Increasing Health Awareness

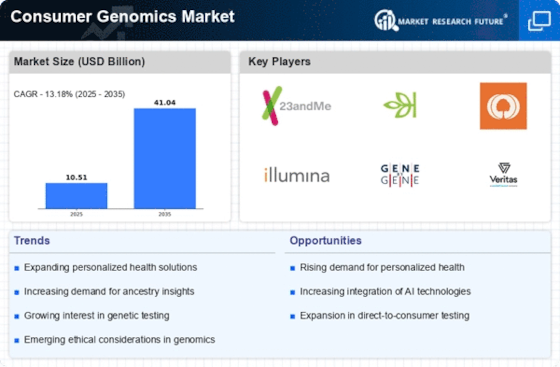

The Consumer Genomics Market is experiencing a notable surge in demand due to rising health awareness among consumers. Individuals are increasingly seeking personalized health insights to make informed lifestyle choices. This trend is reflected in the growing number of consumers opting for genetic testing services, which provide valuable information about predispositions to various health conditions. According to recent data, the market for consumer genomics is projected to reach approximately USD 10 billion by 2026, driven by this heightened awareness. As consumers become more proactive about their health, the Consumer Genomics Market is likely to expand, offering innovative solutions that cater to individual health needs.

Rise of Personalized Medicine

The shift towards personalized medicine is a significant driver of the Consumer Genomics Market. As healthcare moves away from a one-size-fits-all approach, genetic testing is becoming an essential tool for tailoring treatments to individual patients. This trend is supported by a growing body of research that highlights the effectiveness of personalized therapies based on genetic profiles. The Consumer Genomics Market is poised to capitalize on this shift, as healthcare providers increasingly incorporate genetic insights into their treatment plans. Market analysts predict that the demand for personalized medicine will continue to rise, further propelling the growth of the Consumer Genomics Market.

Regulatory Support and Frameworks

The Consumer Genomics Market is benefiting from evolving regulatory support and frameworks that aim to ensure the safety and efficacy of genetic testing services. Governments and regulatory bodies are increasingly recognizing the importance of consumer genomics and are establishing guidelines to protect consumers while promoting innovation. This supportive environment encourages companies to invest in research and development, leading to the introduction of new products and services. As regulations become more defined, the Consumer Genomics Market is likely to see increased consumer trust and participation, further driving market growth.

Advancements in Genomic Technologies

Technological advancements in genomic sequencing and analysis are propelling the Consumer Genomics Market forward. Innovations such as next-generation sequencing (NGS) have significantly reduced the cost and time required for genetic testing, making it more accessible to the general public. The ability to analyze vast amounts of genetic data quickly and accurately has opened new avenues for personalized medicine and health management. As a result, the market is witnessing an influx of new players and products, enhancing competition and driving growth. The Consumer Genomics Market is expected to benefit from these advancements, as they facilitate the development of more comprehensive and user-friendly testing solutions.

Growing Interest in Ancestry and Heritage Testing

The Consumer Genomics Market is also being driven by a burgeoning interest in ancestry and heritage testing. Consumers are increasingly curious about their genetic backgrounds and familial connections, leading to a rise in demand for services that provide insights into ancestry. This trend is supported by the proliferation of social media and online platforms that encourage individuals to explore their roots. Market data indicates that ancestry testing services have seen a significant uptick in usage, contributing to the overall growth of the Consumer Genomics Market. As more consumers seek to understand their heritage, the market is likely to expand further, offering diverse testing options.