Growing Industrial Applications

The Global Corrosion Protection Coating Market Industry is significantly influenced by the expanding industrial sector. Industries such as oil and gas, marine, and manufacturing require robust corrosion protection solutions to safeguard their assets from environmental degradation. The oil and gas sector, in particular, is expected to drive demand due to the harsh conditions faced by pipelines and offshore platforms. With a projected compound annual growth rate (CAGR) of 6.75% from 2025 to 2035, the market is poised for substantial growth as industries increasingly recognize the importance of corrosion protection in maintaining operational efficiency and reducing downtime.

Rising Infrastructure Development

The Global Corrosion Protection Coating Market Industry is experiencing growth driven by increasing infrastructure development across various regions. Governments are investing heavily in infrastructure projects, including bridges, highways, and buildings, to enhance connectivity and economic growth. For instance, the global infrastructure spending is projected to reach approximately 98.4 USD Billion in 2024, creating a substantial demand for corrosion protection coatings. These coatings are essential for extending the lifespan of structures and reducing maintenance costs, thereby supporting the overall growth of the market. As infrastructure projects continue to expand, the need for effective corrosion protection solutions is likely to rise.

Increased Awareness of Asset Longevity

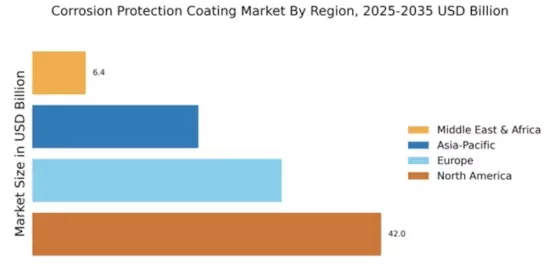

The Global Corrosion Protection Coating Market Industry benefits from a growing awareness of the importance of asset longevity among businesses and governments. Organizations are increasingly recognizing that investing in corrosion protection can lead to significant cost savings over time by reducing maintenance and replacement expenses. This awareness is particularly evident in sectors such as transportation and utilities, where the failure of infrastructure can result in substantial economic losses. As a result, the demand for high-quality corrosion protection coatings is likely to increase, contributing to the market's projected growth to 202.0 USD Billion by 2035.

Environmental Regulations and Standards

The Global Corrosion Protection Coating Market Industry is also shaped by stringent environmental regulations and standards aimed at reducing the environmental impact of industrial activities. Governments worldwide are implementing regulations that mandate the use of eco-friendly coatings, which has led to a shift towards sustainable corrosion protection solutions. For example, the introduction of low-VOC and water-based coatings is becoming more prevalent as industries strive to comply with these regulations. This trend not only supports environmental sustainability but also drives innovation within the market, as manufacturers develop new formulations that meet regulatory requirements while ensuring effective corrosion protection.

Technological Advancements in Coating Solutions

Technological advancements play a crucial role in the evolution of the Global Corrosion Protection Coating Market Industry. Innovations in coating technologies, such as the development of nanocoatings and advanced polymer-based coatings, enhance the performance and durability of corrosion protection solutions. These advancements allow for better adhesion, resistance to harsh environments, and longer service life. As industries seek more efficient and effective coatings, the demand for these advanced solutions is expected to grow. The continuous improvement in coating technologies not only meets the evolving needs of various sectors but also contributes to the overall market expansion.