Market Trends

Key Emerging Trends in the Continuous Positive Airway Pressure Devices Market

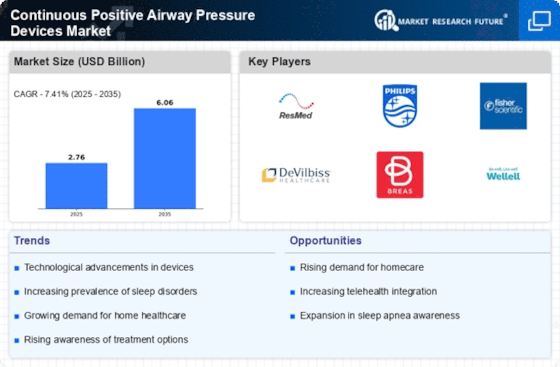

The Continuous Positive Airway Pressure (CPAP) devices market has witnessed significant trends in recent years, reflecting the growing awareness and prevalence of sleep-related disorders, particularly obstructive sleep apnea (OSA). OSA, a condition characterized by interrupted breathing during sleep, has become a global health concern, driving the demand for CPAP devices as a primary treatment option. The market's trajectory is shaped by several key factors, including technological advancements, increasing geriatric population, and a rise in lifestyle-related risk factors contributing to sleep disorders.

Technological innovations have played a pivotal role in shaping the market trends of CPAP devices. Manufacturers are continuously striving to enhance device features, making them more user-friendly, compact, and efficient. Integration of smart technologies, such as connectivity features and mobile applications, has become a common trend, allowing users to monitor their therapy progress and improve overall adherence. Additionally, the development of quieter and less intrusive devices addresses the comfort concerns of users, fostering greater acceptance and compliance with CPAP therapy.

The aging global population is another driving force behind the CPAP devices market trends. With age, the prevalence of sleep apnea tends to increase, contributing to a higher demand for effective treatment options. The elderly population is more prone to comorbidities and chronic conditions, further elevating the significance of CPAP therapy in managing associated health risks. As healthcare systems focus on addressing the needs of an aging demographic, the CPAP devices market is expected to witness sustained growth.

Furthermore, the market trends of CPAP devices are influenced by the changing lifestyle patterns and an increasing awareness of the importance of sleep health. Sedentary lifestyles, obesity, and high-stress levels are identified as key risk factors for sleep disorders, driving individuals to seek medical interventions like CPAP therapy. Awareness campaigns, educational initiatives, and a proactive approach from healthcare providers contribute to an early diagnosis and treatment of sleep-related disorders, thereby bolstering the demand for CPAP devices.

The COVID-19 pandemic has also impacted the CPAP devices market trends. The virus's respiratory implications underscored the importance of respiratory health, leading to a heightened awareness of conditions like sleep apnea. Moreover, disruptions in sleep patterns and the increase in stress during the pandemic have contributed to a surge in sleep-related disorders, further propelling the demand for CPAP devices.

Despite the positive market trends, challenges exist in terms of accessibility and affordability, particularly in developing regions. The cost of CPAP devices and related accessories may limit their adoption in certain demographics. Efforts to address these challenges, such as the development of cost-effective alternatives and increased awareness campaigns, are crucial for ensuring broader access to CPAP therapy.

Leave a Comment