Expansion of E-commerce and Online Shopping

The Contactless Payment Market is also being propelled by the expansion of e-commerce and online shopping. As more consumers turn to digital platforms for their purchasing needs, the demand for efficient and secure payment methods is rising. Data indicates that e-commerce sales are projected to grow significantly, with a substantial portion of these transactions utilizing contactless payment options. This trend is encouraging retailers to adopt contactless payment solutions to cater to the evolving preferences of online shoppers. Consequently, the Contactless Payment Market is likely to see increased investment in technologies that facilitate seamless online transactions, further driving market growth.

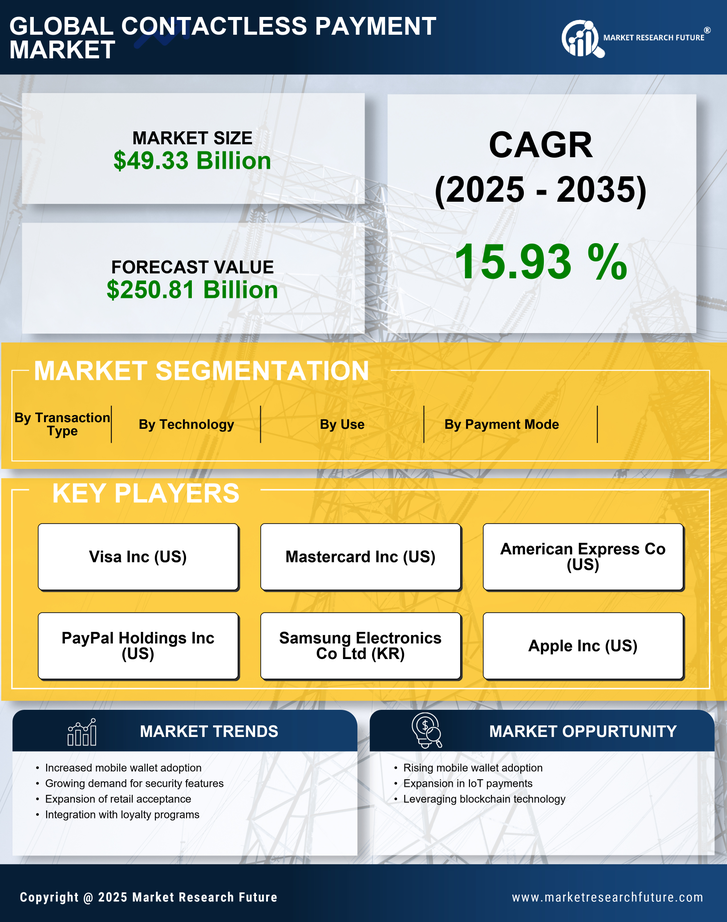

Growing Demand for Contactless Transactions

The Contactless Payment Market is witnessing a growing demand for contactless transactions, driven by consumer preferences for speed and efficiency. Research suggests that consumers are increasingly opting for contactless methods due to their convenience, particularly in high-traffic environments such as public transportation and retail outlets. In fact, a significant percentage of consumers report a preference for contactless payments over traditional methods. This shift is prompting businesses to adopt contactless payment systems to meet customer expectations. As a result, the Contactless Payment Market is likely to expand, with more businesses integrating contactless technology into their payment systems to enhance customer satisfaction and operational efficiency.

Technological Advancements in Payment Systems

The Contactless Payment Market is significantly influenced by technological advancements in payment systems. Innovations such as Near Field Communication (NFC) and Radio Frequency Identification (RFID) are enhancing the functionality and security of contactless payments. These technologies enable seamless transactions, reducing the time spent at checkout and minimizing physical contact. Furthermore, advancements in encryption and tokenization are bolstering security, addressing consumer concerns regarding fraud. As technology continues to evolve, the Contactless Payment Market is expected to benefit from increased consumer trust and adoption, leading to a more robust market landscape.

Increased Adoption of Mobile Payment Solutions

The Contactless Payment Market is experiencing a notable surge in the adoption of mobile payment solutions. As consumers increasingly favor convenience, mobile wallets and payment apps are becoming integral to daily transactions. Recent data indicates that mobile payment transactions are projected to reach trillions of dollars in value by 2025. This trend is driven by the proliferation of smartphones and the growing acceptance of contactless payment methods among merchants. Retailers are investing in infrastructure to support these technologies, thereby enhancing customer experience and streamlining payment processes. The Contactless Payment Market is thus poised for substantial growth as more consumers embrace mobile payment solutions, leading to a shift in traditional payment paradigms.

Regulatory Support for Contactless Payment Solutions

The Contactless Payment Market is benefiting from regulatory support aimed at promoting digital payment solutions. Governments and financial institutions are increasingly recognizing the importance of contactless payments in enhancing financial inclusion and economic efficiency. Initiatives to streamline regulations and promote the adoption of contactless technologies are emerging, which could lead to a more favorable environment for market growth. For instance, some regions are implementing policies that encourage the use of contactless payments in public services and transportation. This regulatory backing is likely to stimulate investment in the Contactless Payment Market, fostering innovation and expanding the reach of contactless payment solutions.