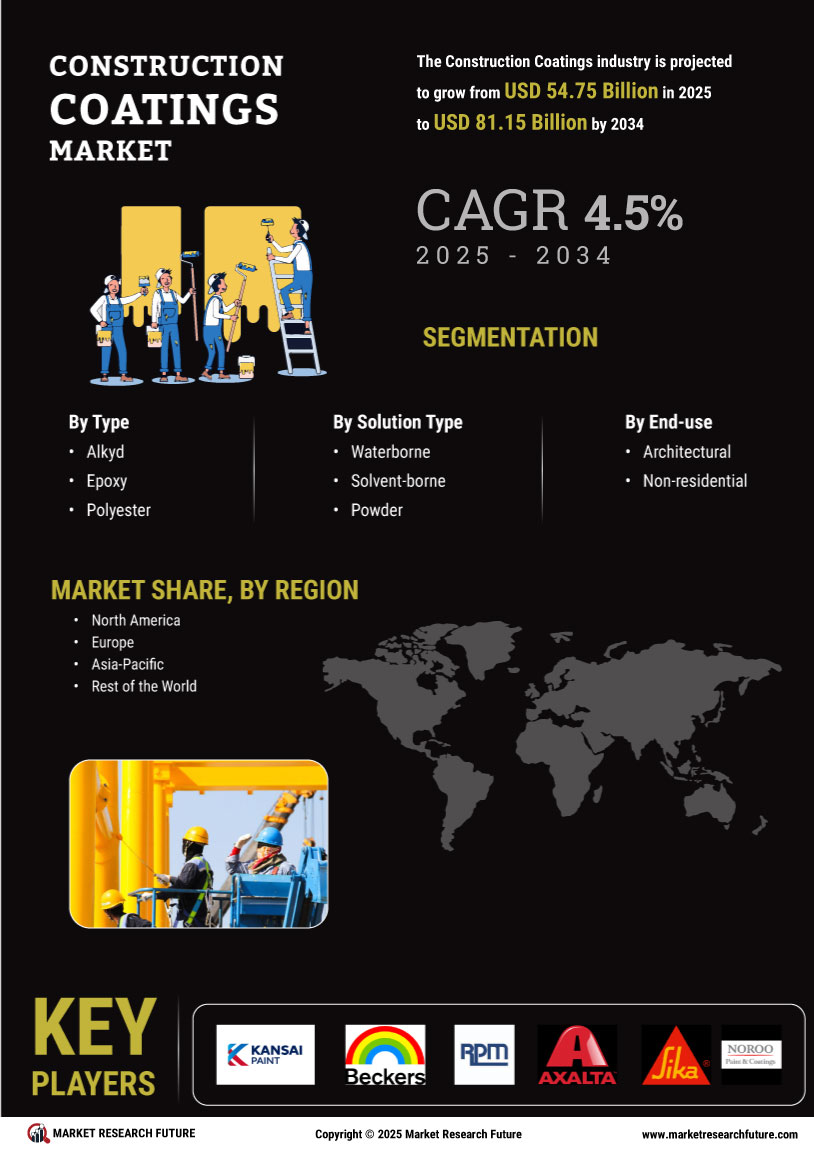

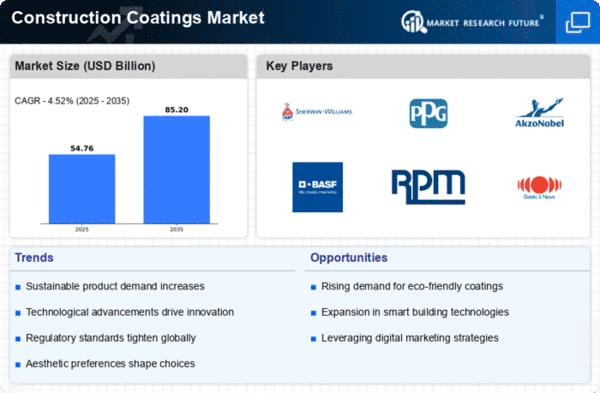

Market Growth Projections

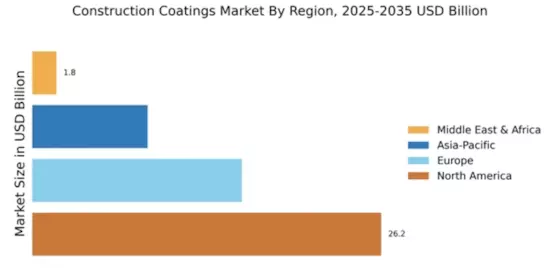

The Global Construction Coatings Market Industry is poised for substantial growth, with projections indicating a market size of 52.4 USD Billion in 2024 and an anticipated increase to 84.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.48% from 2025 to 2035. Such figures underscore the increasing demand for construction coatings driven by various factors, including infrastructure development, technological advancements, and sustainability initiatives. The market's expansion reflects a broader trend towards enhanced durability and performance in construction materials, indicating a promising future for stakeholders in the industry.

Rising Infrastructure Development

The Global Construction Coatings Market Industry experiences a notable boost due to the increasing infrastructure development across various regions. Governments are investing heavily in infrastructure projects, including roads, bridges, and public buildings, which require durable and protective coatings. For instance, the global market is projected to reach 52.4 USD Billion in 2024, driven by these initiatives. The demand for construction coatings is likely to grow as new projects emerge, necessitating high-performance solutions that enhance durability and aesthetics. This trend indicates a robust growth trajectory for the industry, as stakeholders prioritize quality and longevity in construction materials.

Growing Demand for Aesthetic Appeal

The Global Construction Coatings Market Industry is also propelled by the rising demand for aesthetic appeal in construction projects. Homeowners and builders are increasingly seeking coatings that not only provide protection but also enhance the visual aspects of structures. This trend is particularly evident in residential and commercial sectors, where color, texture, and finish play a vital role in design choices. As a result, manufacturers are focusing on developing a diverse range of coatings that cater to these aesthetic preferences. This growing emphasis on aesthetics is likely to further stimulate market growth, as it aligns with consumer expectations for visually appealing environments.

Expansion of the Construction Industry

The expansion of the construction industry globally serves as a significant driver for the Global Construction Coatings Market Industry. With urbanization and population growth, there is an increasing need for residential, commercial, and industrial buildings. This surge in construction activities necessitates the use of various coatings to protect structures from environmental factors and enhance their longevity. As the market evolves, it is expected to witness substantial growth, with projections indicating a rise to 84.8 USD Billion by 2035. This expansion reflects the interconnected nature of construction activities and the demand for high-quality coatings that meet diverse project requirements.

Environmental Regulations and Sustainability

The Global Construction Coatings Market Industry is significantly influenced by stringent environmental regulations and a growing emphasis on sustainability. Governments worldwide are implementing policies that promote the use of eco-friendly coatings, which are low in volatile organic compounds (VOCs) and other harmful substances. This shift not only aligns with global sustainability goals but also encourages manufacturers to innovate and develop greener products. As a result, the market is likely to expand, with a projected CAGR of 4.48% from 2025 to 2035. This trend reflects a broader commitment to environmental stewardship within the construction sector, enhancing the appeal of sustainable coatings.

Technological Advancements in Coating Solutions

Technological advancements play a crucial role in shaping the Global Construction Coatings Market Industry. Innovations in coating formulations, application techniques, and performance characteristics are driving demand for advanced solutions. For example, the development of nanotechnology-based coatings offers superior protection and durability, appealing to construction professionals seeking high-performance materials. As the industry evolves, these advancements are expected to contribute to the market's growth, with projections indicating a rise to 84.8 USD Billion by 2035. This evolution suggests that stakeholders are increasingly prioritizing cutting-edge solutions that enhance the longevity and effectiveness of construction coatings.