Market Trends

Key Emerging Trends in the Contract Packaging Market

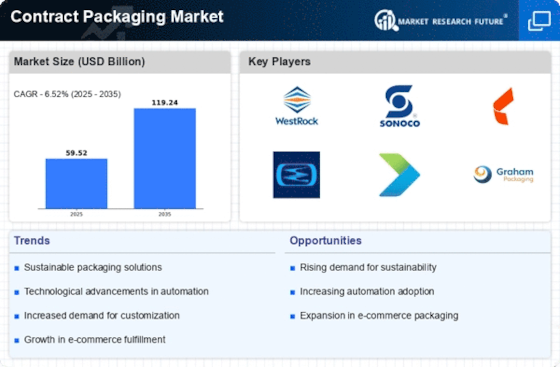

Currently, the contract packaging market is going through high-speed changes driven by the businesses and those they serve, i.e. consumers, who are always looking for new things and different trends that suit their needs. Maneuvering through the maze of the world trade, there are some major areas that worry and influence the way the outsourced field is developing. Beyond this well-known trend is the increasing interest in sustainable and ecologically-approved packaging design. By addressing the rising environmental issues, companies have to consider sustainable minded packaging provider that is powered by green, materials and practices tailored to their green initiatives which is important in the current corporate social responsibility.

Besides, an increase of e-commerce lays a strong foundation for the emergence of contract packaging market. As the audit in online shopping has been increasing, there has become the necessity for packaging solutions which prioritize product protection, fast handling, and themes. About new technology products, including smart packaging and automatic operations, for e-tailing shipment systems, contract packagers are nowadays modifying their operations. It not only makes the packing process easier and simpler but also increases customer experience as well.

Added to this is the transformation of the contract packaging market to flexible packaging formats. Changes in consumers’ preferences is a stage when people seem to opt for the pack that they can effortlessly use and carry. Adaptable packaging not only decrease material wastage but also made cost-effective, hold benefits for both manufacturers and contract packagers which creates competitiveness of which is make it possible for users to choose. From this regard it really comes out clar by referring to the food industry with the example of food and beverage where the stress on portability and convenience led to this change.

Another important factor, which seems to be gaining more popularity, is that of custom-fit packaging. The brands know the role of the designs that set aside the exquisite and attractive packaging is the create exclusive, individual packaging experience as the ability to distinguish themselves from the market where they operate in. To meet consumers demand of an ever changing packaging, contract packagers do this by providing a variety of customization options; such as personalized box designs, innovative shapes, and interactive features. Apart from just the consumer goods, the packaging discipline has also made its way into pharmaceuticals and other areas where a package can become a tool for branding, and it can help in the product differentiation.

The global COVID-19 crisis has also had some effect on the tendencies for market packaging units. Health and safety concerns have become more alert nowadays, and a new focus has been drawn towards hygienic and tamper evident package solutions. Contract packagers adopt the steps that care about the safety of the products during the period of transport and delivery. They do it due to the problems that may happen with the products as a result of the contamination and product integrity. The safety value of this packaging has definitely become a critical element of packaging design and functionality. The materials and the contract manufacturing partners used by brands for meeting the requirements are those primary factors.

Leave a Comment