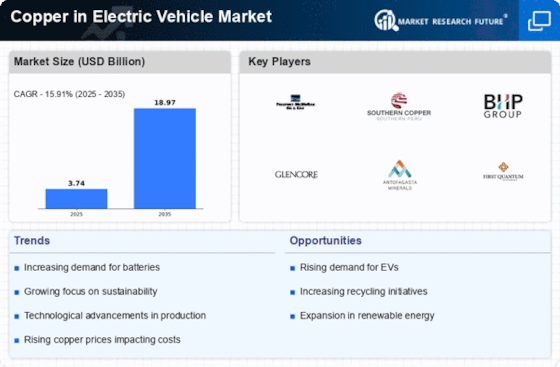

Rising Adoption of Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Copper in Electric Vehicle Market. As consumers and manufacturers shift towards sustainable transportation solutions, the demand for EVs has surged. In 2025, it is estimated that the number of electric vehicles on the road will exceed 30 million units, leading to a corresponding rise in copper usage. Copper is essential for various components in EVs, including batteries, wiring, and electric motors. This trend indicates a robust growth trajectory for the copper market, as each electric vehicle requires approximately 80 kilograms of copper, significantly more than traditional internal combustion engine vehicles. The transition to electric mobility is likely to continue, further solidifying copper's role in the EV sector.

Government Incentives and Regulations

Government incentives and regulations play a crucial role in shaping the Copper in Electric Vehicle Market. Many countries have implemented policies to promote electric vehicle adoption, including tax credits, rebates, and stricter emissions standards. For instance, in 2025, several nations are expected to enforce regulations that mandate a certain percentage of new vehicle sales to be electric. This regulatory environment not only encourages consumers to purchase EVs but also incentivizes manufacturers to invest in electric vehicle technology. Consequently, the demand for copper, a key material in EV production, is likely to rise. The anticipated increase in electric vehicle sales due to these incentives could lead to a significant uptick in copper consumption, further driving market growth.

Increased Investment in EV Infrastructure

Increased investment in electric vehicle infrastructure is a pivotal driver for the Copper in Electric Vehicle Market. As governments and private entities allocate resources to develop charging networks, the demand for copper is likely to escalate. The establishment of widespread charging stations necessitates extensive electrical wiring and components, all of which rely heavily on copper. In 2025, it is anticipated that investments in EV infrastructure will exceed 100 billion dollars, creating a robust market for copper. This influx of capital not only supports the growth of electric vehicles but also reinforces the critical role of copper in ensuring the reliability and efficiency of charging systems. The ongoing development of infrastructure is expected to sustain the demand for copper in the electric vehicle sector for years to come.

Growing Focus on Renewable Energy Integration

The growing focus on renewable energy integration is a significant driver for the Copper in Electric Vehicle Market. As the world transitions towards cleaner energy sources, the synergy between electric vehicles and renewable energy systems becomes increasingly apparent. Electric vehicles can serve as mobile energy storage units, facilitating the integration of solar and wind energy into the grid. This relationship enhances the demand for copper, which is essential for the infrastructure required to support electric vehicle charging stations and renewable energy systems. In 2025, the expansion of charging networks and renewable energy projects is expected to drive copper consumption, as each charging station requires substantial copper wiring and components. This trend highlights the interconnectedness of electric vehicles and renewable energy, further propelling the copper market.

Technological Innovations in Battery Technology

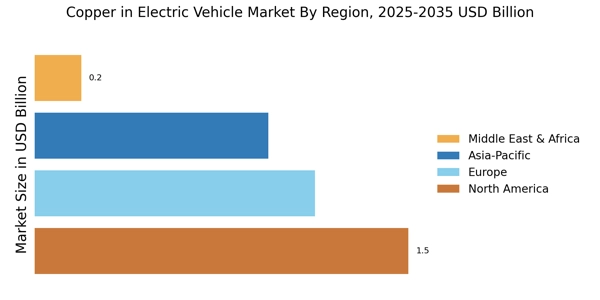

Technological innovations in battery technology are significantly influencing the Copper in Electric Vehicle Market. Advances in battery efficiency, energy density, and charging speed are critical for enhancing the performance of electric vehicles. As manufacturers develop new battery chemistries, the demand for copper in battery production is expected to increase. For example, the introduction of high-capacity lithium-ion batteries requires substantial amounts of copper for their electrical connections and components. In 2025, it is projected that the global demand for copper in battery applications will reach approximately 1.5 million metric tons, reflecting the growing reliance on copper in the EV sector. This trend underscores the importance of copper as a vital resource in the ongoing evolution of electric vehicle technology.