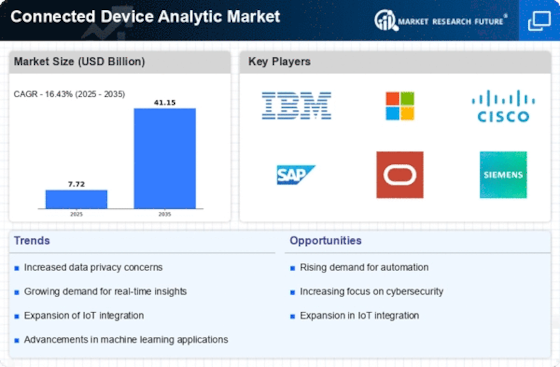

Surge in IoT Adoption

The Connected Device Analytic Market is experiencing a notable surge in the adoption of Internet of Things (IoT) devices across various sectors. As organizations increasingly integrate IoT technologies into their operations, the demand for analytics solutions that can process and interpret the vast amounts of data generated by these devices is rising. According to recent estimates, the number of connected devices is projected to reach over 30 billion by 2030, creating a substantial need for effective data analytics. This trend is likely to drive innovation in the Connected Device Analytic Market, as companies seek to harness real-time insights to enhance operational efficiency and customer experiences.

Advancements in Machine Learning

Advancements in machine learning technologies are playing a crucial role in shaping the Connected Device Analytic Market. As machine learning algorithms become more sophisticated, they enable organizations to derive deeper insights from the data generated by connected devices. This capability not only enhances predictive analytics but also improves the accuracy of data interpretation. The integration of machine learning into analytics solutions is expected to drive market growth, as businesses increasingly seek to leverage these technologies to optimize operations and enhance customer experiences. The Connected Device Analytic Market is likely to witness a surge in demand for machine learning-driven analytics tools.

Expansion of Smart Cities Initiatives

The Connected Device Analytic Market is significantly influenced by the expansion of smart cities initiatives worldwide. As urban areas increasingly adopt smart technologies to improve infrastructure, transportation, and public services, the need for sophisticated analytics solutions becomes paramount. These initiatives often involve the deployment of numerous connected devices, generating vast amounts of data that require effective analysis. Reports indicate that investments in smart city projects are expected to exceed 1 trillion dollars by 2025, highlighting the potential for growth in the Connected Device Analytic Market as cities seek to leverage data for improved governance and citizen engagement.

Growing Demand for Real-Time Analytics

In the Connected Device Analytic Market, there is a growing demand for real-time analytics capabilities. Organizations are increasingly recognizing the value of immediate insights derived from connected devices, which can facilitate timely decision-making and operational adjustments. The ability to analyze data as it is generated allows businesses to respond swiftly to market changes and customer needs. This trend is underscored by the fact that nearly 70% of enterprises are prioritizing real-time data analytics in their strategic initiatives. As a result, the Connected Device Analytic Market is likely to see a proliferation of solutions that offer enhanced real-time processing capabilities.

Increased Regulatory Compliance Requirements

The Connected Device Analytic Market is also being shaped by increased regulatory compliance requirements across various sectors. Organizations are facing mounting pressure to ensure data privacy and security, particularly in industries such as healthcare and finance. Compliance with regulations such as GDPR and CCPA necessitates robust analytics solutions that can monitor and manage data usage effectively. This trend is prompting businesses to invest in advanced analytics capabilities that not only meet compliance standards but also enhance data governance. As a result, the Connected Device Analytic Market is likely to see a rise in demand for solutions that address these regulatory challenges.