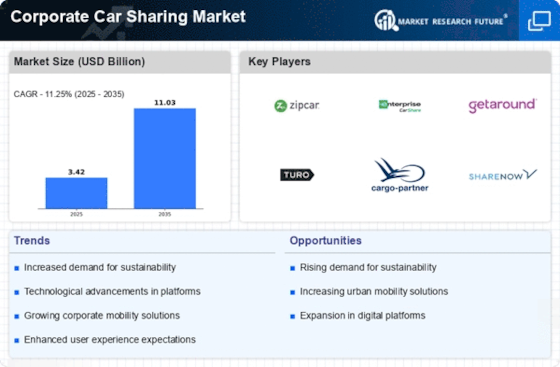

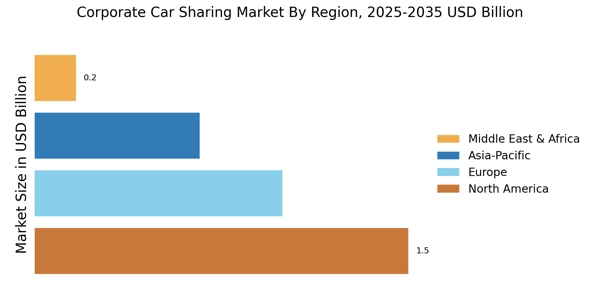

North America : Leading Market for Car Sharing

North America is the largest market for corporate car sharing, holding approximately 45% of the global market share. The growth is driven by increasing urbanization, rising fuel prices, and a shift towards sustainable transportation solutions. Regulatory support, such as tax incentives for car-sharing services, further catalyzes market expansion. The demand for flexible mobility solutions is also on the rise, particularly among corporate clients seeking cost-effective transportation options. The United States is the leading country in this region, with major players like Zipcar, Enterprise CarShare, and Getaround dominating the landscape. Canada follows as the second-largest market, contributing around 15% to the regional share. The competitive landscape is characterized by a mix of established companies and emerging startups, all vying for market share in a rapidly evolving environment. The presence of key players ensures a diverse range of services tailored to corporate needs.

Europe : Innovative Mobility Solutions Hub

Europe is a significant player in the corporate car sharing market, accounting for approximately 30% of the global share. The region's growth is fueled by stringent environmental regulations and a strong push towards reducing carbon emissions. Countries like Germany and the UK are at the forefront, with supportive policies that encourage car-sharing initiatives. The European Union's Green Deal aims to promote sustainable transport, further enhancing market dynamics. Germany leads the European market, with key players such as Car2Go and Share Now, while the UK follows closely with a growing number of services. The competitive landscape is marked by innovation, with companies increasingly integrating technology to enhance user experience. The presence of established brands alongside new entrants fosters a dynamic environment, making Europe a hotbed for corporate car sharing solutions.

Asia-Pacific : Emerging Market with High Potential

Asia-Pacific is rapidly emerging as a key market for corporate car sharing, holding about 20% of the global market share. The growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of environmental issues. Countries like India and China are witnessing a surge in demand for flexible transportation solutions, supported by government initiatives aimed at reducing traffic congestion and pollution. India is leading the charge in this region, with companies like Ola making significant inroads into the corporate sector. China follows closely, with a burgeoning market for car-sharing services. The competitive landscape is characterized by a mix of local startups and international players, all striving to capture the growing demand. The presence of key players ensures a diverse range of offerings tailored to corporate clients, enhancing the overall market appeal.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is still in the nascent stages of corporate car sharing, holding approximately 5% of the global market share. However, the potential for growth is significant, driven by increasing urbanization and a rising middle class. Governments in countries like South Africa and the UAE are beginning to recognize the benefits of car sharing, leading to supportive policies that could catalyze market development. South Africa is currently the leading market in this region, with a few emerging players starting to offer corporate car sharing solutions. The competitive landscape is still developing, with opportunities for both local and international companies to enter the market. As awareness of car sharing grows, the region is poised for substantial growth, making it an attractive area for investment and innovation.