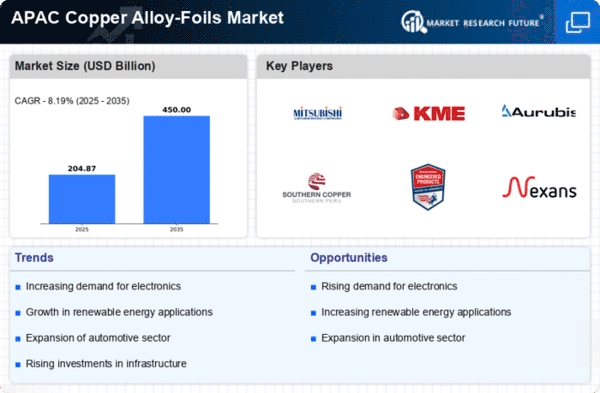

Expansion of Automotive Electronics

The automotive industry in APAC is undergoing a transformation, with a significant shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This transition is likely to enhance the demand for copper alloy-foils, as they are critical in various automotive applications, including wiring harnesses and circuit boards. The automotive electronics market is projected to grow at a CAGR of 10% from 2025 to 2030, indicating a strong upward trajectory. As the copper alloy-foils market aligns with this growth, manufacturers are expected to innovate and develop specialized products to meet the evolving needs of the automotive sector.

Growing Electronics Manufacturing Sector

The electronics manufacturing sector in APAC is experiencing robust growth, which is likely to drive demand for copper alloy-foils. With the region being a hub for electronics production, the need for high-quality materials is paramount. In 2025, the electronics industry in APAC is projected to reach a market value of approximately $1 trillion, indicating a substantial increase in demand for components, including copper alloy-foils. This growth is attributed to the rising adoption of advanced technologies such as 5G, IoT, and AI, which require efficient and reliable materials. Consequently, the copper alloy-foils market is poised to benefit from this trend, as manufacturers seek to enhance the performance and durability of their products.

Increased Investment in Renewable Energy

The shift towards renewable energy sources in APAC is creating new opportunities for the copper alloy-foils market. As countries in the region invest heavily in solar and wind energy, the demand for efficient conductive materials is on the rise. Copper alloy-foils are essential in the production of solar panels and wind turbine components, which are integral to renewable energy systems. In 2025, investments in renewable energy in APAC are expected to exceed $500 billion, further propelling the need for high-performance materials. This trend suggests that the copper alloy-foils market will likely see increased demand as manufacturers align their production capabilities with the growing renewable energy sector.

Rising Demand for High-Performance Materials

The increasing need for high-performance materials across various industries in APAC is driving the copper alloy-foils market. Industries such as telecommunications, aerospace, and medical devices are seeking materials that offer superior conductivity, durability, and thermal resistance. The demand for high-performance copper alloy-foils is expected to grow by approximately 15% annually, reflecting the industry's shift towards advanced materials. This trend indicates that manufacturers in the copper alloy-foils market must focus on research and development to create innovative solutions that cater to the specific requirements of these high-tech applications.

Government Initiatives Supporting Manufacturing

Governments in APAC are implementing initiatives to bolster the manufacturing sector, which is likely to positively impact the copper alloy-foils market. Policies aimed at enhancing local production capabilities and reducing import dependencies are being introduced. For instance, several countries are offering incentives for manufacturers to invest in advanced materials and technologies. This support is expected to lead to a more competitive landscape for the copper alloy-foils market, as local manufacturers can capitalize on these initiatives to expand their production capacities and improve product offerings. As a result, the market is likely to witness increased growth and innovation.