Rising Demand in Electronics

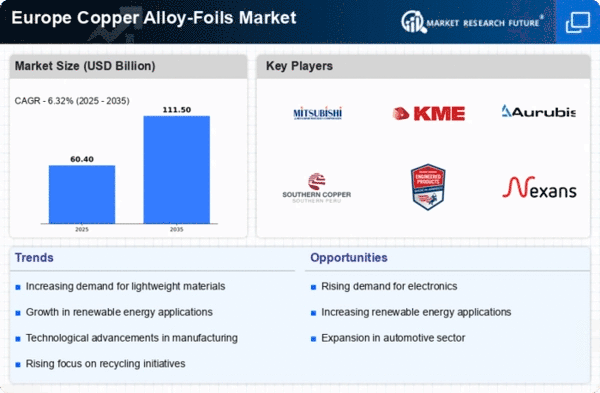

The copper alloy-foils market in Europe is experiencing a notable surge in demand, particularly driven by the electronics sector. As consumer electronics continue to evolve, the need for high-performance materials is paramount. Copper alloy foils are increasingly utilized in the manufacturing of printed circuit boards (PCBs), which are essential components in smartphones, tablets, and other electronic devices. Recent data indicates that the European electronics market is projected to grow at a CAGR of approximately 5.2% over the next five years. This growth is likely to bolster the copper alloy-foils market, as manufacturers seek materials that offer superior conductivity and thermal management properties. Furthermore, the trend towards miniaturization in electronics is expected to further enhance the demand for thinner and more efficient copper alloy foils, thereby driving market expansion.

Growth in Renewable Energy Sector

The copper alloy-foils market in Europe is poised to benefit from the increasing investments in renewable energy sources. As countries strive to meet their sustainability goals, the demand for efficient energy solutions is on the rise. Copper alloy foils are integral in the production of solar panels and wind turbines, where they are used for electrical connections and conductive pathways. The European renewable energy sector has seen substantial growth, with investments reaching approximately €100 billion in recent years. This trend is likely to continue, as governments and private entities prioritize clean energy initiatives. Consequently, the copper alloy-foils market is expected to experience a corresponding increase in demand, as manufacturers align their production capabilities to support the renewable energy infrastructure.

Advancements in Automotive Technology

The automotive industry in Europe is undergoing a transformation, with a significant shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This evolution is creating new opportunities for the copper alloy-foils market, as these materials are essential for various automotive applications, including battery connections and electronic control units. The European automotive market is projected to grow at a CAGR of around 4.5% over the next few years, driven by the increasing adoption of EVs. As automakers seek to enhance vehicle performance and efficiency, the demand for high-quality copper alloy foils is likely to rise. This trend indicates a promising outlook for the copper alloy-foils market, as it aligns with the industry's focus on innovation and sustainability.

Increased Focus on Lightweight Materials

The copper alloy-foils market in Europe is influenced by the growing emphasis on lightweight materials across various industries. As manufacturers strive to improve energy efficiency and reduce emissions, the demand for lighter components is becoming more pronounced. Copper alloy foils, known for their excellent strength-to-weight ratio, are increasingly being utilized in applications ranging from aerospace to consumer goods. Recent studies suggest that the lightweight materials market is expected to grow by approximately 7% annually, which could positively impact the copper alloy-foils market. This trend reflects a broader industry shift towards materials that not only enhance performance but also contribute to sustainability goals, thereby creating new avenues for growth in the copper alloy-foils market.

Emerging Applications in Telecommunications

The telecommunications sector in Europe is rapidly evolving, with the rollout of 5G technology creating new demands for high-performance materials. Copper alloy foils are critical in the production of antennas and other communication devices, where their superior conductivity is essential for efficient signal transmission. As the European telecommunications market expands, driven by the increasing need for faster and more reliable connectivity, the copper alloy-foils market is likely to see a corresponding rise in demand. Industry forecasts indicate that the telecommunications sector could grow by approximately 6% annually, further solidifying the role of copper alloy foils in supporting advanced communication technologies. This emerging application area presents a significant opportunity for growth within the copper alloy-foils market.