Market Share

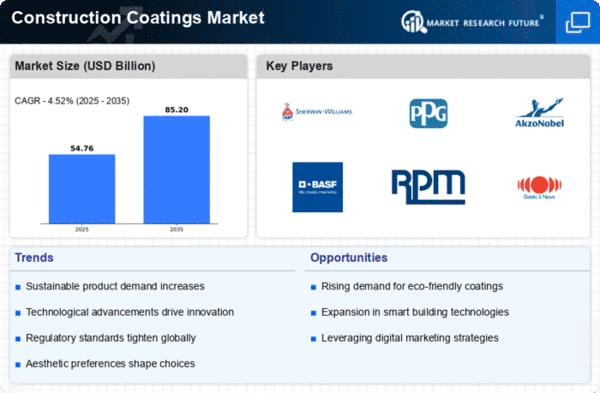

Construction Coatings Market Share Analysis

Companies put money into research and development to come up with new coats that have better qualities like longer longevity, better protection to weather, and better ease of application. Mixing new technologies, like nanotechnology, with older ones lets scientists make high-performance surfaces that meet the changing needs of the building industry.

Providing a wide range of coatings for different uses, such as outdoor walls, roofs, floors, and special coats for specific building materials. Companies can serve a wider range of building projects when they have a wide range of products, which boosts their market presence.

Custom paints for projects in the home, business, industrial, or building sectors, for example. Companies can offer customized solutions and gain a competitive edge in specific markets by understanding the unique needs of each industry group. Making coats that are good for the environment and have low volatile organic compound (VOC) levels to meet environmental rules and green goals. As environmentally friendly building methods become more common, sustainable practices help a brand's image. Forming partnerships with building builders and architects to ensure the stated finishes meet project requirements and industry standards. Working together with important people in the building process makes it more likely that certain finishes will be used and raises brand awareness. Putting an emphasis on the long-lasting and durable qualities of coats to attract customers looking for low-cost options that don't need much upkeep. Customers will be happier if you stress how long coats last. This can lead to return business and good word-of-mouth recommendations. Making delivery routes more efficient and improving supply chain management will make sure that coatings are available on time. Having good operations makes customers happy and helps businesses meet project schedules, which is very important in the building industry. Engaging in educational efforts to train workers and applicators on proper paint application methods. Offering expert support services makes sure that coats are put on properly, which improves performance and lowers the risk of problems after the fact.

Leave a Comment