Regulatory Compliance

Regulatory compliance is a critical driver in the Contract Packaging Market, as companies face increasing scrutiny regarding packaging standards and safety regulations. The need to adhere to stringent guidelines, particularly in sectors such as pharmaceuticals and food, necessitates collaboration with contract packagers who possess expertise in compliance. Recent data indicates that non-compliance can result in significant financial penalties and reputational damage, prompting businesses to prioritize partnerships with reliable packaging firms. As regulations continue to evolve, the demand for contract packaging services that ensure compliance is likely to grow. This trend underscores the importance of quality assurance and risk management within the Contract Packaging Market, as companies strive to protect their brands and maintain consumer trust.

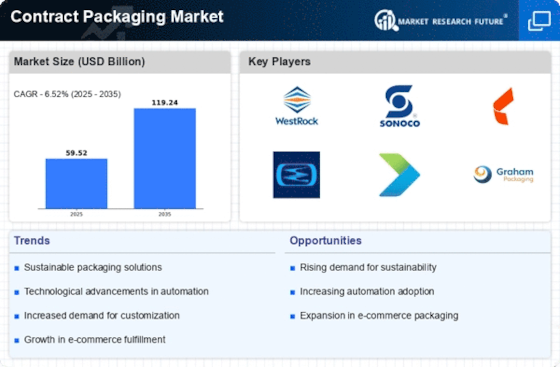

Sustainability Trends

Sustainability has emerged as a pivotal driver within the Contract Packaging Market, as consumers and businesses alike prioritize eco-friendly practices. The increasing awareness of environmental issues has led to a demand for sustainable packaging solutions that minimize waste and reduce carbon footprints. Recent studies indicate that nearly 70% of consumers are willing to pay more for products with sustainable packaging. This trend compels contract packagers to innovate and adopt sustainable materials and processes. As companies strive to meet regulatory requirements and consumer expectations, the Contract Packaging Market is likely to see a surge in demand for sustainable packaging options. This shift not only aligns with corporate social responsibility goals but also enhances brand reputation, making sustainability a crucial factor in the industry's growth.

Expansion of E-commerce

The rapid expansion of e-commerce is reshaping the Contract Packaging Market, as online retail continues to gain traction. With more consumers opting for online shopping, the need for efficient and effective packaging solutions has surged. Data suggests that e-commerce sales have increased by over 20% annually, prompting retailers to seek contract packaging services that can ensure product safety during transit. This shift necessitates innovative packaging designs that not only protect products but also enhance the unboxing experience for consumers. Consequently, contract packagers are increasingly focusing on developing packaging that meets the specific requirements of e-commerce, thereby driving growth within the Contract Packaging Market. As this trend continues, it is anticipated that the demand for specialized packaging solutions will further escalate.

Technological Innovations

Technological advancements are significantly influencing the Contract Packaging Market, as automation and smart packaging solutions become increasingly prevalent. The integration of technology in packaging processes enhances efficiency, reduces costs, and improves product quality. For instance, the adoption of robotics and artificial intelligence in packaging lines has streamlined operations, allowing for faster turnaround times. Furthermore, smart packaging technologies, such as QR codes and NFC tags, provide consumers with interactive experiences and valuable product information. As companies seek to leverage these innovations, the Contract Packaging Market is poised for growth, with an emphasis on adopting cutting-edge technologies that meet the demands of modern consumers. This technological evolution not only enhances operational efficiency but also positions contract packagers as leaders in the competitive landscape.

Rising Demand for Customization

The Contract Packaging Market is experiencing a notable shift towards customization, driven by consumer preferences for personalized products. As brands seek to differentiate themselves, the demand for tailored packaging solutions is increasing. This trend is particularly evident in sectors such as food and beverage, where unique packaging can enhance product appeal. According to recent data, approximately 60% of consumers express a preference for customized packaging, indicating a significant opportunity for contract packagers to innovate. This rising demand for customization not only enhances brand loyalty but also encourages companies to collaborate with contract packaging firms that can provide bespoke solutions. As a result, the Contract Packaging Market is likely to witness sustained growth as businesses adapt to these evolving consumer expectations.