Rising Infrastructure Investments

The Corrosion Monitoring Market is experiencing a surge in demand due to increased investments in infrastructure development. Governments and private sectors are allocating substantial budgets for the construction and maintenance of bridges, roads, and buildings. This trend is particularly evident in emerging economies, where urbanization is accelerating. According to recent data, infrastructure spending is projected to reach trillions of dollars over the next decade. As these structures age, the need for effective corrosion monitoring becomes paramount to ensure safety and longevity. Consequently, the industry is likely to benefit from the heightened focus on maintaining structural integrity, thereby driving the adoption of advanced corrosion monitoring solutions.

Stringent Environmental Regulations

The Corrosion Monitoring Market is significantly influenced by stringent environmental regulations aimed at reducing industrial emissions and waste. Regulatory bodies are enforcing compliance standards that require companies to monitor and manage corrosion-related issues effectively. This regulatory landscape compels industries to adopt corrosion monitoring solutions to ensure compliance and minimize environmental impact. As a result, the market is expected to expand as organizations invest in technologies that not only meet regulatory requirements but also enhance operational efficiency. The increasing focus on sustainability and environmental responsibility is likely to drive the demand for effective corrosion monitoring systems.

Expansion of Renewable Energy Sector

The Corrosion Monitoring Market is poised for growth due to the expansion of the renewable energy sector. As countries transition towards sustainable energy sources, the demand for wind turbines, solar panels, and other renewable energy infrastructure is increasing. These installations are susceptible to corrosion, necessitating effective monitoring solutions to ensure their longevity and efficiency. The renewable energy market is projected to grow significantly, with investments reaching hundreds of billions of dollars in the next few years. This growth presents a substantial opportunity for the corrosion monitoring industry, as stakeholders seek to protect their investments and ensure the reliability of renewable energy systems.

Growing Awareness of Asset Integrity Management

In the Corrosion Monitoring Market, there is a notable shift towards asset integrity management. Organizations are increasingly recognizing the importance of maintaining the integrity of their assets to prevent costly failures and downtime. This awareness is driven by the need to optimize operational efficiency and reduce maintenance costs. Data suggests that companies implementing robust asset integrity programs can achieve significant savings, potentially reducing maintenance expenditures by up to 30%. As industries such as oil and gas, power generation, and manufacturing prioritize asset integrity, the demand for corrosion monitoring technologies is expected to rise, fostering growth in the market.

Technological Advancements in Monitoring Solutions

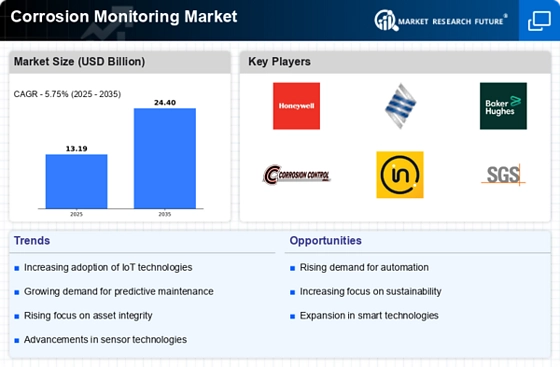

The Corrosion Monitoring Market is witnessing rapid technological advancements that enhance monitoring capabilities. Innovations such as real-time data analytics, IoT integration, and advanced sensor technologies are transforming how corrosion is monitored. These technologies enable organizations to detect corrosion at early stages, allowing for timely interventions. The market for corrosion monitoring solutions is projected to grow at a compound annual growth rate of over 10% in the coming years, driven by these advancements. As industries seek to leverage technology for improved maintenance strategies, the adoption of sophisticated corrosion monitoring systems is likely to increase, further propelling market growth.