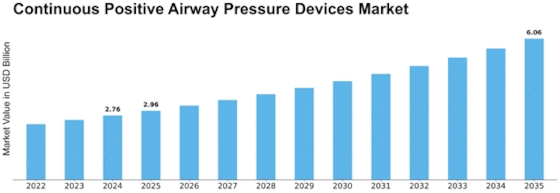

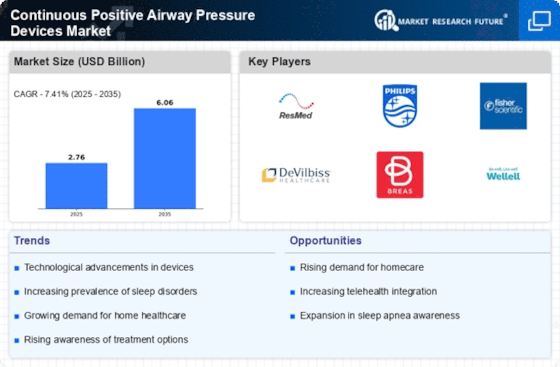

Continuous Positive Airway Pressure Devices Size

Continuous Positive Airway Pressure Devices Market Growth Projections and Opportunities

The Continuous Positive Airway Pressure (CPAP) devices market is influenced by various market factors that play a crucial role in shaping its dynamics. One of the primary drivers of this market is the rising prevalence of sleep apnea and other respiratory disorders. As awareness about these conditions grows, there is an increased demand for effective treatment options, with CPAP devices emerging as a preferred choice. The aging population is another significant factor contributing to the market's expansion, as elderly individuals are more susceptible to respiratory issues, thus driving the need for CPAP therapy.

Technological advancements represent a pivotal market factor, continually enhancing the functionality and comfort of CPAP devices. Innovations such as quieter motors, compact designs, and smart features are gaining traction, improving patient compliance and overall satisfaction. Additionally, the integration of connectivity options, allowing remote monitoring by healthcare providers, has further augmented the market's appeal.

Government initiatives and healthcare policies also significantly impact the CPAP devices market. Supportive regulations, reimbursement programs, and awareness campaigns contribute to increased adoption of these devices. The recognition of sleep apnea as a serious health concern by healthcare authorities globally has led to the inclusion of CPAP therapy in various treatment guidelines, positively influencing market growth.

Economic factors, including disposable income and healthcare expenditure, play a role in shaping the CPAP devices market. As economies develop, individuals are more willing to invest in their health, leading to increased sales of CPAP devices. However, cost remains a significant concern, especially in developing regions, where affordability can hinder widespread adoption. Manufacturers are increasingly focusing on developing cost-effective solutions to address this challenge and tap into emerging markets.

Market competition and the presence of a diverse range of CPAP devices contribute to market dynamics. The existence of various players, each offering unique features and pricing strategies, fosters competition and innovation. This competitive landscape not only benefits consumers by providing them with choices but also drives manufacturers to improve their products continually.

The COVID-19 pandemic has had a dual impact on the CPAP devices market. On one hand, the increased awareness of respiratory health and the potential complications associated with infections has highlighted the importance of CPAP therapy. On the other hand, disruptions in the supply chain and healthcare priorities shifting towards pandemic management have posed challenges for market growth.

Consumer preferences and lifestyle changes also influence the CPAP devices market. As individuals become more health-conscious and seek non-invasive treatment options, the demand for CPAP devices is likely to witness an upward trajectory. Moreover, the convenience of home-based therapy compared to hospital stays has driven the preference for CPAP devices, contributing to market growth.

Leave a Comment