic Chemicals Market Industry is projected to experience steady growth, with significant milestones anticipated in the coming years. The market is expected to reach a valuation of 23.0 USD Billion in 2024, with further growth leading to an estimated 31.9 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 2.99% from 2025 to 2035. Such projections reflect the increasing consumer demand for innovative and effective cosmetic products, as well as the industry's adaptability to emerging trends. As brands continue to evolve and respond to consumer preferences, the market is poised for sustained expansion.

Rising Awareness of Personal Grooming

The Global Cosmetic Chemicals Market Industry is benefiting from an increasing awareness of personal grooming and self-care among consumers. This trend is particularly pronounced in emerging markets, where rising disposable incomes and changing lifestyles are driving demand for cosmetic products. As individuals prioritize personal appearance, the consumption of cosmetics and personal care products is on the rise. This heightened focus on grooming is expected to contribute to the market's expansion, with projections indicating a market value of 31.9 USD Billion by 2035. Brands are capitalizing on this trend by launching targeted marketing campaigns that emphasize the importance of self-care and grooming.

Growing Demand for Natural Ingredients

The Global Cosmetic Chemicals Market Industry is witnessing a notable shift towards natural and organic ingredients. Consumers increasingly prefer products that are free from synthetic chemicals, leading to a surge in demand for plant-based alternatives. This trend is reflected in the rising sales of natural cosmetics, which are projected to reach approximately 23.0 USD Billion in 2024. Brands are responding by reformulating products to include botanical extracts and essential oils, thereby enhancing their appeal. This growing preference for natural ingredients not only caters to consumer health concerns but also aligns with sustainability goals, further propelling the market forward.

Regulatory Support for Cosmetic Safety

Regulatory frameworks governing cosmetic safety are evolving, positively influencing the Global Cosmetic Chemicals Market Industry. Governments are increasingly implementing stringent regulations to ensure consumer safety, which, while challenging for manufacturers, also fosters innovation. Compliance with these regulations encourages companies to invest in research and development, leading to the creation of safer and more effective products. For instance, the European Union's REACH regulation mandates the registration and evaluation of chemical substances, prompting manufacturers to adopt safer alternatives. This regulatory support not only enhances consumer trust but also drives market growth as companies strive to meet safety standards.

Technological Advancements in Formulation

Innovations in cosmetic formulation technology are significantly impacting the Global Cosmetic Chemicals Market Industry. Advanced techniques such as microencapsulation and nanotechnology are enabling the development of more effective and stable cosmetic products. These technologies enhance the delivery of active ingredients, improving product performance and consumer satisfaction. For instance, the incorporation of nanotechnology allows for better penetration of ingredients into the skin, leading to enhanced efficacy. As brands adopt these cutting-edge technologies, they are likely to attract a broader consumer base, contributing to the market's growth trajectory. This trend is expected to support a compound annual growth rate of 2.99% from 2025 to 2035.

Diverse Product Offerings and Customization

The Global Cosmetic Chemicals Market Industry is characterized by a diverse range of product offerings, catering to various consumer preferences and needs. Brands are increasingly focusing on customization, allowing consumers to choose products that align with their specific requirements. This trend is evident in the rise of personalized skincare solutions and tailored cosmetic formulations. By leveraging consumer data and feedback, companies can develop products that resonate with their target audience. This approach not only enhances customer satisfaction but also fosters brand loyalty, ultimately contributing to the market's growth. As consumers seek unique and personalized experiences, the demand for customized cosmetic products is likely to rise.