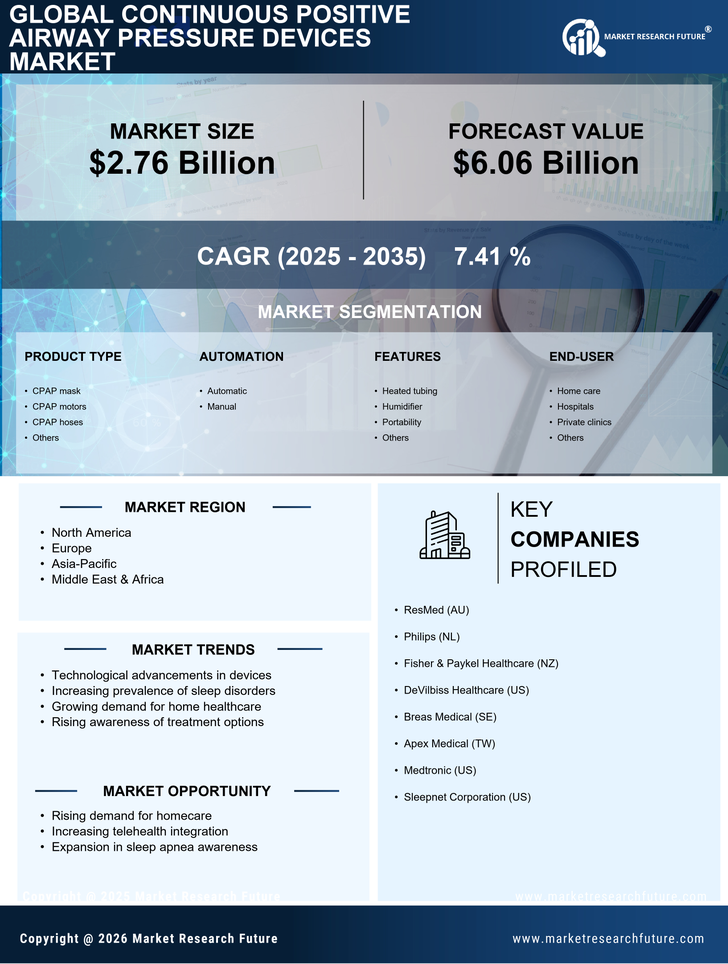

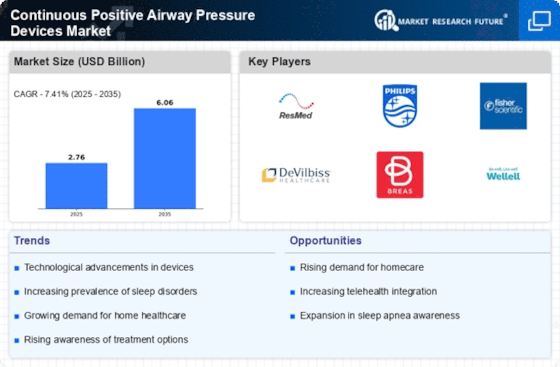

Rising Healthcare Expenditure

Rising healthcare expenditure is another critical driver influencing the Continuous Positive Airway Pressure Devices Market. As countries allocate more resources to healthcare, there is a corresponding increase in spending on medical devices, including CPAP machines. This trend is particularly evident in regions where healthcare reforms are underway, leading to improved access to treatment for sleep disorders. Increased funding for sleep studies and awareness campaigns further supports the growth of the market. Data indicates that healthcare spending is expected to rise significantly in the coming years, which may enhance the affordability and availability of CPAP devices. Consequently, this financial commitment to healthcare is likely to bolster the Continuous Positive Airway Pressure Devices Market.

Increasing Geriatric Population

The increasing geriatric population is a significant driver for the Continuous Positive Airway Pressure Devices Market. As individuals age, the likelihood of developing sleep apnea and other respiratory disorders escalates. According to demographic data, the global population aged 65 and older is projected to reach 1.5 billion by 2050, creating a substantial market for CPAP devices. Older adults often experience comorbidities that exacerbate sleep-related issues, necessitating effective management solutions. Healthcare systems are increasingly focusing on providing adequate care for this demographic, which includes the prescription of CPAP devices. This trend indicates a growing recognition of the importance of sleep health in the elderly, thereby driving demand within the Continuous Positive Airway Pressure Devices Market.

Rising Prevalence of Sleep Apnea

The rising prevalence of sleep apnea is a primary driver for the Continuous Positive Airway Pressure Devices Market. Studies indicate that approximately 22 million individuals in the United States suffer from sleep apnea, with a significant portion remaining undiagnosed. This condition, characterized by repeated interruptions in breathing during sleep, necessitates effective treatment options. As awareness of sleep disorders increases, more patients seek diagnosis and treatment, thereby propelling demand for CPAP devices. The market is projected to grow as healthcare providers emphasize the importance of managing sleep apnea to prevent associated health risks, such as cardiovascular diseases and diabetes. Consequently, the growing patient population is likely to stimulate innovation and expansion within the Continuous Positive Airway Pressure Devices Market.

Growing Focus on Preventive Healthcare

The growing focus on preventive healthcare is emerging as a vital driver for the Continuous Positive Airway Pressure Devices Market. As healthcare systems shift towards preventive measures, there is an increasing emphasis on early diagnosis and management of sleep disorders. This proactive approach encourages individuals to seek treatment before complications arise, thereby increasing the demand for CPAP devices. Public health initiatives aimed at educating the population about the risks associated with untreated sleep apnea are gaining traction. Market data suggests that this shift towards preventive healthcare is likely to result in higher adoption rates of CPAP devices, as patients become more aware of the importance of managing their sleep health. This trend is expected to significantly impact the Continuous Positive Airway Pressure Devices Market.

Technological Innovations in CPAP Devices

Technological innovations play a crucial role in shaping the Continuous Positive Airway Pressure Devices Market. Recent advancements have led to the development of more compact, user-friendly, and efficient CPAP devices. Features such as automatic pressure adjustments, integrated humidifiers, and connectivity with mobile applications enhance user experience and compliance. The introduction of smart CPAP devices, which monitor sleep patterns and provide real-time feedback, is particularly noteworthy. These innovations not only improve patient outcomes but also attract a broader consumer base. Market data suggests that the demand for technologically advanced CPAP devices is on the rise, with a notable increase in sales attributed to enhanced functionalities. As manufacturers continue to invest in research and development, the Continuous Positive Airway Pressure Devices Market is expected to witness sustained growth.