Market Growth Projections

The Global Corrosion Protection Polymer Coating Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 32.5 USD Billion in 2024, the industry is expected to reach 61.0 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.88% from 2025 to 2035. Factors such as increasing infrastructure development, rising awareness of corrosion costs, and technological advancements are driving this expansion. The market's potential is further enhanced by stringent regulatory standards and growing demand from emerging economies, indicating a promising outlook for the corrosion protection polymer coating sector.

Stringent Regulatory Standards

The implementation of stringent regulatory standards regarding corrosion protection is a significant driver for the Global Corrosion Protection Polymer Coating Market Industry. Governments and regulatory bodies are enforcing guidelines to ensure that industries comply with safety and environmental standards. This has led to a heightened demand for high-performance coatings that meet these regulations. Industries such as automotive, aerospace, and construction are particularly affected, as they must adhere to these standards to avoid penalties. Consequently, the market is likely to see increased investment in compliant polymer coatings, further propelling its growth in the coming years.

Rising Awareness of Corrosion Costs

There is a growing recognition of the economic impact of corrosion on various industries, which is propelling the Global Corrosion Protection Polymer Coating Market Industry forward. Corrosion can lead to substantial financial losses, estimated at billions annually, due to maintenance, repairs, and replacements. Industries such as oil and gas, marine, and manufacturing are increasingly adopting polymer coatings to mitigate these costs. This heightened awareness is likely to drive the market's growth, as companies seek to enhance the longevity of their assets. As a result, the industry is expected to see a compound annual growth rate of 5.88% from 2025 to 2035.

Increasing Infrastructure Development

The Global Corrosion Protection Polymer Coating Market Industry is experiencing a surge due to the rapid expansion of infrastructure projects worldwide. Governments are investing heavily in transportation, energy, and urban development, which necessitates robust corrosion protection solutions. For instance, the construction of bridges, highways, and buildings requires coatings that can withstand harsh environmental conditions. This trend is projected to contribute significantly to the market, with the industry expected to reach 32.5 USD Billion in 2024. As infrastructure continues to grow, the demand for effective corrosion protection will likely increase, driving innovation and investment in polymer coatings.

Growing Demand from Emerging Economies

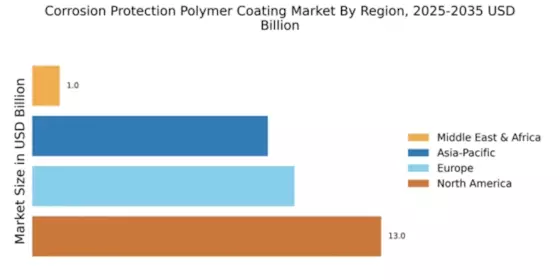

Emerging economies are witnessing rapid industrialization and urbanization, which is driving the Global Corrosion Protection Polymer Coating Market Industry. As these regions develop, there is a heightened need for effective corrosion protection in various sectors, including construction, automotive, and manufacturing. Countries in Asia-Pacific and Latin America are particularly notable for their increasing investments in infrastructure and industrial projects. This trend is expected to contribute significantly to the market's expansion, as the industry adapts to meet the specific needs of these growing economies. The overall growth potential in these regions is substantial, indicating a robust future for polymer coatings.

Technological Advancements in Coating Solutions

The Global Corrosion Protection Polymer Coating Market Industry is benefiting from continuous technological advancements that enhance the performance of coating solutions. Innovations such as nanotechnology and smart coatings are emerging, offering superior protection against corrosion. These advanced coatings not only improve durability but also provide additional functionalities, such as self-healing properties. As industries demand more efficient and effective solutions, the market is likely to expand. The anticipated growth trajectory indicates that the industry could reach 61.0 USD Billion by 2035, reflecting the increasing adoption of advanced polymer coatings across various sectors.