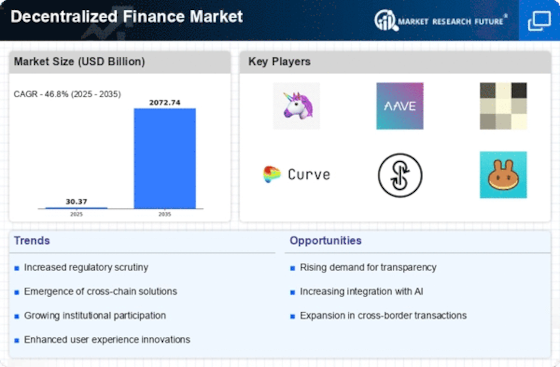

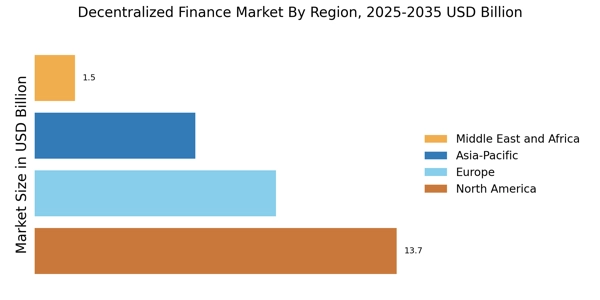

North America : Innovation and Leadership Hub

North America is the largest market for decentralized finance (DeFi), holding approximately 45% of the global market share. North America remains the leading region in the decentralized finance market, driven by technological innovation, strong venture capital presence, and increasing institutional participation in defi crypto ecosystems. The region's growth is driven by a robust technological infrastructure, increasing adoption of blockchain technologies, and favorable regulatory frameworks. The U.S. leads in DeFi innovation, while Canada follows closely, contributing to a significant demand for decentralized financial services. Key players such as Uniswap, Compound, and MakerDAO are headquartered in the U.S., fostering a competitive landscape that encourages innovation. The presence of venture capital and a strong developer community further enhances the region's DeFi ecosystem. As regulatory clarity improves, more institutional players are expected to enter the market, solidifying North America's position as a leader in DeFi.

Europe : Regulatory Framework and Growth

Europe is rapidly becoming a significant player in the decentralized finance market, holding around 30% of the global market share. Europe continues to strengthen its role in the decentralized finance market, supported by progressive regulations and the expansion of decentralized finance platforms led by major industry players. The region benefits from a strong regulatory framework that encourages innovation while ensuring consumer protection. Countries like Germany and France are at the forefront, with increasing investments in blockchain technology and DeFi solutions, driven by a growing demand for alternative financial services. The competitive landscape features key players such as Aave and Curve Finance, which are leading the charge in DeFi innovation. The European Union's regulatory initiatives, such as the Markets in Crypto-Assets Regulation, aim to create a harmonized framework for digital assets, further boosting market confidence. This regulatory clarity is expected to attract more participants and investments into the European DeFi space.

Asia-Pacific : Rapid Adoption and Innovation

Asia-Pacific is witnessing a surge in decentralized finance adoption, accounting for approximately 20% of the global market share. Asia-Pacific is witnessing accelerated adoption of decentralized finance defi, driven by digital transformation, innovation, and increasing participation in the decentralized market. The region's growth is fueled by a young, tech-savvy population and increasing smartphone penetration, which drives demand for innovative financial solutions. Countries like Japan and Singapore are leading the charge, with supportive regulatory environments that encourage blockchain and DeFi development. The competitive landscape is vibrant, featuring players like SushiSwap and dYdX, which are gaining traction in the market. The region's unique blend of traditional finance and emerging technologies creates a fertile ground for DeFi innovations. As governments continue to explore regulatory frameworks, the potential for growth in the Asia-Pacific DeFi market remains significant, attracting both local and international investments.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is an emerging player in the decentralized finance market, holding about 5% of the global market share. The Middle East and Africa represent an emerging opportunity within the decentralized finance market, supported by financial inclusion initiatives and growing interest in defi market development. The growth is driven by increasing interest in blockchain technology and a need for financial inclusion in underserved markets. Countries like South Africa and the UAE are leading the way, with initiatives aimed at fostering innovation and attracting investment in the DeFi space. The competitive landscape is still developing, with local players beginning to emerge alongside global giants. The region's unique challenges, such as regulatory uncertainty, are being addressed through collaborative efforts between governments and industry stakeholders. As awareness and understanding of DeFi grow, the MEA region is poised for significant growth, presenting numerous opportunities for investors and entrepreneurs alike.