Consumer Preference for Convenience

Consumer preferences in France are shifting towards convenience, significantly impacting the contactless payment market. A recent survey indicates that approximately 65% of consumers prefer contactless methods for their speed and ease of use. This inclination is particularly evident among younger demographics, who are more inclined to adopt new technologies. As a result, retailers are increasingly integrating contactless payment options to meet customer expectations. The convenience factor not only enhances customer satisfaction but also drives higher transaction volumes, thereby contributing to the growth of the contactless payment market. This trend suggests that businesses that prioritize consumer convenience may gain a competitive edge in the evolving payment landscape.

Increased Focus on Health and Hygiene

The contactless payment market in France is witnessing an increased focus on health and hygiene, which is reshaping consumer behavior. As more individuals prioritize contactless transactions to minimize physical contact, the demand for such payment methods is likely to rise. A survey indicates that nearly 60% of consumers are more inclined to use contactless payments due to health concerns. This trend is prompting businesses to enhance their payment systems, ensuring that contactless options are readily available. Consequently, the contactless payment market is expected to expand as both consumers and merchants recognize the benefits of adopting hygienic payment solutions. This shift may lead to a long-term transformation in payment preferences.

Government Initiatives and Regulations

Government initiatives in France are playing a pivotal role in shaping the contactless payment market. Regulatory bodies are actively promoting digital payment solutions to enhance financial inclusion and streamline transactions. For instance, the French government has implemented policies that encourage the adoption of contactless payments, including raising transaction limits to €50. Such measures are designed to facilitate quicker transactions and reduce cash dependency. As a result, the contactless payment market is likely to benefit from increased consumer trust and participation, fostering a more robust digital economy. These initiatives indicate a strategic alignment between government objectives and market growth, potentially leading to a more integrated payment ecosystem.

Rise of E-commerce and Online Shopping

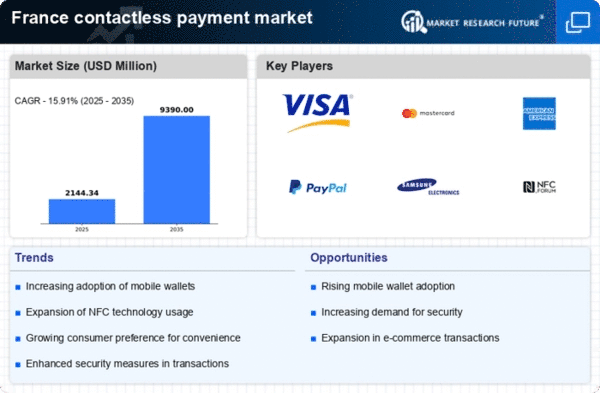

The rise of e-commerce and online shopping in France is significantly influencing the contactless payment market. With an increasing number of consumers opting for online purchases, the demand for secure and efficient payment methods has escalated. In 2025, it is projected that online sales will account for over 20% of total retail sales, necessitating the integration of contactless payment solutions. This shift not only enhances the shopping experience but also encourages retailers to adopt contactless technologies to cater to evolving consumer preferences. The growth of e-commerce is likely to drive innovation within the contactless payment market, as businesses seek to provide seamless and secure payment options for their customers.

Technological Advancements in Payment Systems

The contactless payment market in France is experiencing a surge due to rapid technological advancements in payment systems. Innovations such as Near Field Communication (NFC) and Radio Frequency Identification (RFID) are enhancing transaction efficiency and user experience. In 2025, it is estimated that over 70% of all transactions in retail settings will utilize contactless technology, reflecting a significant shift in consumer behavior. This trend is driven by the increasing demand for seamless payment solutions, which are perceived as faster and more convenient. As merchants adopt these technologies, the contactless payment market is likely to expand, fostering a competitive landscape that encourages further innovation and investment in payment infrastructure.