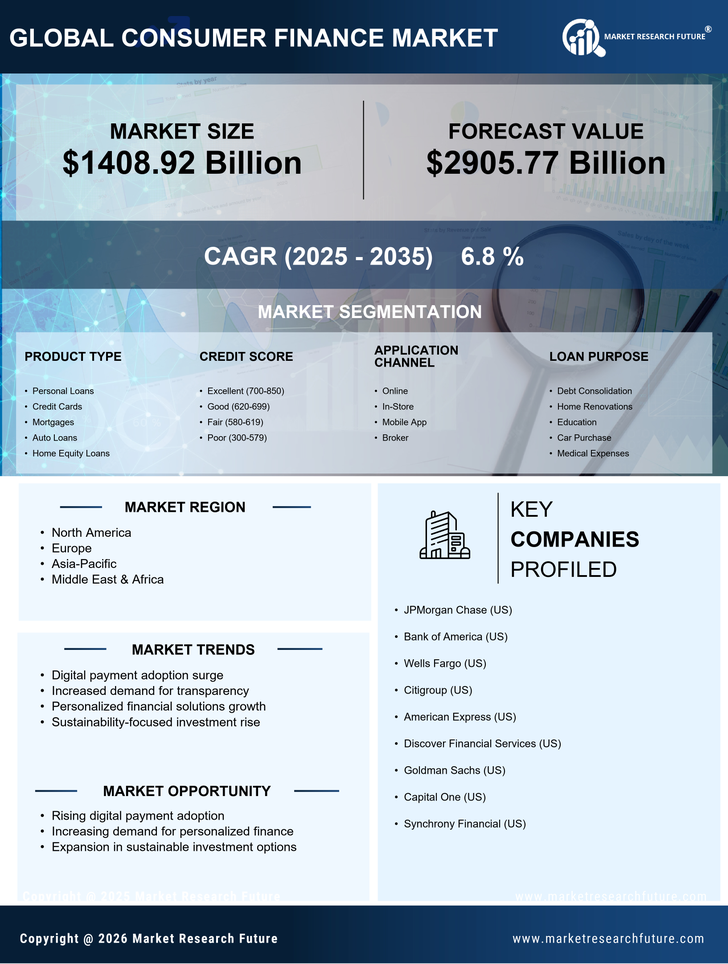

The Consumer Finance Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, evolving consumer preferences, and regulatory changes. Major players such as JPMorgan Chase (US), Bank of America (US), and American Express (US) are strategically positioning themselves through digital transformation and innovative product offerings. For instance, JPMorgan Chase (US) has been focusing on enhancing its digital banking capabilities, which appears to be a response to the increasing demand for seamless online financial services. Meanwhile, Bank of America (US) emphasizes customer-centric solutions, leveraging data analytics to tailor financial products to individual needs, thereby enhancing customer loyalty and retention.The market structure is moderately fragmented, with a mix of large institutions and emerging fintech companies. Key players are employing various business tactics, such as optimizing their supply chains and localizing services to better meet regional demands. This collective influence of established banks and agile fintechs creates a competitive environment where innovation and customer experience are paramount.

In September American Express (US) announced a partnership with a leading fintech to enhance its digital payment solutions. This strategic move is likely to bolster its market position by integrating cutting-edge technology into its existing services, thereby appealing to a younger demographic that prioritizes digital transactions. Such partnerships may also facilitate the expansion of American Express's customer base, as they adapt to the shifting landscape of consumer finance.

In August Wells Fargo (US) launched a new suite of financial wellness tools aimed at helping customers manage their finances more effectively. This initiative reflects a growing trend among financial institutions to prioritize customer education and empowerment, which could lead to increased customer satisfaction and loyalty. By focusing on financial literacy, Wells Fargo (US) positions itself as a trusted advisor in the consumer finance space, potentially differentiating itself from competitors.

In July Citigroup (US) unveiled a new AI-driven credit assessment tool designed to streamline the loan approval process. This innovation not only enhances operational efficiency but also improves the customer experience by reducing wait times for loan decisions. The integration of AI into traditional banking processes signifies a broader trend towards automation and data-driven decision-making in the consumer finance sector, which could reshape competitive dynamics.

As of October the Consumer Finance Market is witnessing significant trends such as digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are increasingly shaping the competitive landscape, as companies seek to leverage each other's strengths to enhance their offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability, as firms strive to meet the changing demands of consumers.