Top Industry Leaders in the Copper Alloy Foils Market

Market Summary:

Market Summary:

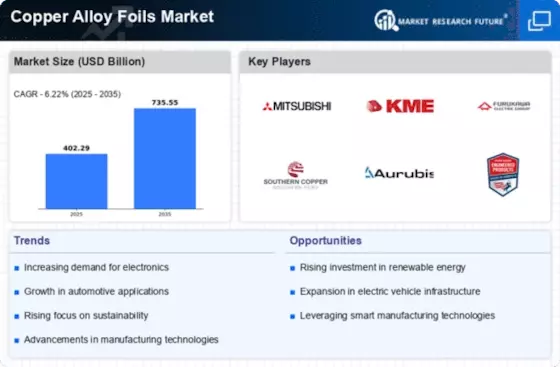

This robust growth is fueled by increasing demand across various sectors, including construction, infrastructure, electronics, and renewable energy.

Strategies:

-

Vertical Integration: Expanding their operations across the entire value chain, from mining and refining to manufacturing and distribution, to secure raw materials and optimize costs. -

Product Diversification: Developing innovative copper alloy solutions with enhanced properties tailored to specific applications, like high-strength alloys for automotive and aerospace industries. -

Geographical Expansion: Targeting promising emerging markets in Asia and Africa to capitalize on the burgeoning demand for infrastructure development and electrification. -

Technological Advancements: Investing in R&D for greener and more efficient production processes to address environmental concerns and meet regulatory requirements.

Factors Influencing Market Share:

Beyond the strategies employed by individual players, broader market forces also play a crucial role in determining market share:

-

Price Fluctuations: Copper is a highly volatile commodity, and its price fluctuations can significantly impact the profitability of the entire industry. Players with robust hedging strategies and diversified revenue streams are better equipped to weather such storms. -

Supply Chain Disruptions: Geopolitical tensions, trade wars, and pandemics can disrupt the global copper supply chain, causing shortages and price hikes. Companies with reliable sourcing networks and flexible production capabilities are more resilient to such disruptions. -

Regional Demand Dynamics: Emerging economies in Asia and Africa are experiencing rapid urbanization and industrialization, leading to a surge in demand for copper and copper alloys. Players with a strong presence in these regions are positioned for significant growth. -

Sustainability Concerns: Environmental regulations and consumer demand for eco-friendly products are pushing companies to adopt sustainable practices throughout the copper lifecycle. Investing in recycling initiatives and developing low-carbon production technologies can provide a competitive edge.

Key Companies

- Amari Copper Metals

- KME Germany GmbH & Co KG, Nexans

- JX Nippon Mining & Metals Corporations

- Carl Schlenk AG

- Brass and Copper Holdings, Inc.

- LAMINERIES MATTHEY

- Arcotech Ltd.

- Civen Metal Material Co., Ltd

Recent Developments

-

September 2023: A major copper mine in Chile experiences a production outage due to labor strikes, leading to a temporary rise in global copper prices and impacting downstream alloy manufacturers. -

October 2023: Aurubis AG commences operations of its new state-of-the-art recycling facility in Georgia, USA, significantly increasing its capacity to process scrap copper and promote material circularity. -

November 2023: A consortium of leading copper producers launches a joint research project to develop next-generation copper alloys with superior strength and conductivity for advanced applications in renewable energy technologies. -

December 2023: The global copper market shows signs of stabilization following a turbulent year, with prices slowly retracing and demand expected to remain steady in the first half of 2024.